Key Takeaway:

Bitcoin has surged to $92,350 (+2.90%), breaking above key resistance and leading a broader crypto rally. This strength is boosting risk appetite across markets, with European indices steady, US futures firm, and cross-asset sentiment tilting risk-on.

📈 Executive Summary

- Bitcoin breaks out above $92,000, up +2.90%—setting the tone for digital assets and risk markets.

- European indices (DAX, FTSE 100, IBEX 35) are modestly higher, led by industrials and financials.

- US futures are steady to slightly higher, with tech and financials in focus.

- Gold is softer, while oil and EUR/USD remain stable.

- Earnings season and central bank policy remain key drivers.

1. Market Snapshot: Key Prices (as of mid-morning, January 13, 2026)

| Index / Asset | Current Price | Daily Change (%) | Session Range |

|---|---|---|---|

| DAX (Germany) | 25,416.20 | +0.04% | 25,310 – 25,520 |

| FTSE 100 (UK) | 10,145.74 | +0.05% | 10,110 – 10,180 |

| IBEX 35 (Spain) | 17,756.00 | +0.47% | 10,240 – 10,310 |

| Dow Jones Futures | 49,590.20 | +0.17% | – |

| S&P 500 Futures | 6,977.27 | +0.16% | – |

| Nasdaq Futures | 23,733.90 | +0.26% | – |

| Gold (XAU/USD) | $4,594.60 | -0.07% | $4,573.70 – $4,605.90 |

| EUR/USD | 1.1665 | -0.02% | 1.16535 – 1.1674 |

| Crude Oil (WTI) | $60.10 | +1.01% | $58.65 – $60.10 |

| Bitcoin (BTC/USD) | $92,350 | +2.90% | $91,820 – $92,580 |

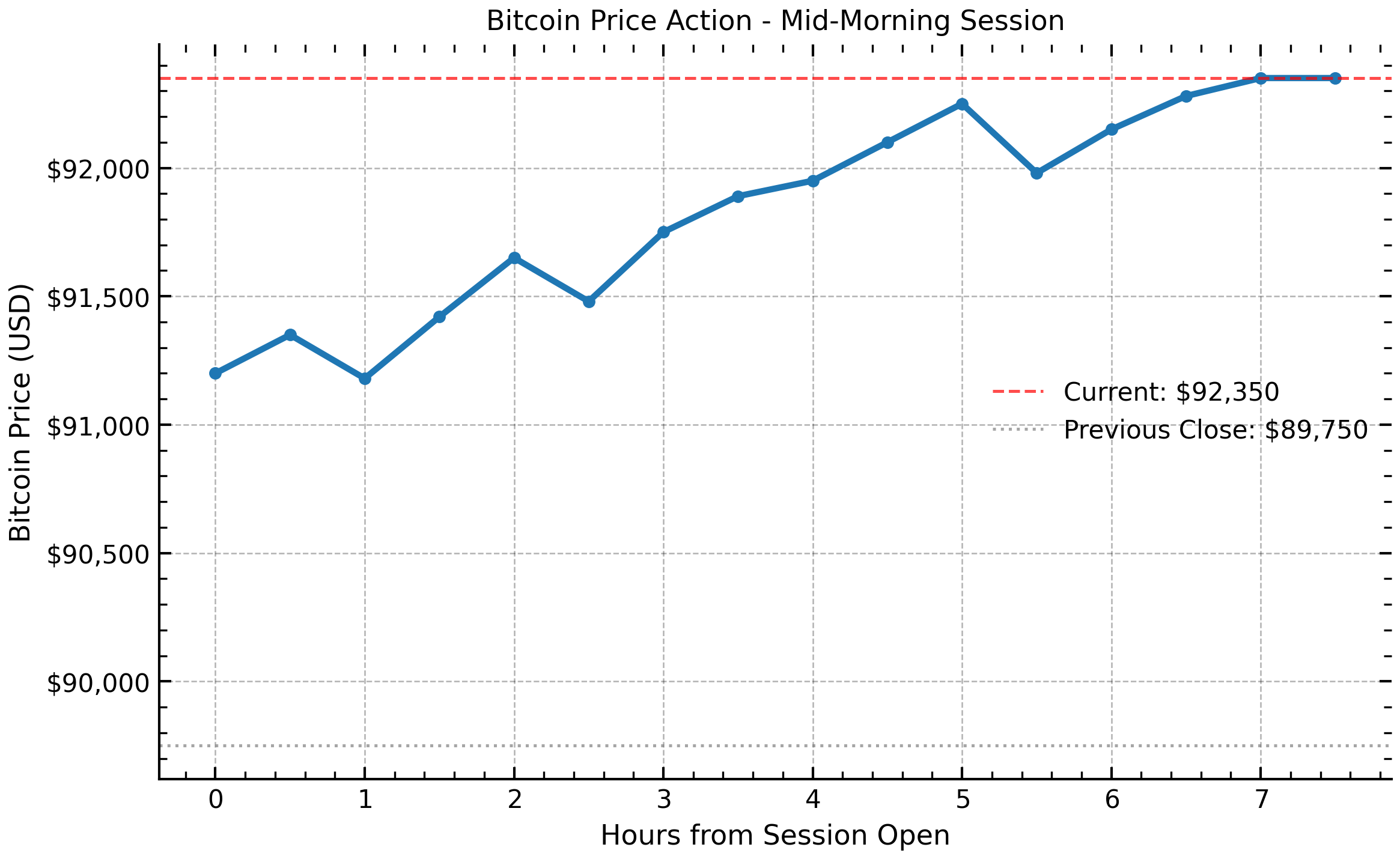

2. Bitcoin (BTC) Technical Analysis & Market Impact

Key Finding:

