Key Takeaway:

Global markets closed sharply lower as investors reacted to a U.S. government shutdown, delayed economic data, and weak labor market signals. Technology and consumer sectors led the declines, while only Consumer Staples managed a gain. Gold and silver extended their rallies, oil prices plunged, and volatility spiked, signaling heightened risk aversion heading into the weekend.

📉 Major Global Indices – Closing Snapshot

| Index | Close | Change (Points) | Change (%) |

|---|---|---|---|

| S&P 500 | 6,550.88 | -184.23 | -2.74% |

| Dow Jones | 45,479.60 | -878.82 | -1.90% |

| Nasdaq | 22,204.43 | -820.20 | -3.56% |

| FTSE 100 | 9,427.47 | -81.93 | -0.86% |

| DAX | 24,266.80 | -344.45 | -1.40% |

| Nikkei 225 | 48,088.80 | -491.64 | -1.01% |

All major indices finished in the red, with the Nasdaq suffering the steepest drop as tech stocks sold off.

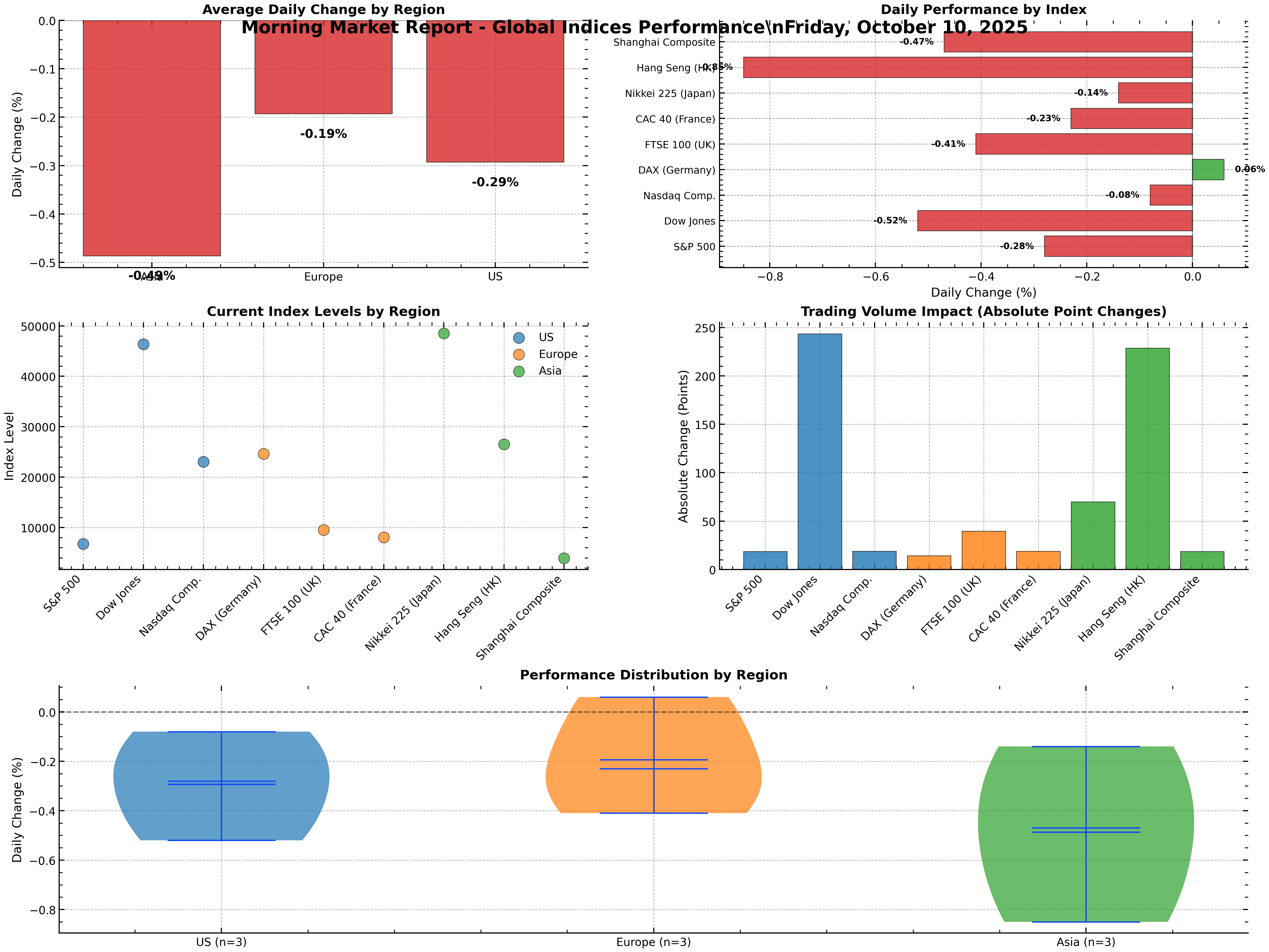

📊 Visual: Global Market Performance

Figure: Global index performance and regional breakdown, October 10, 2025.

🏦 S&P 500 Sector Performance

| Sector | Change % |

|---|---|

| Consumer Discretionary | −3.29% |

| Consumer Staples | +0.25% |

| Health Care | −1.49% |

| Industrials | −2.23% |

| Information Technology | −3.97% |

| Materials | −1.79% |

| Real Estate | −1.12% |

| Communication Services | −2.31% |

| Utilities | −0.44% |

| Financials | −2.16% |

| Energy | −2.80% |

Information Technology and Consumer Discretionary led the declines, while Consumer Staples was the only sector to post a gain.

🚀 Notable Stock Movers

Top Gainers

| Symbol | Company Name | % Change | Closing Price |

|---|---|---|---|

