🌅 Pre-Opening Market Report – August 14, 2025

Key Takeaway:

Global markets are set for a cautiously optimistic open, with major indices holding above key support levels and volatility at manageable levels. Today’s focus is on US retail sales, Eurozone GDP, and a fresh round of Fed commentary—each with the potential to move prices and set the tone for the session.

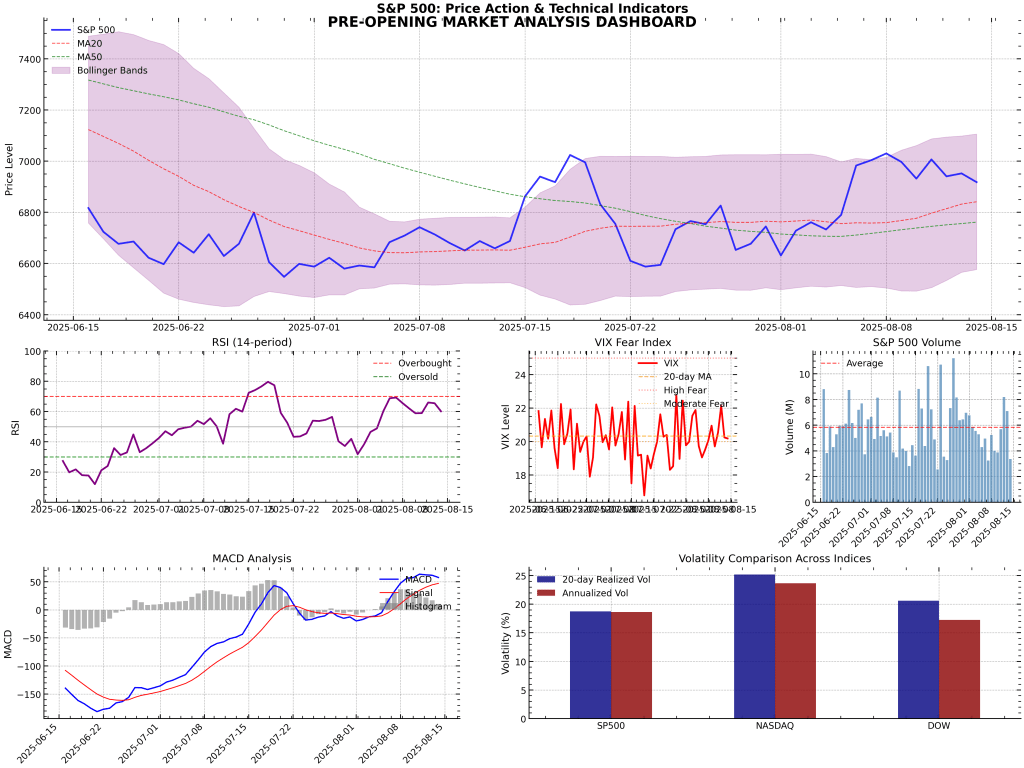

🏦 Futures & Technical Overview

| Index | Last Close | Support (MA20) | Resistance | RSI | Trend | Volatility (20d) |

|---|---|---|---|---|---|---|

| S&P 500 | 6,918 | 6,841 | 7,056 | 60.1 | Bullish | 18.7% |

| NASDAQ | 53,040 | 52,279 | 54,101 | 51.1 | Bullish | 25.2% |

| DOW | 66,348 | 64,900 | 67,675 | 55.6 | Bullish | 20.6% |

| VIX | 20.2 | — | — | — | Neutral | — |

- All major indices are above their 20-day moving averages, signaling a bullish technical backdrop.

- VIX remains at moderate levels (~20), indicating a controlled volatility environment.

- RSI readings are neutral, suggesting no immediate overbought or oversold conditions.

📰 Latest News & Market Drivers

- US Retail Sales (8:30am ET):

Expected to show a 0.4% MoM increase. A strong print could boost risk appetite and support equities, while a miss may trigger volatility and revive recession concerns. - Eurozone Q2 GDP (Preliminary):

Markets are watching for signs of economic resilience or slowdown. A positive surprise could lift European stocks and the euro; a weak number may pressure risk assets. - Fed Speakers:

Several FOMC members are scheduled to speak today. Any hints about the timing or magnitude of future rate cuts will be closely parsed by traders. - China Data:

Overnight, China reported better-than-expected industrial production but weaker retail sales, keeping global growth concerns in play. - Earnings:

Key reports today include Cisco, Applied Materials, and JD.com. Strong results could help tech and growth stocks extend gains.