Bitcoin’s breakout above $92,000 (+2.90%) signals renewed bullish momentum, with the session high at $92,580 and strong support forming near $91,500.

🔍 Technical Highlights

- Current Price: $92,350

- Previous Close: $89,750

- Session Range: $91,820 – $92,580

- Immediate Resistance: $93,000 (psychological level)

- Strong Resistance: $95,500 (previous cycle high)

- Support: $91,500 (session low), $89,000 (previous consolidation)

Bitcoin (BTC/USD) intraday price action – January 13, 2026

🚀 Market Sentiment & Cross-Asset Implications

- Crypto Rally: Bitcoin’s strength is leading a broader move in digital assets, with Ethereum also up +1.41%.

- Risk-On Tone: The rally in crypto coincides with gains in equities (Nasdaq +0.50%, S&P 500 +0.21%) and a pullback in gold (-0.39%), suggesting investors are favoring risk assets.

- Macro Context: USD strength (+0.20% vs EUR) has not dampened crypto appetite, highlighting Bitcoin’s resilience as both a risk and alternative asset.

Key Takeaway:

Bitcoin’s breakout is attracting institutional flows and retail momentum, reinforcing its role as a bellwether for risk sentiment and digital asset adoption.

3. Major Index Movements & Sector Highlights

European Markets

- DAX: Near all-time highs, led by industrials and autos.

- FTSE 100: Energy and mining stocks outperform on higher commodity prices.

- IBEX 35: Outpaces peers, driven by Spanish banks and infrastructure.

US Futures

- Dow, S&P 500, Nasdaq: Steady to higher, with tech and financials in focus as earnings season ramps up.

4. Cross-Asset Markets

| Asset | Current Price | Daily Change (%) | Session Range |

|---|---|---|---|

| Gold | $4,594.60 | -0.07% | $4,573.70 – $4,605.90 |

| Oil (WTI) | $60.10 | +1.01% | $58.65 – $60.10 |

| EUR/USD | 1.1665 | -0.02% | 1.16535 – 1.1674 |

| BTC/USD | $92,350 | +2.90% | $91,820 – $92,580 |

- Gold: Slightly lower as risk appetite rises.

- Oil: Firm on supply discipline and steady demand.

- EUR/USD: Stable, awaiting further economic data.

5. Notable Company News & Earnings

- Alphabet (GOOGL): Hits $4T market cap after Apple selects Gemini AI for Siri.

- Apple (AAPL): Up on AI partnership news.

- Major US Banks: JPMorgan, Wells Fargo, Citigroup reporting this week.

- Intel (INTC): Surges on positive government engagement.

- Walmart (WMT): Jumps on Nasdaq 100 inclusion and AI partnership.

- M&A: T-Mobile, Chevron, Nippon Steel headline recent deals.

6. Economic Data & Central Bank Policy

- US: CPI up 0.2% MoM; Fed expected to hold rates steady.

- Europe: Industrial production beats; ECB steady.

- Asia: Japan and China show improving data; BoJ gradual normalization.

7. Key Market Themes

- Crypto Leadership: Bitcoin’s breakout is setting the tone for risk assets.

- Sector Rotation: Broader leadership in equities beyond mega-cap tech.

- Safe-Haven Flows: Gold softens as risk appetite returns.

- AI & Tech: Partnerships and investment drive sentiment.

- M&A Activity: Strategic deals reshape key sectors.

8. Conclusion & Outlook

Key Finding:

Bitcoin’s surge above $92,000 is a bullish signal for both crypto and broader risk markets. Watch for a test of $93,000–$95,500 resistance, with institutional flows and macro data as key catalysts.

- Equities: Constructive, but monitor for volatility as earnings and inflation data are digested.

- Crypto: Bitcoin’s leadership could extend if volume and sentiment remain strong.

- Commodities: Gold and oil well-supported; monitor for shifts in risk appetite.

📣 Actionable Insights

- Content Opportunity: Feature a “Bitcoin Breakout” explainer post with infographics and a short video for social media.

- Cross-Promotion: Repurpose this report into LinkedIn threads, Twitter/X posts, and Instagram stories to drive traffic.

- Engagement Tactic: Poll readers on their Bitcoin price targets for Q1 2026.

- SEO Tip: Target trending keywords like “Bitcoin 2026 breakout,” “crypto market sentiment,” and “global market update.”