Key Takeaway:

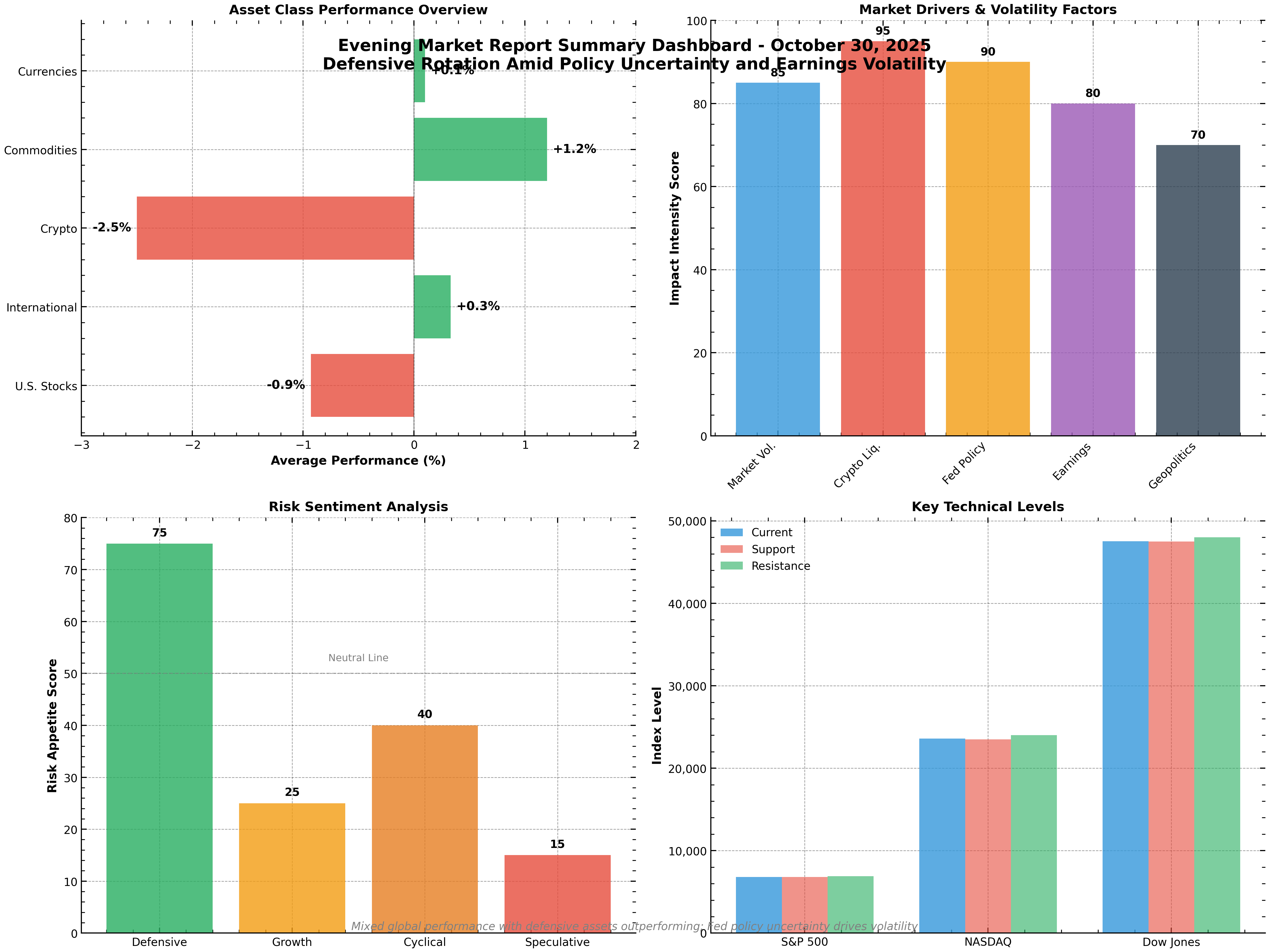

Markets pivoted defensively as the Federal Reserve’s rate cut was overshadowed by hawkish guidance and a historic U.S. data blackout. Utilities, healthcare, and consumer staples led gains, while tech and consumer discretionary stocks lagged. Crypto markets saw a sharp selloff, and commodities were mixed. Investors are advised to focus on quality, defensive sectors, and monitor policy and data developments closely.

