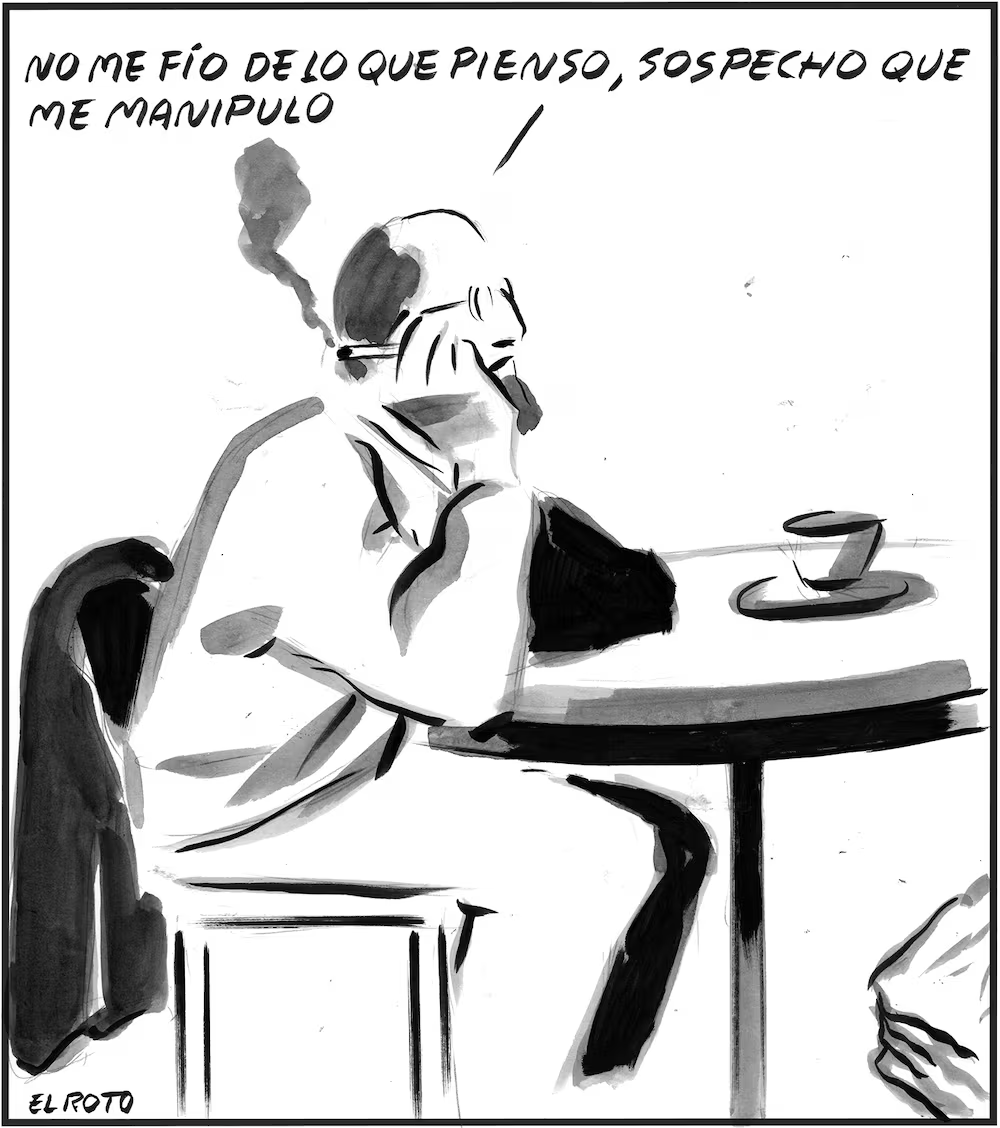

Esta viñeta de El Roto en El País de hoy sábado es otra de sus joyas donde lo absurdo se disfraza de cotidiano para darnos una lección de realidad.

«No me fío de lo que pienso, sospecho que me manipulo.»

Andrés Rábago tiene ese don casi místico para plantear situaciones que, de entrada, parecen un sinsentido —como un hombre que sospecha de su propio cerebro en la mesa de un bar, tomando un café—, pero que en cuanto las dejas reposar, revelan un fondo de verdad absoluto.

El absurdo como espejo

A veces necesitamos ver el disparate dibujado para entender que el verdadero absurdo es cómo vivimos.

- El «yo» conspiranoico: Hemos llegado a un punto en el que buscamos conspiraciones en todas partes, excepto en el lugar más obvio: entre nuestra oreja izquierda y la derecha.

- La ingeniería de la excusa: El Roto retrata a la perfección esa cualidad humana de ser, a la vez, el estafador y la víctima del timo. Sospechar de uno mismo es el mayor acto de honestidad intelectual que existe.

Personalmente, me fascina mi capacidad para manipularme. Soy capaz de convencerme de que comprar ese gadget tecnológico que no necesito es «una inversión estratégica para mi productividad», y lo peor es que me lo digo con una cara tan seria que termino por creerme. Mi «yo» interior es un comercial tan bueno que, si me descuidara, terminaría vendiéndome mi propia casa y dándole las gracias por la oportunidad.

Reírse de uno mismo es la única forma de desarmar al manipulador que llevamos dentro. Porque, seamos sinceros: si no nos fiamos de los políticos ni del algoritmo de Instagram, ¿por qué íbamos a fiarnos de ese tipo que nos mira desde el espejo y siempre tiene una justificación brillante para sus errores?