| QNRX | Quoin Pharmaceuticals, Ltd. | +145.10% | $20.00 |

| GWH | ESS Tech, Inc. | +144.19% | $4.20 |

| SGBX | Safe & Green Holdings Corp. | +92.59% | $6.24 |

| YHGJ | Yunhong Green CTI Ltd. | +52.01% | $9.12 |

| STAI | ScanTech AI Systems Inc. | +39.00% | $0.62 |

Small- and mid-cap stocks saw outsized moves, with QNRX and GWH more than doubling in value.

💹 Commodities, Bonds & Currencies

Commodities

| Commodity | Price | Change (%) |

|---|---|---|

| Gold | $4,012.71 | +0.92% |

| Silver | $50.05 | +1.85% |

| Brent Oil | $62.75 | -3.80% |

| WTI Oil | $58.84 | -4.36% |

| Platinum | $1,609.00 | -0.83% |

| Palladium | $1,437.00 | +1.55% |

- Gold and silver extended their rallies, while oil prices plunged on OPEC+ production news.

Bonds

| Country | 10Y Yield (%) |

|---|---|

| US | 4.11 |

| Germany | 2.64 |

| UK | 4.67 |

| Japan | 1.70 |

- US Treasury yields edged lower as investors sought safety.

Currencies

| Pair | Rate | % Change | Direction |

|---|---|---|---|

| EUR/USD | 1.1614 | +0.42% | EUR up |

| USD/JPY | 151.61 | -0.93% | JPY up |

| GBP/USD | 1.3352 | +0.38% | GBP up |

- The US dollar weakened against the euro, yen, and pound.

📰 Key Market Drivers & News

- U.S. Government Shutdown: Delayed key economic data, including jobs and inflation reports, fueling uncertainty and risk-off sentiment .

- Labor Market: ADP private payrolls showed a surprise loss, increasing expectations for a Fed rate cut .

- Volatility: The S&P 500 VIX spiked 31.8% to 21.66, reflecting heightened market anxiety .

- Commodities: Oil prices tumbled after OPEC+ signaled higher production; gold and silver continued their strong run .