Executive Summary

- Defensive rotation dominates: Utilities (+1.99%), healthcare, and staples outperformed as investors sought safety.

- Fed delivers rate cut, but signals caution: December easing is “far from assured,” fueling volatility.

- Big Tech earnings drive sharp stock moves: Winners and losers diverged dramatically.

- Crypto markets tumble: $1.12B in liquidations, Bitcoin -3.8%.

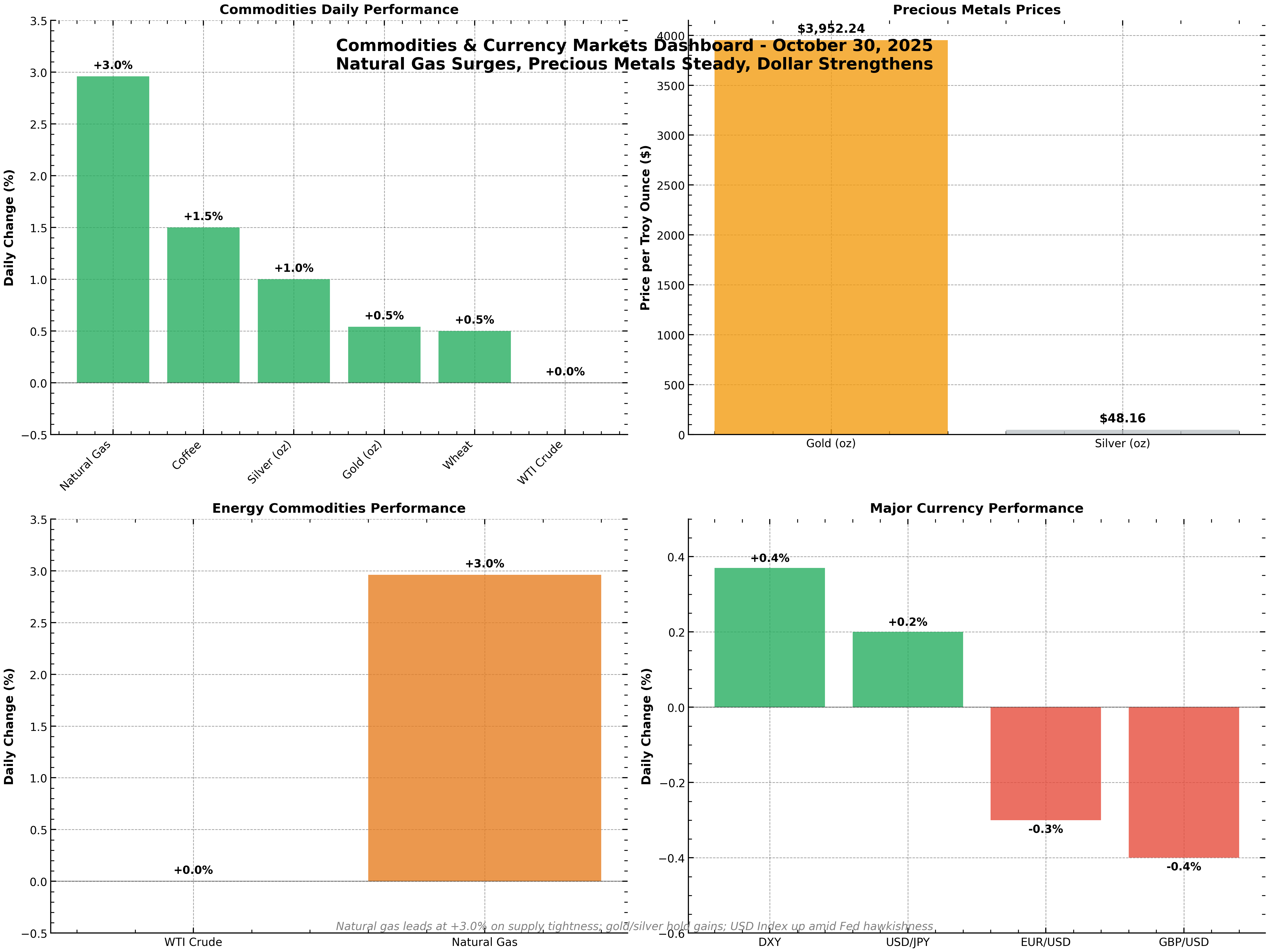

- Commodities mixed: Natural gas surges, gold and silver rally, oil flat.

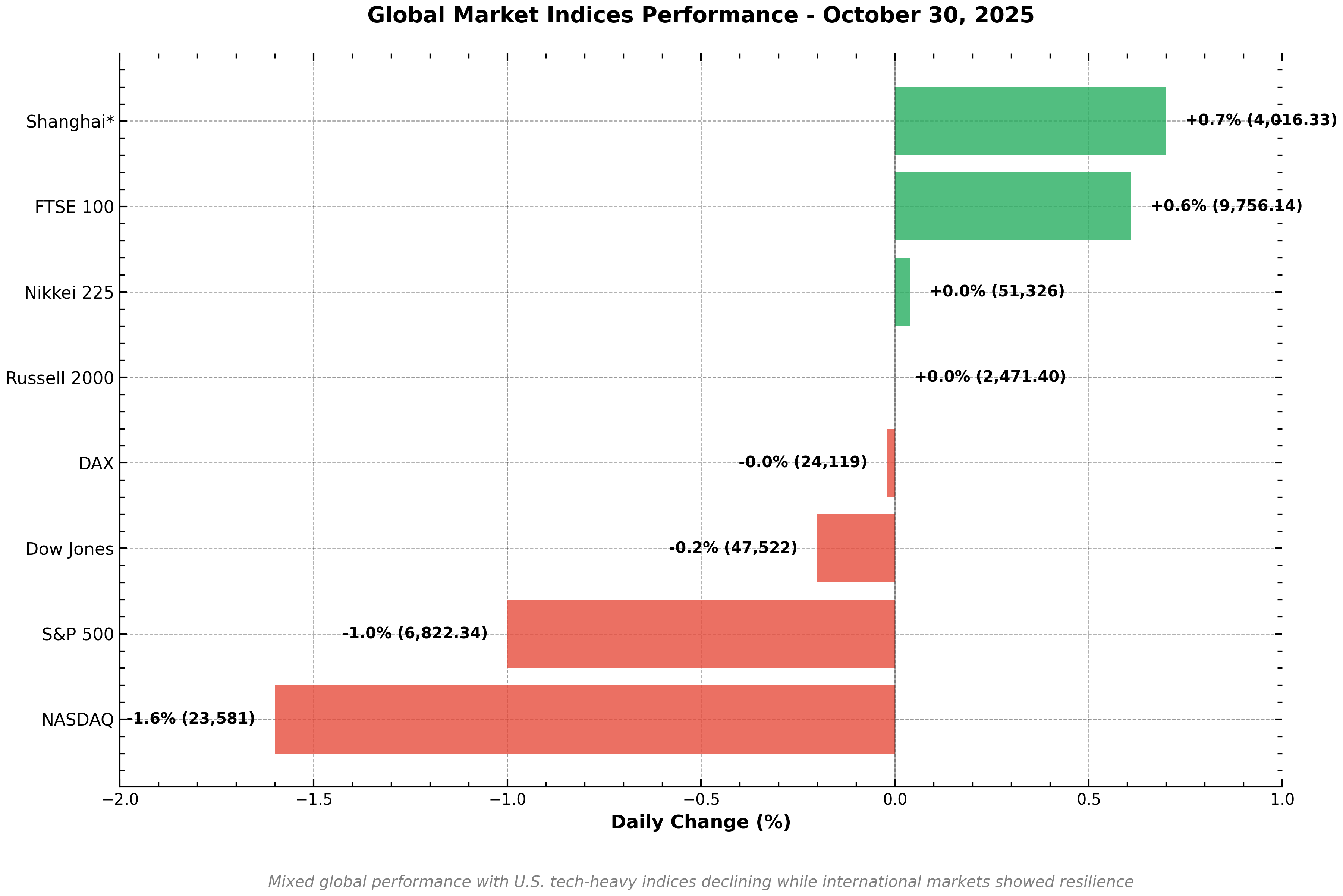

- Global divergence: U.S. indices fell, but FTSE 100 and Nikkei 225 outperformed.