🗓️ Economic Calendar – Key Events

| Time (ET) | Event | Consensus | Market Impact |

|---|---|---|---|

| 8:30 | US Retail Sales (Jul) | +0.4% | High |

| 10:00 | US Business Inventories | +0.2% | Moderate |

| 10:00 | Eurozone Q2 GDP (Prelim.) | +0.3% QoQ | High |

| 14:00 | Fed Minutes & Speakers | — | High |

| 16:00 | US TIC Flows | — | Low |

Market focus: US retail sales and Eurozone GDP are the main catalysts. Surprises in either direction could drive sharp moves in equities, bonds, and currencies.

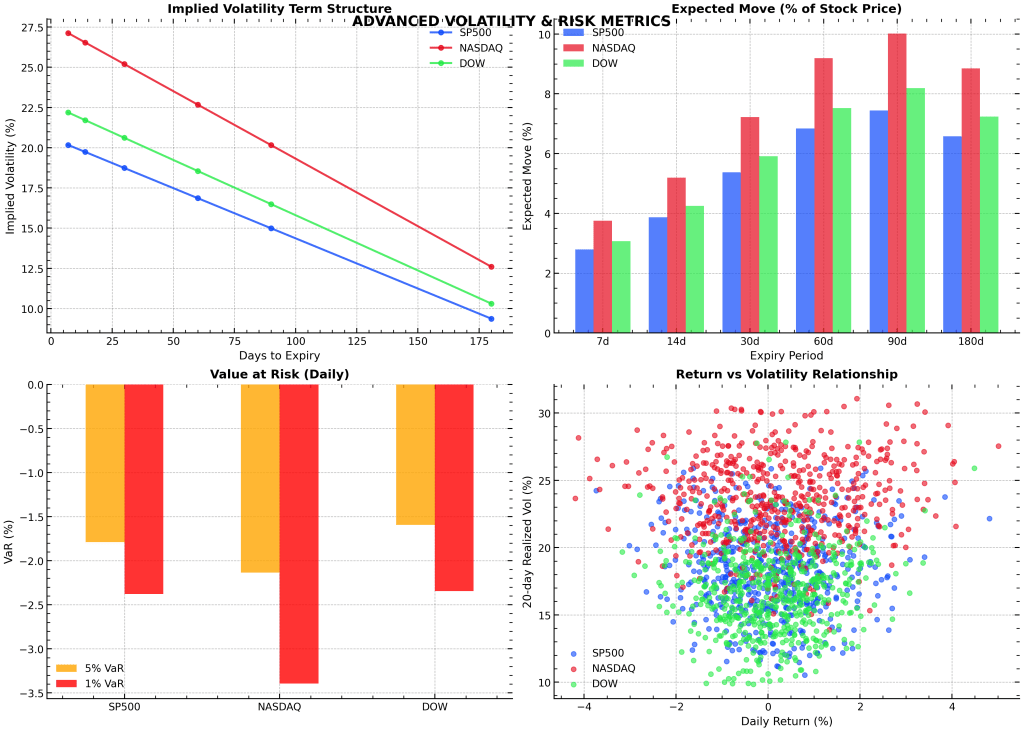

🔍 Volatility & Risk Analysis

| Index | 1-Week Expected Move | 1-Month Expected Move | Vega Exposure |

|---|---|---|---|

| S&P 500 | ±179 pts (2.6%) | ±372 pts (5.4%) | 7.87 |

| NASDAQ | ±1,851 pts (3.5%) | ±3,832 pts (7.2%) | 60.40 |

| DOW | ±1,894 pts (2.9%) | ±3,921 pts (5.9%) | 75.51 |

- Volatility is moderate across all indices, with NASDAQ showing the highest sensitivity to market swings.

- Options premiums are fairly valued, favoring volatility selling strategies for experienced traders.

📊 Visual Dashboard

📝 Trading Outlook & Key Levels

- Bias: Cautiously bullish above MA20 support; watch for pullbacks on data disappointments.

- Key Levels:

- S&P 500: Support at 6,841, resistance at 7,056

- NASDAQ: Support at 52,279, resistance at 54,101

- DOW: Support at 64,900, resistance at 67,675

- Volatility Triggers:

- Strong US retail sales or hawkish Fed commentary could spark upside volatility.

- Weak macro data or dovish surprises may lead to defensive rotation and higher VIX.

Summary:

Markets enter the session with a constructive tone, but remain highly sensitive to today’s economic data and central bank signals. Expect volatility around the US retail sales and Eurozone GDP releases, with technicals favoring a bullish bias as long as key support levels hold.

For real-time updates and actionable insights, follow http://www.ramonmorell.com and our social channels!