Key Takeaway:

Markets are rallying on hopes of Fed rate cuts after Jackson Hole, with stocks, forex, commodities, and crypto all showing notable moves. Here’s your no-fluff, table-driven summary to stay ahead this week!

🌍 Global Market Snapshot

| Region | Asset/Class | Asset/Pair | Daily Change | Weekly Change | Key Driver/Status |

|---|---|---|---|---|---|

| Europe | Equity | STOXX 600 | +0.2% | +1.4% | Energy & financials strength |

| Europe | Equity | DAX (Germany) | +0.1% | Flat | Stable, little change |

| Europe | Equity | FTSE 100 (UK) | +0.3% | +2.0% | Record highs, UK inflation 3.8% |

| US | Equity | S&P 500 | +0.1%* | +0.3% | Fed cut signals, labor softening |

| US | Equity | Dow Jones | +0.2%* | +1.5% | Weekly surge, Fed dovish tone |

| US | Equity | Nasdaq | +0.3%* | -0.6% | Tech profit-taking |

| Global | Currency | USD Index (DXY) | — | — | Easing, Powell dovish |

| Global | Currency | EUR/USD | — | — | Advancing, Eurozone PMI strength |

| Global | Currency | GBP/USD | — | — | Firm, UK inflation & PMI |

| Global | Commodity | Gold (XAU/USD) | +0.2% | — | Safe-haven, lower yields |

| Global | Commodity | WTI Oil | +0.1% | +1.6% | Tariff talks, inventory draws |

| Global | Crypto | Bitcoin | +1.0% | — | ETF inflows, Fed cut hopes |

| Global | Crypto | Ethereum | +1.0% | — | Risk-on sentiment |

*Futures pre-market change

📊 Key Economic Indicators

| Indicator | Value | Context/Driver |

|---|---|---|

| Fed Rate Cut Odds (Sept) | 89% | Post-Jackson Hole, Powell dovish |

| US Unemployment Rate | 4.2% | Labor market softening |

| US Jobless Claims (latest) | 235,000 | Above expected, labor concern |

| UK Inflation (July) | 3.8% | Accelerating |

| UK PMI (August) | 53.0 | Solid business activity |

| Eurozone PMI (August) | 51.1 | Expansion, 3rd month |

| Japan Core CPI (Y/Y) | 3.1% | Above BoJ target, easing |

| Eurozone Consumer Confidence | -15.5 | Weakened |

| US PMI (Forecast) | 50.5 | Key for forex, risk sentiment |

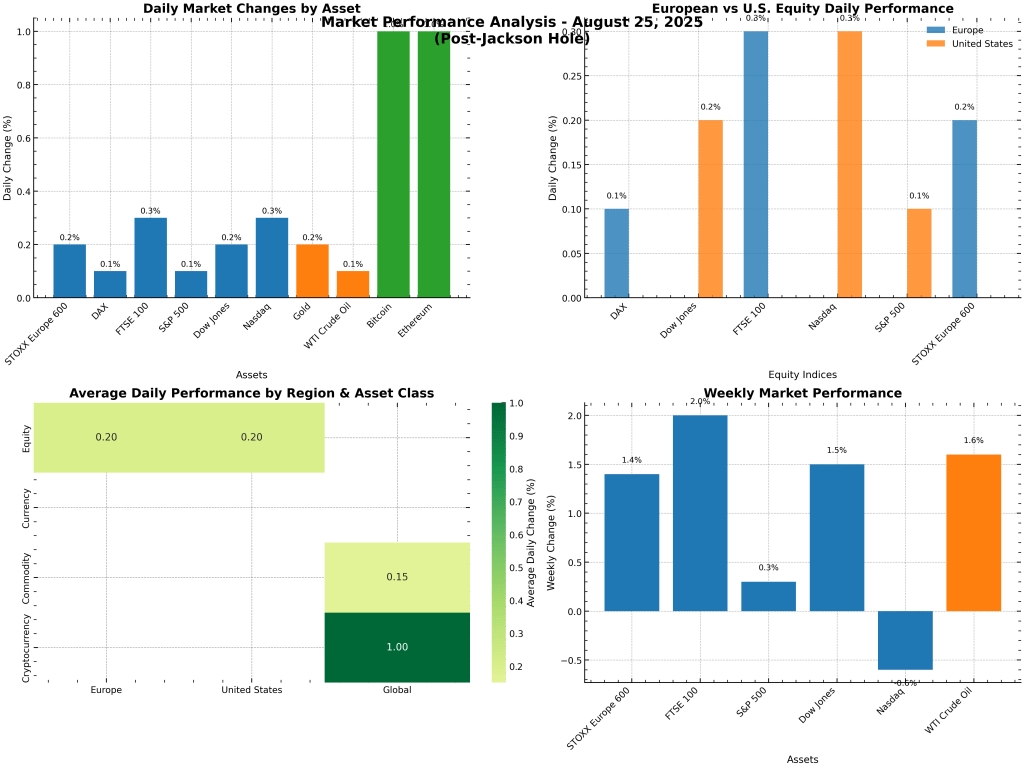

📈 Visual Market Overview

🔥 What’s Moving the Markets?

- Fed Rate Cut Hopes: Powell’s Jackson Hole speech boosted odds of a September cut to 89%, sparking global equity rallies and a weaker dollar.

- Europe: Energy and financials lead gains; UK’s FTSE 100 at record highs on strong inflation and PMI.

- US: S&P 500 and Dow up on Fed optimism; Nasdaq lags on tech profit-taking.

- Forex: Dollar softens, euro and pound gain on central bank stability and strong PMIs.

- Commodities: Gold rises as a safe haven; oil edges up on tariff/inventory news.

- Crypto: Bitcoin and Ethereum rebound with risk-on sentiment and ETF inflows.

🏆 Key Market Levels

| Asset | Level | Status/Driver |

|---|---|---|

| S&P 500 | 6,466.91 | Fed cut optimism |

| Dow Jones | 45,631.74 | Weekly surge |

| Nasdaq | 21,496.54 | Tech profit-taking |

| STOXX 600 | 559.07 | Energy/financials up |

| FTSE 100 | 9,321.40 | Record highs |

| EUR/USD | 1.12 | Advancing |

| GBP/USD | 1.32 | Firm |

| Gold | $2,510 | Safe-haven gains |

| WTI Oil | $64.00 | Tariff/inventory impact |

| Bitcoin | $64,000 | Risk-on recovery |

Summary:

Markets are in rally mode post-Jackson Hole, with Fed rate cut hopes driving gains across equities, forex, commodities, and crypto. Watch for key economic data this week—especially US PMI and inflation—for the next big move!