🌍 Global Indices Performance

| Index | Close | Change (pts) | % Change | Volume | Support | Resistance |

|---|---|---|---|---|---|---|

| S&P 500 | 6,822.34 | -68.25 | -1.00% | 2.1B | 6,800 | 6,900 |

| Dow Jones | 47,522.12 | -109.88 | -0.20% | 51.5M | 47,500 | 48,000 |

| NASDAQ | 23,581.14 | -377.33 | -1.60% | 725.6M | 23,500 | 24,000 |

| Russell 2000 | 2,471.40 | +0.10 | +0.00% | n/a | 2,450 | 2,500 |

| FTSE 100 | 9,756.14 | +59.40 | +0.61% | n/a | 9,700 | 9,800 |

| DAX | 24,118.89 | -5.32 | -0.02% | n/a | 24,000 | 24,500 |

| Nikkei 225 | 51,325.61 | +17.96 | +0.04% | >10T JPY | 51,000 | 51,500 |

| Shanghai | 4,016.33* | +28.11* | +0.70%* | n/a | 4,000 | 4,050 |

Major global indices performance, October 30, 2025

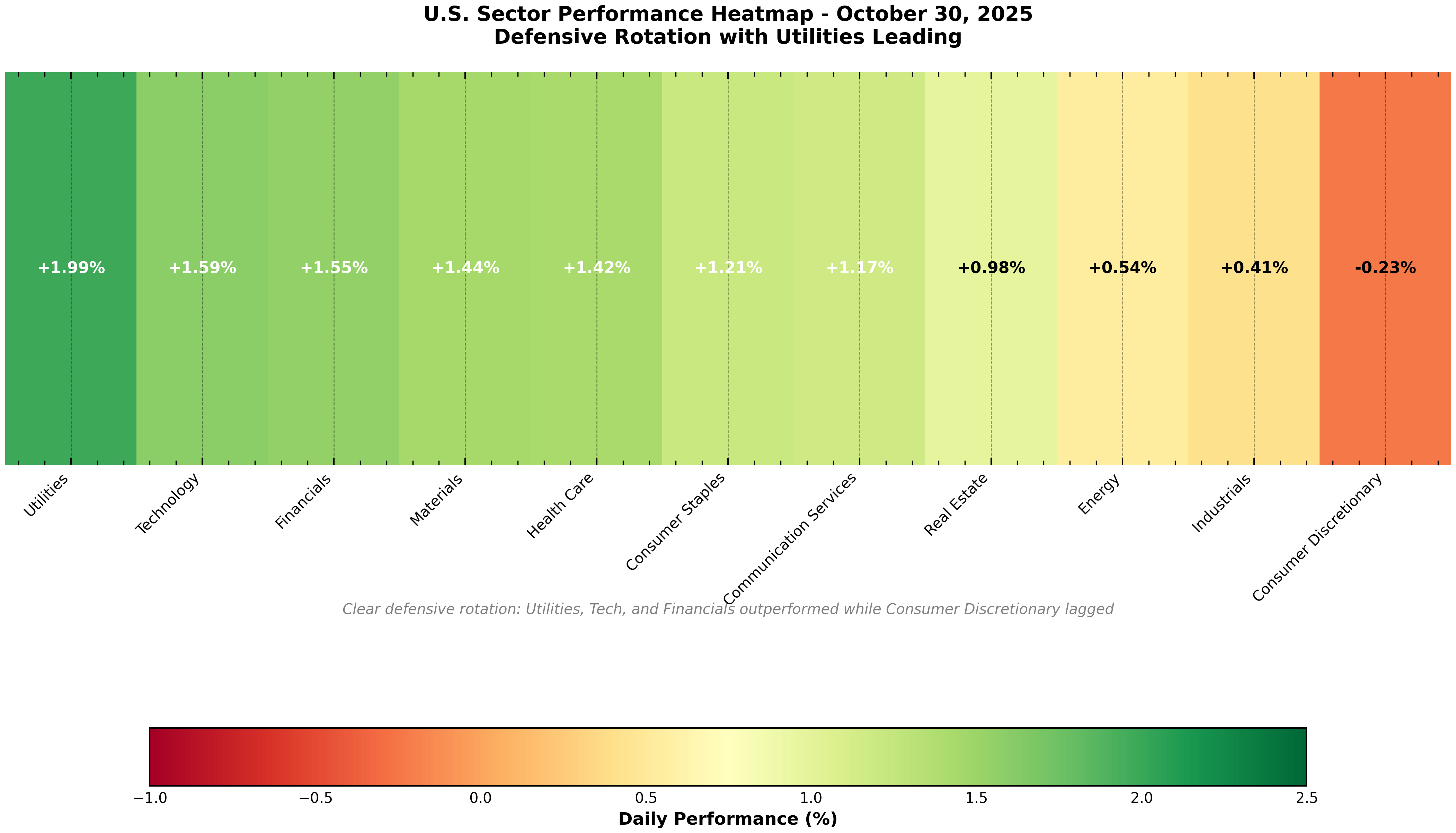

🔥 U.S. Sector Rotation & Performance

| Rank | Sector | % Change | Theme |

|---|---|---|---|

| 1 | Utilities | +1.99% | Defensive Flight |

| 2 | Technology | +1.59% | Selective Strength |

| 3 | Financials | +1.55% | Rate Sensitivity |

| 4 | Materials | +1.44% | Infrastructure Play |

| 5 | Health Care | +1.42% | Safe Haven |

| 6 | Consumer Staples | +1.21% | Defensive |

| 7 | Communication Services | +1.17% | Mixed Signals |

| 8 | Real Estate | +0.98% | Yield Play |

| 9 | Energy | +0.54% | Commodity Pressure |

| 10 | Industrials | +0.41% | Cyclical Lag |

| 11 | Consumer Discretionary | -0.23% | Consumer Pressure |

Sector rotation heatmap – Defensive sectors lead, October 30, 2025

Key Finding:

Investors rotated into defensive sectors as policy and earnings uncertainty increased, while consumer discretionary lagged on spending concerns.

