I was twenty-six when I first knew the market was wrong.

SPY had gapped down 4 %, the VIX was spitting blood, and every forum screamed capitulation.

I loaded the boat on triple-leveraged calls expiring in three days.

“Volatility mean-reverts,” I typed with the certainty of a kid who’d read one Reminiscences chapter and called it a PhD.

The options expired worthless.

I blamed the Fed, the algos, the weather.

Never the mirror.

Forty years later, white hair and hairline in full retreat, and the only thing I know is that I know nothing—except the taste of my own footprints.

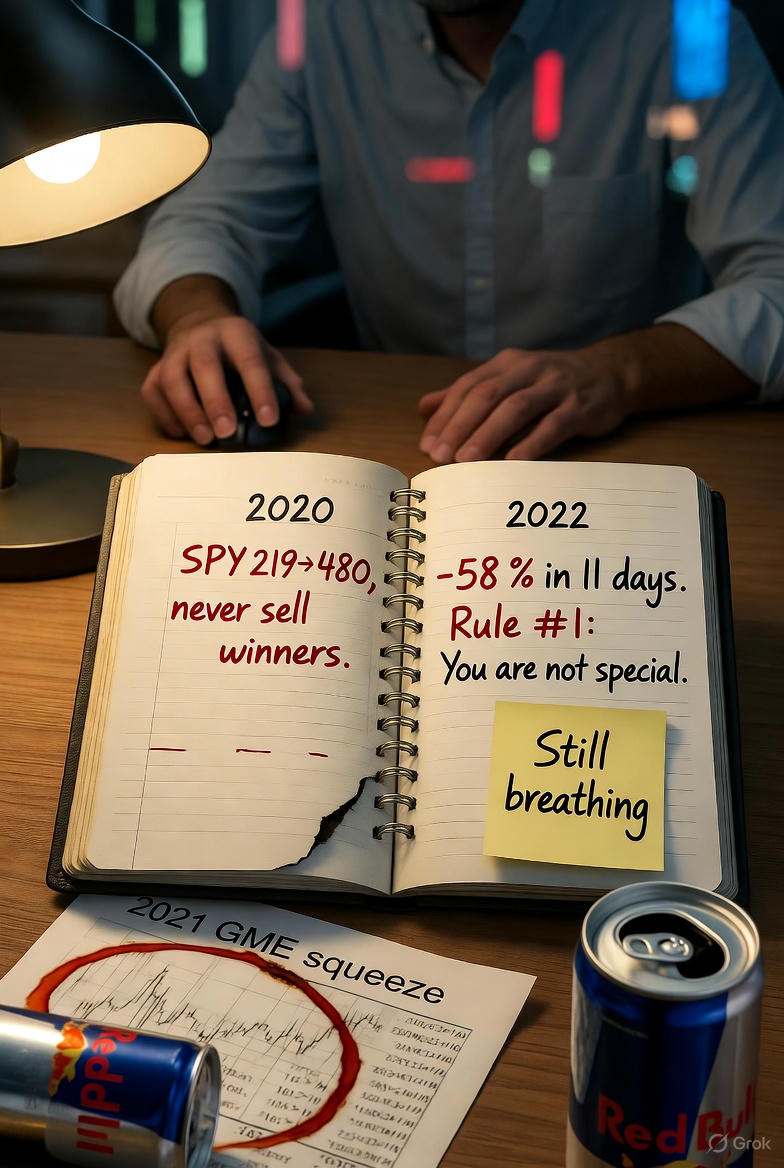

I’ve ridden the 2020 crash, the meme apocalypse, the NFT winter, the AI summer.

Each cycle left a scar shaped like a P&L screenshot I swore I’d never take again.

Yet here I am, 2:17 a.m., watching the same candle print on a different ticker, whispering the same prayer in a deeper voice.

The irony is surgical:

Youth gifts you conviction sharp enough to cut your own throat.

Age gifts you doubt dull enough to keep the blade sheathed—most nights.

Between those nights lies the trader’s real education:

a slow hemorrhage of certainty, paid in margin calls and sleepless Delta calculations.

I met a kid last month—let’s call him NeoEdge—who DM’d me his “100 % win-rate scalping bot.”

Backtested on 37 trades.

All green.

I asked for the drawdown path.

He sent a smoothed equity curve that looked like a ski slope in Val Thorens.

I sent him a screenshot of my 2022 ledger:

-42 % in forty-three days, annotated in red Sharpie: “Still here.”

He blocked me.

Some lessons you can only invoice in real money.

The market is a mirror that only reflects clearly after you’ve bled on it.

Early on, you see genius.

Later, you see noise.

Eventually, you see yourself—small, caffeinated, mortal—trying to outsmart a system that eats overconfidence for breakfast and still has room for dessert.

Wilde nailed it.

The young know everything because they haven’t met the market’s invoice yet.

The rest of us trade smaller, sleep worse, and keep a sticky note on the monitor that reads:

“You’ve been wrong before. Spectacularly.”

It’s not wisdom.

It’s scar tissue with better risk management.