Key Takeaway:

Markets closed higher worldwide, but late-session profit-taking trimmed earlier gains. Technology and Communication Services led the advance, while the US government shutdown resolution and dovish Fed signals boosted sentiment. Crypto and commodities saw mixed moves, and after-hours earnings set the stage for tomorrow’s volatility.

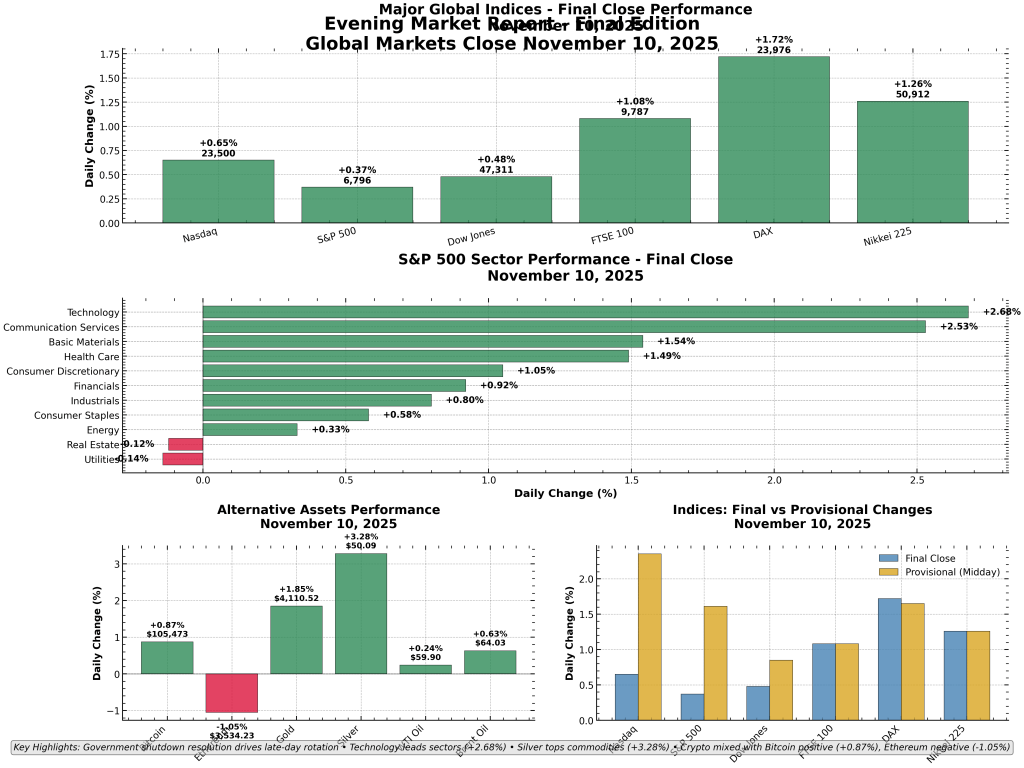

🕙 Final Market Snapshot: Indices, Sectors & Alternative Assets

| Index | Final Close | % Change | Provisional % | Change vs. Provisional |

|---|---|---|---|---|

| Nasdaq | 23,499.80 | +0.65% | +2.35% | -1.70% |

| S&P 500 | 6,796.29 | +0.37% | +1.61% | -1.24% |

| Dow Jones | 47,311.00 | +0.48% | +0.85% | -0.37% |

| FTSE 100 | 9,787.15 | +1.08% | +1.08% | 0.00% |

| DAX | 23,976.07 | +1.72% | +1.65% | +0.07% |

| Nikkei 225 | 50,911.76 | +1.26% | +1.26% | 0.00% |

| ————————– | —————- | ————— | ———————– | |

| Technology | +2.68% | +2.61% | +0.07% | |

| Communication Services | +2.53% | +2.56% | -0.03% | |

| Basic Materials | +1.54% | +1.59% | -0.05% | |

| Health Care | +1.49% | +1.47% | +0.02% | |

| Consumer Discretionary | +1.05% | +1.11% | -0.06% | |

| Financials | +0.92% | +0.93% | -0.01% | |

| Industrials | +0.80% | +0.72% | +0.08% | |

| Consumer Staples | +0.58% | +0.68% | -0.10% | |

| Energy | +0.33% | +0.43% | -0.10% | |

| Real Estate | -0.12% | -0.38% | +0.26% | |

| Utilities | -0.14% | +0.03% | -0.17% | |

| ————– | —————— | ———- | ————— | ———————– |

| Bitcoin | $105,472.80 | +0.87% | +0.4% | +0.47% |

| Ethereum | $3,534.23 | -1.05% | +0.1% | -1.15% |

| Gold | $4,110.52/oz | +1.85% | +1.7% | +0.15% |

| Silver | $50.09/oz | +3.28% | +3.2% | +0.08% |

| WTI Oil | $59.90/bbl | +0.24% | +0.65% | -0.41% |

| Brent Oil | $64.03/bbl | +0.63% | +0.63% | 0.00% |

🌟 Visual: Final Market Performance Overview

🔍 Key Market Drivers & Late-Breaking News

1. US Government Shutdown: Resolution in Sight

- The Senate advanced a bipartisan bill to end the 40-day shutdown, with the House expected to vote imminently. This breakthrough lifted risk assets and is set to restore government services and economic data releases .

- Relief rally was strongest in sectors tied to government spending and data-dependent trading.

2. Federal Reserve: Dovish Tilt

- The Fed left rates unchanged but announced an early end to its balance sheet runoff, supporting market liquidity .

