Key Takeaway:

Today’s markets turned risk-off as US labor data showed a clear cooling trend: job growth slowed sharply, unemployment ticked up, and wage gains remained steady. This labor market shift, combined with Fed hawkishness and global trade tensions, drove volatility—sending crypto and equities lower while gold surged.

📈 Quick Market Recap

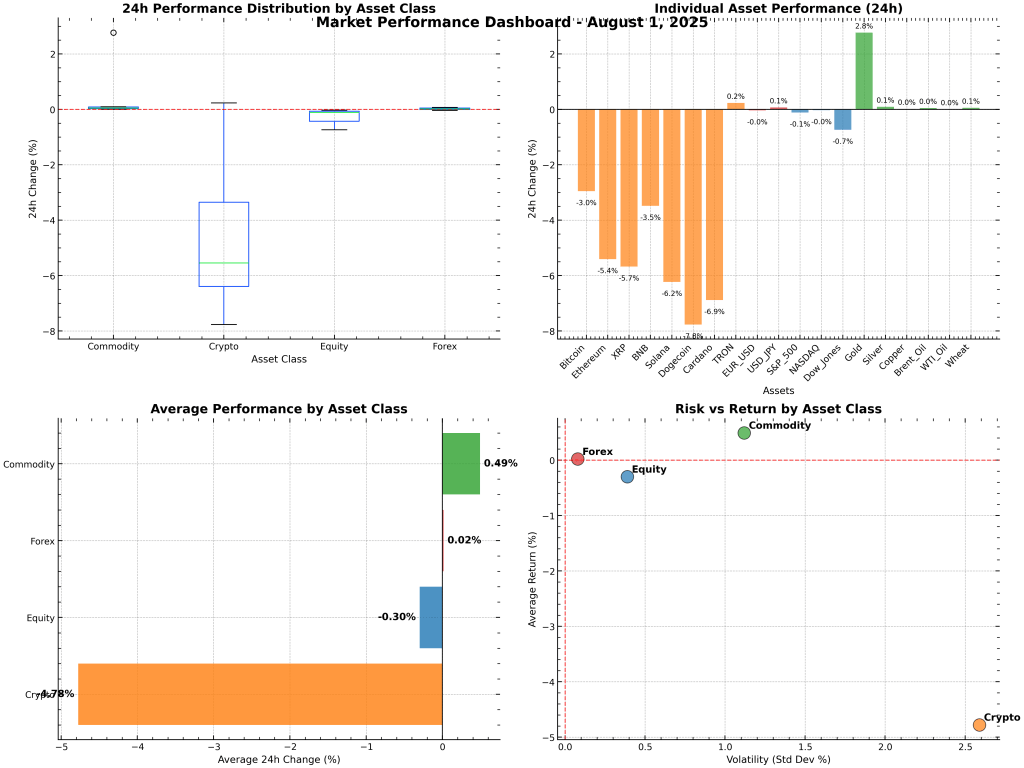

| Asset Class | Avg. 24h Return | Volatility | Best Performer | Worst Performer |