- International: European stocks outperformed for the week, while Japan’s Nikkei and Hong Kong’s Hang Seng fell .

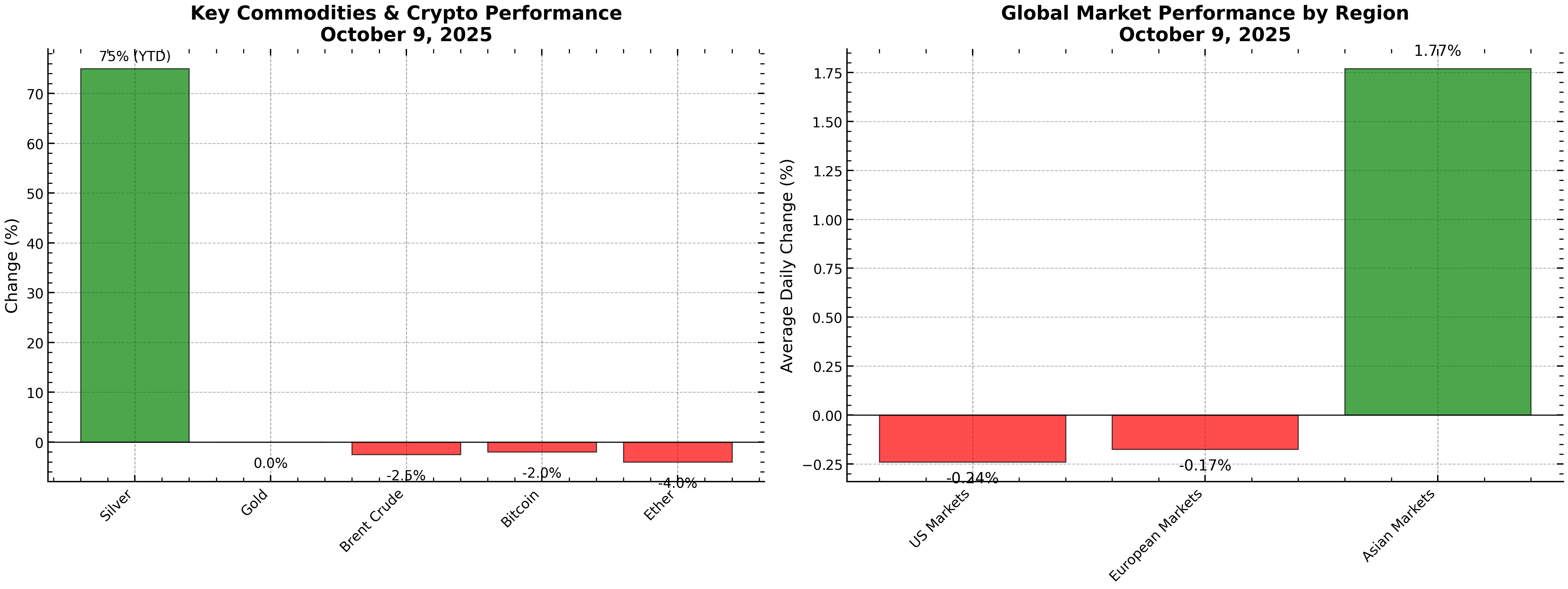

📈 Market Performance Dashboard

Figure: Commodities, currencies, and regional market performance summary, October 10, 2025.

🔮 Outlook & What to Watch

- Volatility likely to persist as the U.S. government shutdown continues and key economic data remain delayed.

- Watch for:

- Progress on U.S. budget negotiations

- Fed commentary and potential rate moves

- Ongoing swings in commodities, especially oil and precious metals

- International market reactions to U.S. policy and data uncertainty

🏁 Conclusion

Markets ended the week with sharp declines, led by tech and consumer stocks, as uncertainty from the U.S. government shutdown and weak labor data spooked investors. Gold and silver remain in focus as safe havens, while oil’s slide and a spike in volatility point to ongoing caution. Stay tuned for further updates and actionable insights.