Key Takeaway:

The latest US jobs data and looming benchmark revisions have put the Federal Reserve in the hot seat. With job growth stalling and markets on edge, the September Fed meeting could be a game-changer for stocks, the dollar, and global risk sentiment.

📊 The NFP Shock: What Happened?

August’s Nonfarm Payrolls (NFP) report delivered a jolt to markets:

- Only 22,000 jobs were added (vs. 75,000 expected), the weakest print in years.

- Unemployment rose to 4.3%, the highest since 2021.

- Wage growth slowed to 3.7% year-over-year.

- Revisions to prior months were ugly:

- June: revised down to a net loss of 13,000 jobs

- May: previously revised down by 125,000 jobs

- July: a modest upward revision to 79,000 jobs

But the real bombshell? The annual BLS benchmark revision (due this week) is expected to show the US added 475,000 to 900,000 fewer jobs from April 2024 to March 2025 than previously reported—a massive downward adjustment that could reshape the Fed’s outlook .

🏦 Will the Fed Deliver a Jumbo 50bps Cut?

Market odds:

- 25bps cut: ~93% probability

- 50bps cut: ~7% probability (but rising if the benchmark revision is worse than feared)

What the experts say:

- Fed Chair Powell has acknowledged “downside risks” to the labor market and signaled readiness to act if job growth falters further .

- Standard Chartered and other analysts argue a 50bps “catch-up” cut is possible if the benchmark revision confirms a much weaker labor market .

- Historical precedent: In 2024, a similar negative revision led to an immediate 50bps cut .

Bottom line:

The Fed is almost certain to cut rates in September. If the benchmark revision is at the high end of estimates (close to -900k jobs), a 50bps cut is “in play”—and would send a powerful signal to markets.

📈 How Are Markets Reacting?

US Stocks

- Equities rallied after the weak NFP, as investors bet on imminent Fed easing.

- Tech and rate-sensitive sectors outperformed, with the S&P 500 and Nasdaq both gaining ground .

- “Bad news is good news”: Markets are cheering weak data, expecting lower rates to boost valuations and liquidity.

The US Dollar

- The dollar index fell 0.7% on NFP day, hitting a one-month low and extending its YTD decline to nearly 10% .

- EUR/USD surged above 1.17; other majors (GBP, JPY) also gained.

- Gold hit new all-time highs as investors sought safety and hedged against further USD weakness .

Bond Yields

- 10-year Treasury yield dropped 16bps to 4.07%, the lowest since April .

- Futures now fully price a 25bps cut, with a non-negligible chance of 50bps if the revision is severe .

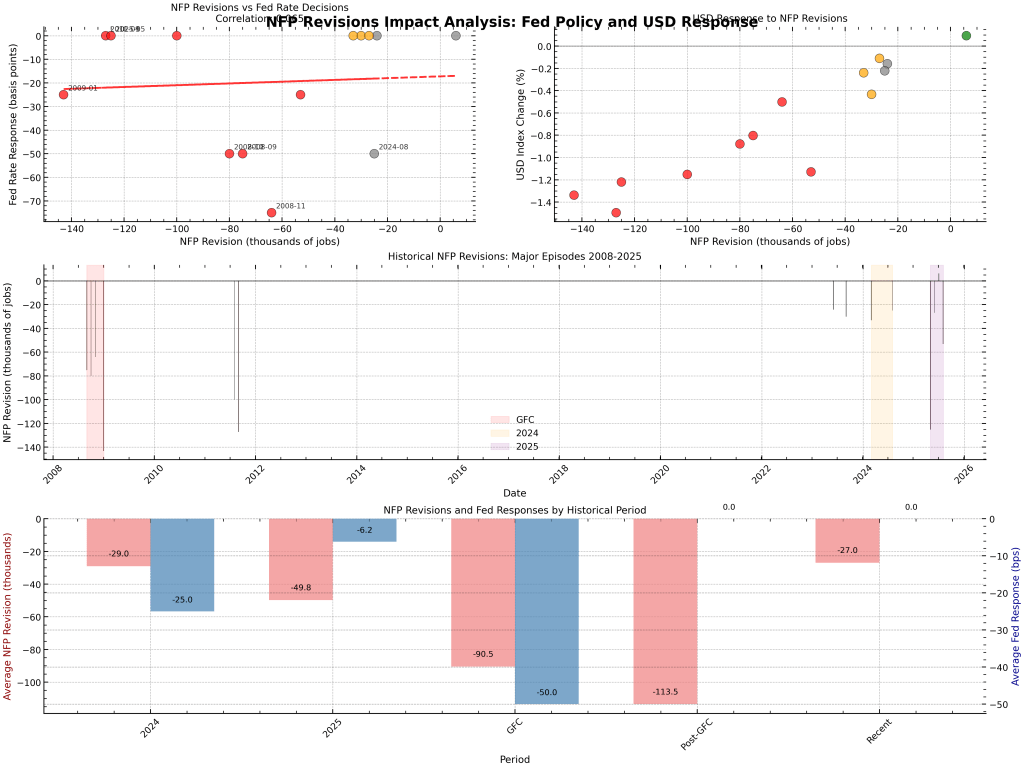

📉 Visual: NFP Revisions, Fed Cuts & Market Moves

Figure: Major NFP revisions have historically triggered aggressive Fed rate cuts and sharp USD declines. The 2024 benchmark revision led to a 50bps cut; 2025 could repeat the pattern.

🔮 Scenario Analysis: What’s Next?

| Scenario | Probability | Fed Action | USD Impact | S&P 500 Impact | Rationale |

|---|---|---|---|---|---|

| 25bps Cut (Base Case) | 92.6% | -25bps | -0.5% | +1.2% | Moderate NFP revision, labor market cooling |

| 50bps Cut (Aggressive) | 7.4% | -50bps | -1.5% | +2.5% | Large benchmark revision, severe job weakness |

| No Cut (Hawkish Surprise) | ~0% | 0bps | +1.0% | -2.0% | Fed holds despite weak data (very unlikely) |

Expected market moves:

- USD: -0.57%

- S&P 500: +1.3%

🧠 What History Tells Us

- Major NFP revisions (>100k jobs) have averaged a -50bps Fed response.

- USD typically falls 0.7% on moderate negative revisions (50k+).

- Stock markets rally on rate cut hopes, but the effect can reverse if the Fed disappoints or if labor weakness signals a deeper recession.

⚠️ Key Risks to Watch

- Benchmark revision worse than -900k jobs

- Unemployment rate rises above 4.5%

- Inflation remains sticky above 3%

- Geopolitical or financial market shocks

📝 Ramon’s Take: What Should Investors Do?

- Stay nimble: Volatility is likely as the Fed decision approaches.

- Watch the benchmark revision: If it’s at the high end, brace for a bigger cut and more USD weakness.

- Diversify: Gold, quality tech, and non-USD assets may outperform if the Fed turns more dovish.

- Don’t chase rallies blindly: If the Fed disappoints or signals concern about inflation, risk assets could reverse quickly.

Summary:

The September Fed meeting could be a watershed moment. With the US labor market flashing red and a massive jobs revision looming, the odds of a jumbo rate cut are rising. For investors, the next week will be all about Fed signals, the dollar’s direction, and whether “bad news” can keep fueling the bull market.