- Chair Powell signaled readiness to cut rates if needed, but stopped short of promising a December move. Treasury yields dipped, and growth stocks benefited.

3. Corporate Earnings: Mixed After-Hours Moves

- Pinterest (-18%) and Super Micro Computer (-10%) fell sharply after missing earnings, while Amgen and Rivian posted positive surprises .

- Pfizer’s $10B acquisition of Metsera and Warner Brothers Discovery’s M&A news added to after-hours volatility.

4. Alternative Assets: Divergence

- Bitcoin rebounded late to close up +0.87%, but Ethereum dropped -1.05% after a midday reversal.

- Gold (+1.85%) and silver (+3.28%) held near highs on safe-haven demand, while oil prices were steady.

5. Sector Rotation: Tech Stays on Top

- Technology (+2.68%) and Communication Services (+2.53%) led, with late-session strength in Industrials and Health Care.

- Defensive sectors (Real Estate, Utilities) lagged, reflecting a risk-on mood.

📊 Analysis: What Changed Since the Provisional Report?

- US indices gave back much of their midday surge as traders locked in profits and digested Fed and shutdown news. Nasdaq’s gain shrank from +2.35% to +0.65%.

- Tech sector extended its lead (+2.68%), while Communication Services held strong. Industrials and Health Care saw late buying.

- Crypto volatility increased: Bitcoin recovered, but Ethereum reversed lower.

- Gold and silver outperformed as geopolitical and policy risks kept safe-haven demand high.

- After-hours earnings are likely to drive tomorrow’s sector moves, especially in tech and biotech.

Key Finding:

The late-session pullback in US stocks was driven by profit-taking and a “wait-and-see” approach to the shutdown deal and Fed policy. Tech and growth themes remain dominant, but sector rotation is picking up as investors look for broader participation.

🗓️ What’s Next?

- Shutdown bill passage and the return of government data will be closely watched.

- Fed commentary and Treasury market moves could drive further volatility.

- Earnings fallout from Pinterest, Super Micro, and others will shape sector leadership.

- Geopolitical risks and global policy uncertainty remain key background factors.

Summary Box:

- US and global stocks closed higher, but off their peaks

- Tech and Communication Services led, defensives lagged

- Shutdown resolution and Fed policy boosted sentiment

- Crypto and commodities saw mixed moves

- After-hours earnings set up a volatile open tomorrow