Rollo May wasn’t your average armchair philosopher. He was a clinical psychologist who dared to inject existentialism into psychotherapy — because clearly, what Freud needed was more angst. May believed that anxiety, freedom, and responsibility were central to the human experience. In other words, he understood that when people are lost, they don’t sit down and ask for directions — they sprint into the fog, hoping velocity will compensate for cluelessness.

Which brings us to traders.

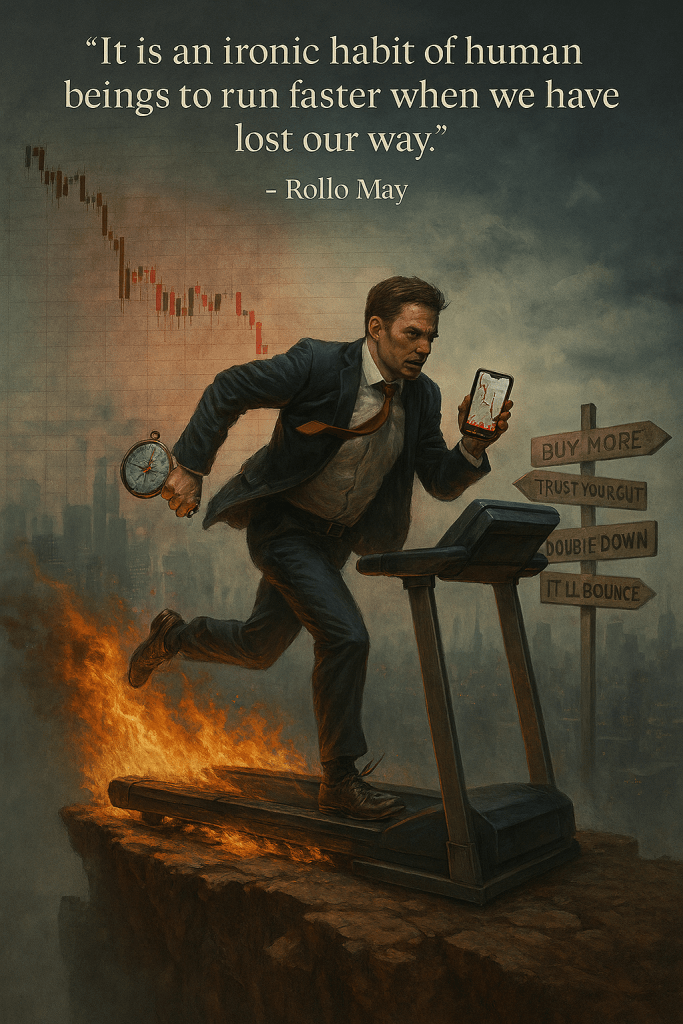

There’s a peculiar ritual that unfolds when a position starts to deteriorate. You’d think the logical response would be to reassess, reduce exposure, maybe even — gasp — close the trade. But no. Many traders, gripped by the sacred fear of missing out or being wrong, do the opposite. They double down. They add to losers. They start clicking buttons like they’re trying to summon a miracle from MetaTrader.

It’s not strategy. It’s panic dressed up as conviction.

And it’s ironic, isn’t it? The moment we should slow down, we speed up. We chase, we force, we “just need one good trade to get back.” It’s like watching someone dig a hole and then switch to a jackhammer because the shovel wasn’t fast enough.

May’s quote isn’t just poetic — it’s painfully accurate. The faster we run when we’re lost, the further we get from clarity. In trading, that means deeper drawdowns, more emotional damage, and eventually, a very expensive lesson in humility.

So next time your chart looks like a crime scene, maybe don’t sprint. Pause. Zoom out. Ask yourself: are you trading, or are you just running faster because you’ve lost your way?