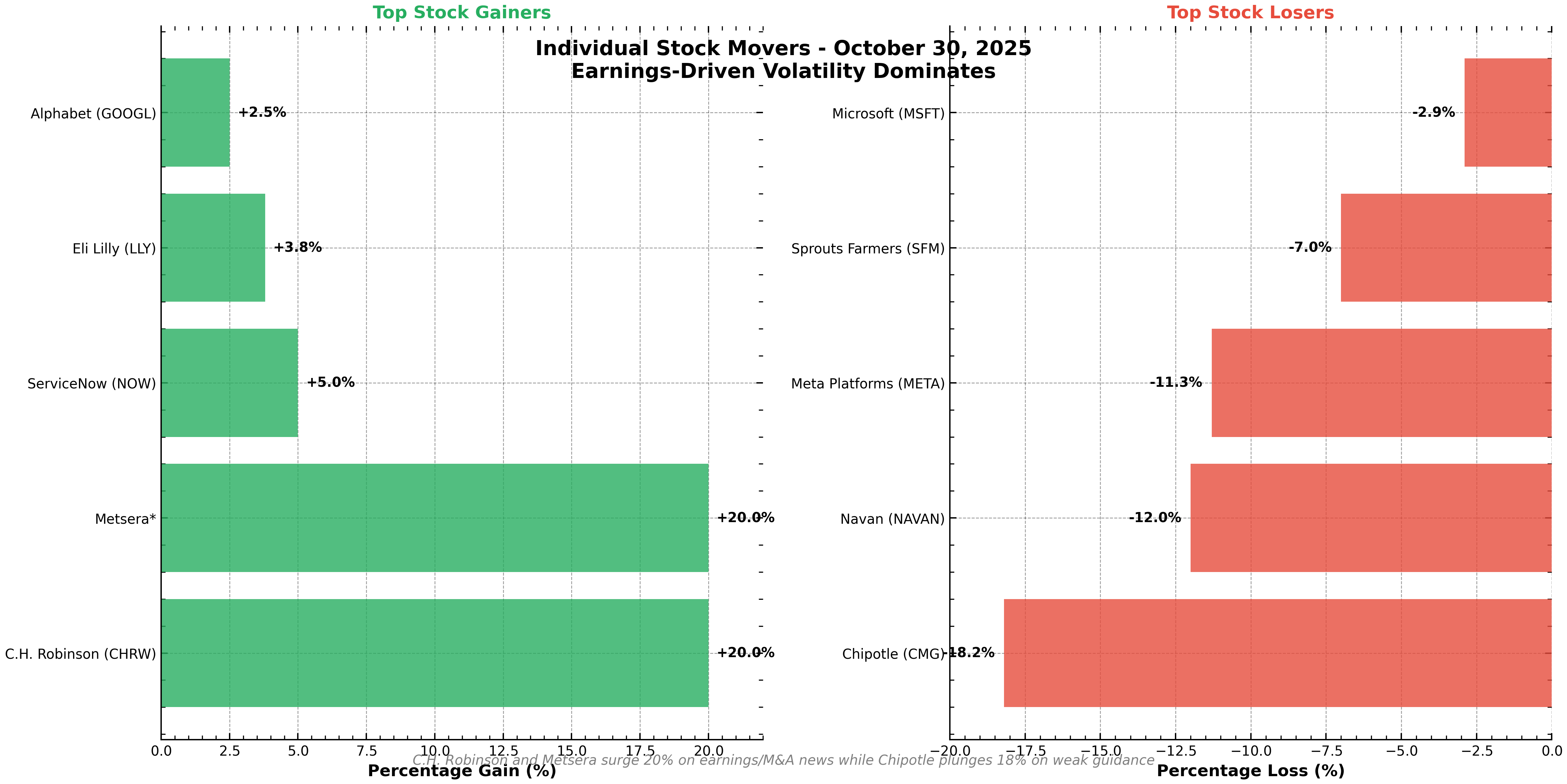

🚀 Top Stock Movers

| Gainers | % Change | Reason |

|---|---|---|

| C.H. Robinson (CHRW) | +20.0% | AI-driven cost savings, strong earnings |

| Metsera* (Private) | +20.0% | Novo Nordisk rival bid, M&A activity |

| ServiceNow (NOW) | +5.0% | Earnings beat, 5-for-1 stock split |

| Eli Lilly (LLY) | +3.8% | Blockbuster drug sales, raised guidance |

| Alphabet (GOOGL) | +2.5% | $100B+ revenue, ad/cloud growth |

| Losers | % Change | Reason |

|---|---|---|

| Chipotle (CMG) | -18.2% | Weak guidance, consumer traffic decline |

| Navan (NAVAN) | -12.0% | IPO debut disappointment |

| Meta Platforms (META) | -11.3% | Earnings miss, higher 2026 AI expenses |

| Sprouts Farmers (SFM) | -7.0% | Weak same-store sales outlook |

| Microsoft (MSFT) | -2.9% | Higher capex guidance despite earnings beat |

