Charles Bukowski (1920–1994) was a German-American novelist, poet, and short story writer. Often labeled as a counter-cultural icon, his writing style was gritty, visceral, and uncompromisingly honest, focusing on the lives of ordinary, marginalized Americans: poverty, alcohol, exploitative labor, and the bleakness of city life. His work is characterized by a cynical, semi-autobiographical persona—Henry Chinaski—who navigates the world with a mixture of despair, resignation, and dark humor.

🧠 The Bukowski Trading Paradox: Doubt vs. Confidence

Bukowski’s observation—»The problem with the world is that the intelligent people are full of doubts, while the stupid ones are full of confidence»—serves as a profound commentary on the dynamics of financial trading, especially in highly volatile markets like Forex, cryptos, and CFDs. The quote highlights the inverse relationship between knowledge and conviction that is often detrimental to trading success.

1. The Burden of Intelligent Doubt (The Professional)

The intelligent person in the trading world is the experienced professional, the professor, or the disciplined trader. They are full of doubts because they understand:

- Non-Linearity and Complexity: They know the market is a complex adaptive system. They are aware of unknown unknowns (tail risks) and the sheer difficulty of predicting price action with certainty. They are familiar with the «efficient market hypothesis» debate and understand that edges are thin and fleeting.

- Risk and Probability: They operate in the realm of probability, not certainty. Every trade is a hypothesis. Their doubt is healthy skepticism, leading to rigorous risk management (e.g., using stop-losses, sizing positions small). This internal questioning is what keeps them solvent.

- Cognitive Biases: The intelligent trader has studied behavioral finance and knows the enemy is often internal. They doubt their own confirmation bias or their tendency to chase losses, forcing them to rely on mechanical systems over gut feelings.

2. The Danger of Stupid Confidence (The Amateur)

The stupid one who is full of confidence is often the new or undisciplined retail trader. Their confidence stems from a lack of knowledge, often fueled by quick initial wins or the pervasive «get-rich-quick» narrative. This misplaced confidence manifests as:

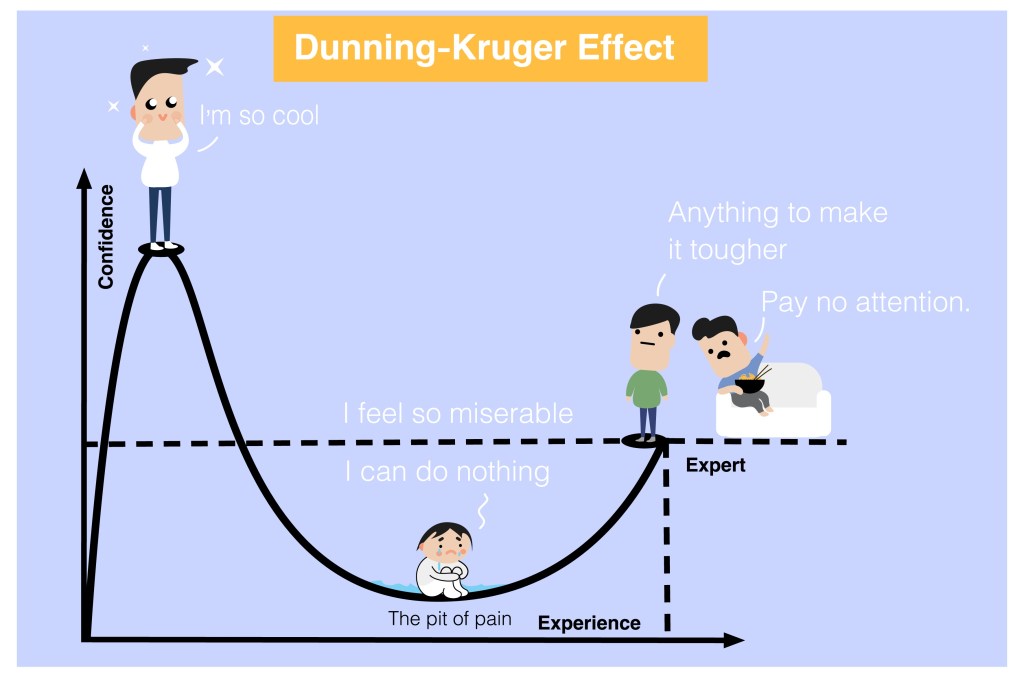

- Illusory Superiority (The Dunning-Kruger Effect): Beginners often achieve a basic understanding (e.g., how to draw a trendline) and, due to their limited knowledge, mistakenly believe they are experts. They confuse luck with skill.

- Over-Leveraging and No Stops: Confidence often translates into taking excessive risk. In Forex or CFD trading, they will use maximum leverage and skip stop-loss orders because they are «certain» the price will revert. This leads to catastrophic account blow-ups when the market inevitably proves them wrong.

- Ignoring Fundamentals/Context: They display supreme confidence in a simple signal or indicator without doubting the broader market context, liquidity conditions, or fundamental risks specific to an asset (e.g., a change in crypto regulation or a central bank decision).

3. The Path to Consistency

For a professional trader, the goal is not to eliminate doubt entirely (that would be stupid confidence), but to channel intelligent doubt into disciplined execution.

The professional’s formula is:

$$\text{Intelligent Doubt} + \text{Disciplined System} = \text{Consistent Edge}$$

They doubt the outcome of any single trade, but maintain absolute confidence in the long-term validity of their well-tested system. Bukowski’s quote thus serves as a powerful reminder to your students: Arrogance is the fastest way to liquidation. Doubt leads to preparation; preparation leads to survival.