|---|---|---|---|---|

| Crypto | -4.78% | 2.59% | TRON (+0.23%) | Dogecoin (-7.77%) |

| Equity | -0.30% | 0.39% | NASDAQ (-0.03%) | Dow Jones (-0.74%) |

| Forex | +0.02% | 0.08% | USD/JPY (+0.07%) | EUR/USD (-0.04%) |

| Commodity | +0.49% | 1.12% | Gold (+2.77%) | WTI Oil (0.00%) |

📰 Today’s Market Drivers

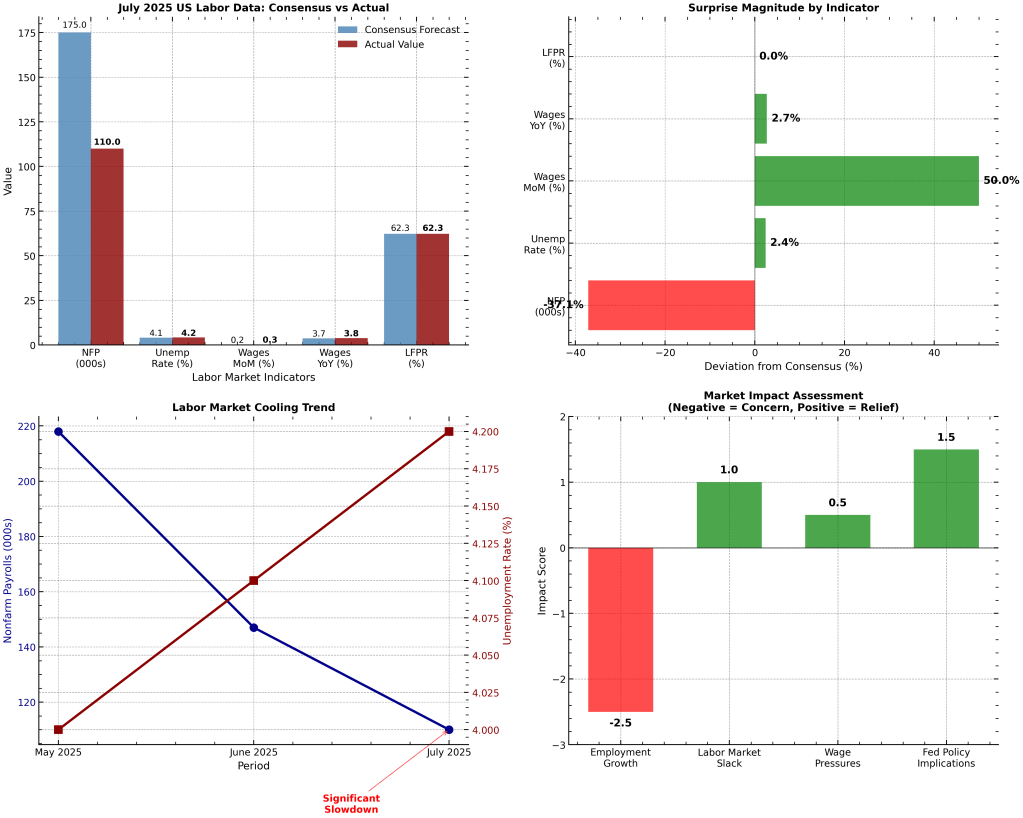

- US Labor Market Cools: July’s nonfarm payrolls rose by just 110,000—well below consensus and the slowest in five months. The unemployment rate edged up to 4.2%, and wage growth held steady at +0.3% MoM (+3.8% YoY). This signals a gradual labor market slowdown, with job creation now 25% below the recent average and unemployment at its highest since early 2022 .

- Fed Holds, Stays Hawkish: The Federal Reserve kept rates steady but signaled no rush to cut, citing sticky inflation and a still-resilient economy. The softer labor data, however, may increase pressure for a more dovish stance if the cooling trend persists.

- Tariff Turbulence: New US tariffs on Europe and Canada, plus fresh trade deals with Asia, rattled global sentiment and stoked safe-haven demand.

- Earnings Season: Energy and consumer staples (Exxon, Chevron, Kimberly-Clark) beat expectations, but tech stocks wobbled after a strong July.

- Commodities: Gold rallied as investors sought safety; oil stayed flat amid oversupply; copper and wheat ticked up on supply/demand dynamics.

📊 Visual Dashboard: Market & Labor Data at a Glance

🔍 Deep Dive: Asset Class & Labor Market Analysis

🚨 US Labor Market: Cooling Confirmed

| Indicator | Consensus | Actual (July) | Prior (June) | Deviation | Direction |

|---|---|---|---|---|---|

| Nonfarm Payrolls (000s) | 175 | 110 | 147 | -65 (-37.1%) | Below |

| Unemployment Rate (%) | 4.1 | 4.2 | 4.1 | +0.1 (+2.4%) | Above |

| Avg. Hourly Earnings MoM | 0.2 | 0.3 | 0.2 | +0.1 (+50%) | Above |

| Avg. Hourly Earnings YoY | 3.7 | 3.8 | 3.7 | +0.1 (+2.7%) | Above |

| Labor Force Participation | 62.3 | 62.3 | 62.3 | 0.0 (0%) | In-line |

Key Finding:

The biggest miss was in job creation, with payrolls coming in 65,000 below consensus—a 37% shortfall. Unemployment rose to 4.2%, the highest in over two years, while wage growth surprised slightly to the upside. The overall signal: the US labor market is cooling, but not collapsing.

📉 Equities: Modest Pullback After Record July

- S&P 500: 6,332 (-0.12%)

- NASDAQ: 21,122.45 (-0.03%)

- Dow Jones: 44,130.98 (-0.74%)

- Context: Investors took profits after a record July, bracing for jobs data and digesting mixed earnings.

💱 Forex: Dollar Dominance, Yen Weakness

- EUR/USD: 1.1435 (-0.04%) – Bearish, pressured by US data and Eurozone uncertainty.

- USD/JPY: 150.60 (+0.07%) – Bullish, as BoJ stays dovish and US data impresses.

🪙 Commodities: Gold Outshines, Oil Flat

- Gold: $3,291.27 (+2.77%) – Best performer, safe-haven demand.

- Oil: Brent $71.73 (+0.04%), WTI $69.26 (0.00%) – Range-bound on oversupply.

- Copper: $4.39 (+0.01%) – Supported by green energy demand.

- Wheat: $524 (+0.05%) – Stable, weather and trade in focus.

🧠 Key Insights & Predictions

Key Finding:

The July labor report confirms a cooling US job market: job growth is sharply below trend, unemployment is rising, and wage gains are steady but not accelerating. This reduces inflation risk and increases the odds of a more dovish Fed stance in coming months.

- Labor Market: The sharp slowdown in job creation and uptick in unemployment signal a normalization of the labor market, not a collapse. This should ease wage and inflation pressures, supporting a “soft landing” scenario.

- Fed Policy: With labor market slack increasing and inflation moderating, the probability of a Fed rate cut later this year has risen—especially if upcoming inflation data confirm the trend.

- Markets: The dollar remains strong on relative US resilience, but risk assets (crypto, equities) are under pressure as investors digest the implications of a softer labor market and ongoing Fed caution.

- Commodities: Gold’s rally reflects safe-haven demand amid macro uncertainty and labor market cooling. Oil remains range-bound, with no major supply shocks.

- Forward Risks: Watch for further labor market softening or a surprise in inflation data—either could quickly shift Fed expectations and market direction.

🏁 Conclusion

Summary Box:

The US labor market is cooling: job growth is slowing, unemployment is rising, and wage gains are steady. This shift, combined with Fed caution and global trade tensions, is driving a risk-off mood in markets. Stay tuned to www.ramonmorell.com for daily insights, actionable strategies, and the latest on how macro trends are shaping your investments.

by Ramon Morell