Top stock gainers and losers, October 30, 2025

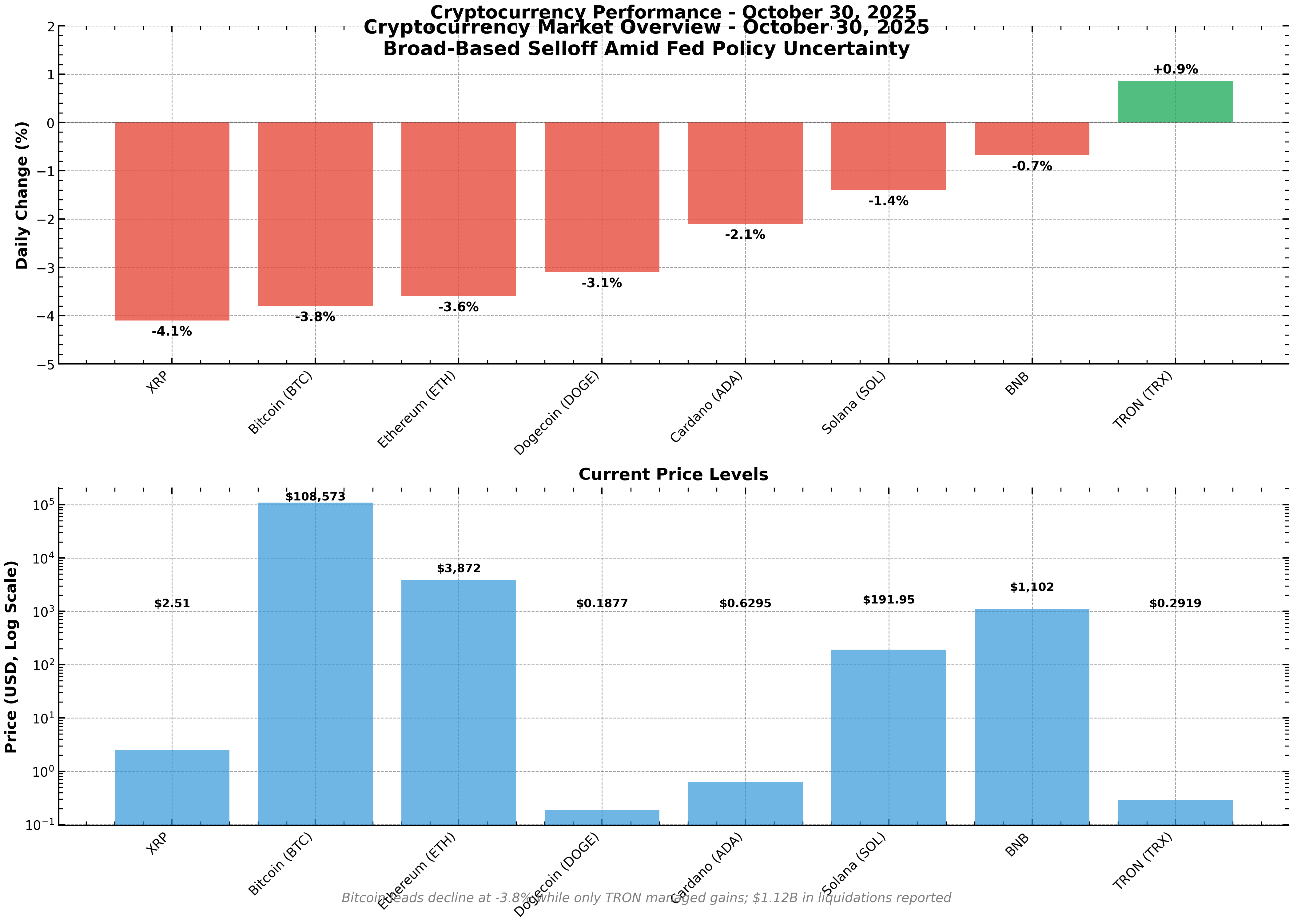

₿ Cryptocurrency Market Update

| Asset | Price (USD) | Daily % Change | Market Cap |

|---|---|---|---|

| Bitcoin (BTC) | $108,572.57 | -3.8% | $2.16T |

| Ethereum (ETH) | $3,871.51 | -3.6% | $467.28B |

| BNB | $1,102.46 | -0.7% | $151.85B |

| Solana (SOL) | $191.95 | -1.4% | $103.10B |

| XRP | $2.51 | -4.1% | $149.85B |

| Cardano (ADA) | $0.6295 | -2.1% | $22.22B |

| Dogecoin (DOGE) | $0.1877 | -3.1% | $35.33B |

| TRON (TRX) | $0.2919 | +0.9% | $27.73B |

Major cryptocurrency performance, October 30, 2025

Key Finding:

Crypto markets saw a broad selloff, with $1.12B in liquidations. Only TRON managed gains. Institutional ETF inflows continue, but regulatory and Fed uncertainty weigh on sentiment.

