Key Takeaway:

Today’s Forex session was dominated by a broad US dollar decline, strong gains in commodity-linked currencies, and a risk-on market regime. Major economic data and central bank decisions set the tone for heightened volatility and clear trading opportunities heading into tomorrow.

Executive Summary

- US Dollar Weakness: The USD fell against most majors after a spike in US jobless claims and sticky inflation, reinforcing expectations for a Fed rate cut next week.

- Commodity Currencies Surge: AUD, NZD, and CAD outperformed, reflecting improved risk sentiment and stable commodity prices.

- ECB Holds, Turns Hawkish: The ECB kept rates steady but signaled a more hawkish stance, boosting the euro.

- Volatility Remains High: Market volatility is up 20% year-over-year, with strong moves in several pairs and no statistical outliers detected.

1. Major Currency Pair Performance

| Pair | Latest Price | Daily Change (%) | Signal | Risk Category |

|---|---|---|---|---|

| EUR/USD | 1.1736 | +0.32 | Buy | Medium |

| USD/JPY | 147.17 | -0.14 | Sell | Low |

| GBP/USD | 1.3577 | +0.38 | Strong Buy | Medium |

| AUD/USD | 0.6662 | +0.78 | Strong Buy | High |

| USD/CAD | 1.3841 | -0.14 | Buy | Low |

| USD/CHF | 0.7959 | -0.29 | Sell | Medium |

| NZD/USD | 0.5976 | +0.67 | Strong Buy | High |

Top Gainers:

- AUD/USD (+0.78%)

- NZD/USD (+0.67%)

- GBP/USD (+0.38%)

- EUR/USD (+0.32%)

Top Losers:

- USD/CHF (-0.29%)

- USD/JPY (-0.14%)

- USD/CAD (-0.14%)

2. Technical Analysis & Key Levels

| Pair | Support | Resistance | Technical Bias |

|---|---|---|---|

| EUR/USD | 1.163 | 1.177 | Bullish |

| GBP/USD | 1.345 | 1.360 | Bearish |

| USD/JPY | 146.70 | 148.50 | Range-bound |

| AUD/USD | 0.725 | Channel Top | Bullish |

| NZD/USD | Dynamic | 0.600 | Bullish |

- EUR/USD: Bullish breakout potential above 1.177.

- GBP/USD: Watch for a reversal if 1.345 support breaks.

- AUD/USD & NZD/USD: Momentum remains strong; watch for resistance tests.

3. Economic News & Market Drivers

- US CPI (Aug): +0.4% MoM (vs. 0.3% expected), +2.9% YoY.

- US Jobless Claims: 263K (vs. 235K expected) – highest since 2021.

- ECB: Rates unchanged at 2.00%, but President Lagarde’s hawkish tone lifted the euro.

- Fed Outlook: 91% probability of a 25bp rate cut at next week’s FOMC meeting.

- Risk Sentiment: Strong, with commodity currencies leading and safe havens lagging.

4. Statistical & Sentiment Analysis

- Mean Daily Change: +0.23%

- Volatility (Std Dev): 0.42%

- Risk-On Regime: Commodity currencies averaged +0.44%; safe havens averaged -0.22%.

- No Outliers: All major pairs moved within expected statistical bounds.

- Correlations:

- Strong positive: EUR/USD & GBP/USD, GBP/USD & AUD/USD, AUD/USD & NZD/USD.

- Negative: USD/JPY & AUD/USD.

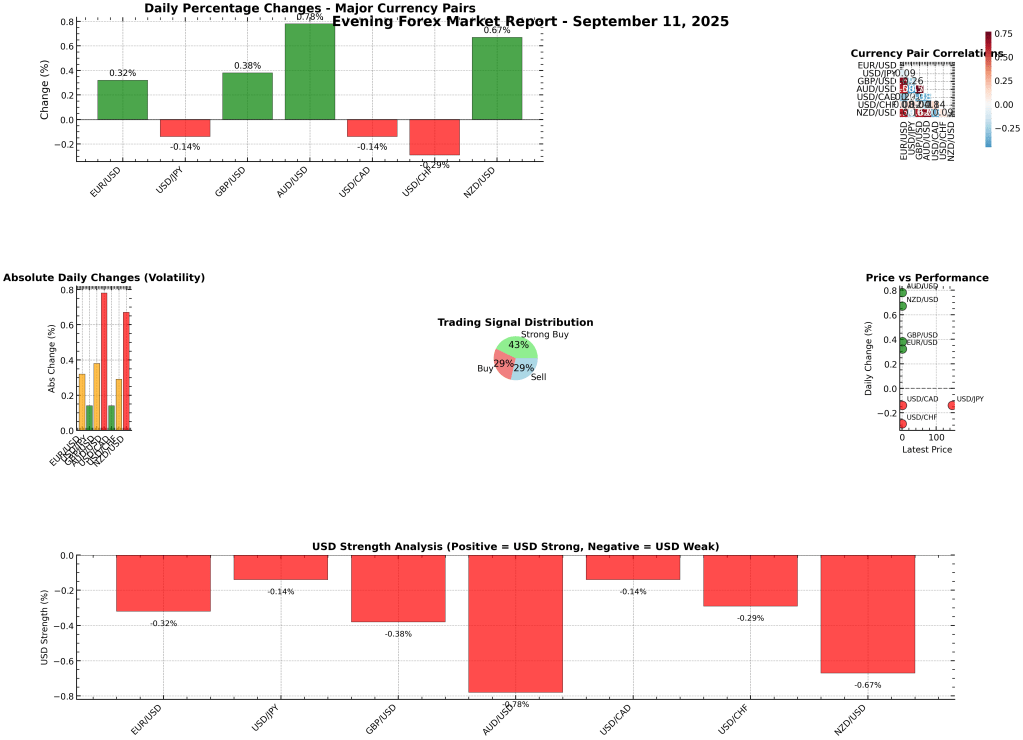

5. Visual Market Overview

6. Trading Recommendations

- Strong Buy: GBP/USD, AUD/USD, NZD/USD – momentum likely to continue if risk sentiment holds.

- Caution: USD/JPY and USD/CHF – technical resistance and USD weakness may limit upside.

- Watch: EUR/USD for a breakout above 1.177; GBP/USD for support at 1.345.

7. Outlook for Tomorrow

- Focus: Fed rate cut expectations, further US labor data, and commodity price trends.

- Volatility: Expected to remain elevated; maintain disciplined risk management.

- Key Levels:

- EUR/USD: 1.177 resistance

- GBP/USD: 1.360 resistance

- AUD/USD: Watch for channel breakout

Summary Box:

The Forex market closed with a clear risk-on tone, commodity currencies outperforming, and the US dollar under pressure from weak labor data and dovish Fed expectations. Technicals favor further gains in AUD, NZD, and GBP, while EUR/USD eyes a breakout. Stay alert for volatility and central bank headlines in the next session.