🛢️ Commodities & Currency Dashboard

| Commodity | Price | Daily % Change | Key Driver |

|---|---|---|---|

| Gold (oz) | $3,952.24 | +0.54% | Safe haven demand |

| Silver (oz) | $48.16 | +1.00% | Industrial/hedge demand |

| WTI Crude | $60.57 | 0.00% | Supply glut |

| Natural Gas | $3.93 | +2.96% | Global demand surge |

| Wheat | $5.29 | +0.50% | Trade truce optimism |

| Coffee | $335.00 | +1.50% | Supply chain concerns |

| Currency Pair | Rate | Daily % Change | Driver |

|---|---|---|---|

| DXY | 99.53 | +0.37% | Fed hawkish guidance |

| EUR/USD | 1.165 | -0.30% | Dollar strength |

| GBP/USD | 1.33 | -0.40% | UK growth concerns |

| USD/JPY | 151.0 | +0.20% | BoJ rate hike expectations |

Commodities and currency performance, October 30, 2025

🏦 Central Bank Policy & Economic Data

- Federal Reserve: Cut rates 25bps to 3.75–4.00%, but signaled no guarantee of further cuts in December. Two dissenting votes. Quantitative tightening ends December 1. Data blackout continues due to government shutdown.

- Bank of Japan: Held at 0.5%, two dissents for hikes, ETF sales announced.

- ECB: Rates unchanged at 2.00%, inflation target on track.

- Bank of England: Expected to cut below 4% next meeting amid 4% inflation.

- PBOC: Resumed treasury bond purchases, signaling more stimulus.

Key Takeaway:

Central banks are cautious and data-dependent. The Fed’s hawkish tone and lack of economic data are driving volatility and defensive positioning.

📈 Technical Analysis & Market Outlook

- S&P 500: Testing 6,800 support; break below targets 6,750, reclaim of 6,900 needed for uptrend.

- NASDAQ: 23,500 support holding, but tech momentum weakening.

- Dollar Index: 99.53, with 100.00 as psychological resistance.

- VIX: Elevated at 18.5, signaling increased uncertainty.

Investment Implications

- Overweight: Utilities, Healthcare, Consumer Staples

- Neutral: Technology (selective), Financials

- Underweight: Consumer Discretionary, Real Estate

- Crypto: High volatility, but institutional adoption theme intact

- Commodities: Natural gas and precious metals favored

📝 Conclusion & Actionable Insights

Key Takeaway:

In times of policy and data uncertainty, defensive positioning and quality stocks are paramount. Monitor technical support levels, stay diversified, and use volatility to add to long-term positions.

Action Steps:

- Focus on defensive sectors and quality companies.

- Watch for further Fed and government data updates.

- Use market volatility to build positions in strong, dividend-paying stocks.

- Monitor crypto and commodities for tactical opportunities.

📣 Social Media Highlights

- “Defensive rotation dominates: Utilities +2% as Fed signals caution. #MarketInsights”

- “$1.12B crypto liquidation wave as Bitcoin drops 3.8%. Institutions still buying the dip. #CryptoMarkets”

- “Chipotle’s -18% crash is a warning on consumer spending. #ConsumerAlert”

- “Natural gas leads commodities, up 3% on global demand. #CommodityInsights”

- “Fed’s data blackout = markets flying blind. Defensive positioning is key. #FedPolicy”

📊 Visual Market Dashboard

Market summary dashboard, October 30, 2025

Key Takeaway:

October 30, 2025, was a day for defensive strategies and tactical flexibility. Stay alert, stay diversified, and let quality lead the way.