Key Takeaway:

Markets are holding near record highs as the Federal Reserve’s rate cut and strong tech earnings fuel risk appetite. Equities are broadly positive, the US dollar remains firm, crypto is mixed with sharp sector rotation, and commodities are consolidating after recent volatility. Market breadth is healthy, but cross-asset rotation and central bank policy remain in focus.

1. Executive Summary

- Equities: US and European indices are at or near all-time highs, led by tech and AI. Asia’s Nikkei 225 surged to a new record.

- Forex: The US dollar is strong, with EUR/USD and GBP/USD both lower. Commodity currencies are rebounding.

- Crypto: Bitcoin and Ethereum are slightly lower, but select altcoins (Polkadot, Litecoin) are outperforming. Solana saw a sharp correction.

- Commodities: Gold is consolidating after a correction, silver outperformed, and oil is volatile on geopolitical headlines.

2. Global Equity Markets – Current Prices & Performance

| Index | Price | Daily % | Weekly % | Monthly % | Region |

|---|---|---|---|---|---|

| S&P 500 | 6,890.59 | +0.00% | +1.4% | +4.2% | US |

| Dow Jones | 47,632.00 | –0.16% | +1.1% | +3.8% | US |

| Nasdaq Composite | 23,827.49 | +0.80% | +2.2% | +6.1% | US |

| DAX | 24,124.21 | –0.64% | +0.2% | +2.7% | Europe |

| FTSE 100 | 9,756.14 | +0.61% | +1.5% | +3.9% | Europe |

| CAC 40 | 8,200.88 | –0.19% | +0.7% | +2.8% | Europe |

| IBEX 35 | 16,036.34 | +0.23% | +1.1% | +3.2% | Europe |

| STOXX 600 | 577.04 | +0.22% | +0.8% | +2.5% | Europe |

| FTSE MIB | 42,911.57 | +1.00% | +2.1% | +4.4% | Europe |

| Nikkei 225 | 51,307.65 | +2.17% | +3.8% | +7.2% | Asia |

| Hang Seng | 26,346.14 | –0.33% | +1.1% | +4.5% | Asia |

| Shanghai Comp. | 4,016.33 | +0.70% | +2.2% | +3.9% | Asia |

| Sensex | 84,997.13 | +0.44% | +1.6% | +5.1% | Asia |

US and European stocks are consolidating at highs, with Asia’s Nikkei 225 leading global gains.

3. Forex Market – Live Rates & Trends

| Pair | Rate | Daily % | Trend/Notes |

|---|---|---|---|

| EUR/USD | 1.1594 | –0.50% | Dollar surges post-Fed, euro weak |

| GBP/USD | 1.3236 | –0.33% | Sterling pressured |

| USD/JPY | 152.10 | –0.03% | Yen steady, BoJ on hold |

| AUD/USD | 0.6532 | +0.18% | Aussie rebounds |

| USD/CAD | 1.3895 | –0.32% | Loonie rallies after BoC cut |

| USD/CHF | 0.7967 | +0.08% | Franc softens |

| NZD/USD | 0.5791 | +0.11% | Kiwi recovers |

| USD/CNY | 7.1952 | +0.09% | Yuan stable |

The US dollar remains firm, especially against the euro and pound, as central bank divergence and risk sentiment drive flows.

4. Cryptocurrency Market – Top Coins & Movers

| Cryptocurrency | Price (USD) | 24h % | 7d % | Notes |

|---|---|---|---|---|

| Bitcoin (BTC) | $114,289 | –1.20% | +2.50% | Market leader |

| Ethereum (ETH) | $4,120 | –2.10% | +1.80% | Smart contract king |

| Binance Coin (BNB) | $1,117 | –2.42% | –1.20% | Exchange token |

| XRP | $2.66 | –0.35% | +10.44% | Regulatory clarity |

| Solana (SOL) | $195.46 | –12.59% | +8.39% | Sharp correction |

| Cardano (ADA) | $0.65 | +1.38% | +2.22% | Network upgrades |

| Dogecoin (DOGE) | $0.20 | +0.38% | +5.10% | Meme coin |

| TRON (TRX) | $0.30 | +0.95% | +7.23% | Stablecoin flows |

| Litecoin (LTC) | $100.60 | +2.86% | +7.97% | PoW interest |

| Polkadot (DOT) | $3.12 | +4.37% | +4.03% | Interoperability |

Crypto is mixed: Bitcoin and Ethereum are steady, but Solana and BNB saw sharp declines. Polkadot and Litecoin are top gainers.

5. Commodities – Key Prices & Performance

| Commodity | Price | Daily % | YTD % | Notes |

|---|---|---|---|---|

| Gold (Dec 2025) | $3,983.10/oz | –0.91% | +49.6% | Correcting from highs |

| Silver (Dec 2025) | $47.32/oz | +1.18% | +45.2% | Outperforms gold |

| WTI Crude Oil | $60.08/bbl | –2.20% | –11.4% | Volatile on sanctions |

| Brent Crude Oil | $64.33/bbl | –1.80% | –10.8% | OPEC+ output in focus |

| Natural Gas (HH) | $3.47/MMBtu | –0.50% | +29.0% | LNG demand, AI data centers |

| Wheat | $528.13/bu | –0.17% | –8.5% | Ample global supply |

| Corn | $431.13/bu | 0.00% | –12.2% | Strong US harvest |

| Soybeans | $1,206.25/bu | –0.30% | –15.3% | China demand steady |

| Copper | $4.04/lb | +0.20% | +12.8% | Electrification theme |

| Aluminum | $2,813/MT | +0.30% | –5.4% | Substitution for copper |

Gold and oil are consolidating after recent volatility. Silver and industrial metals are showing resilience.

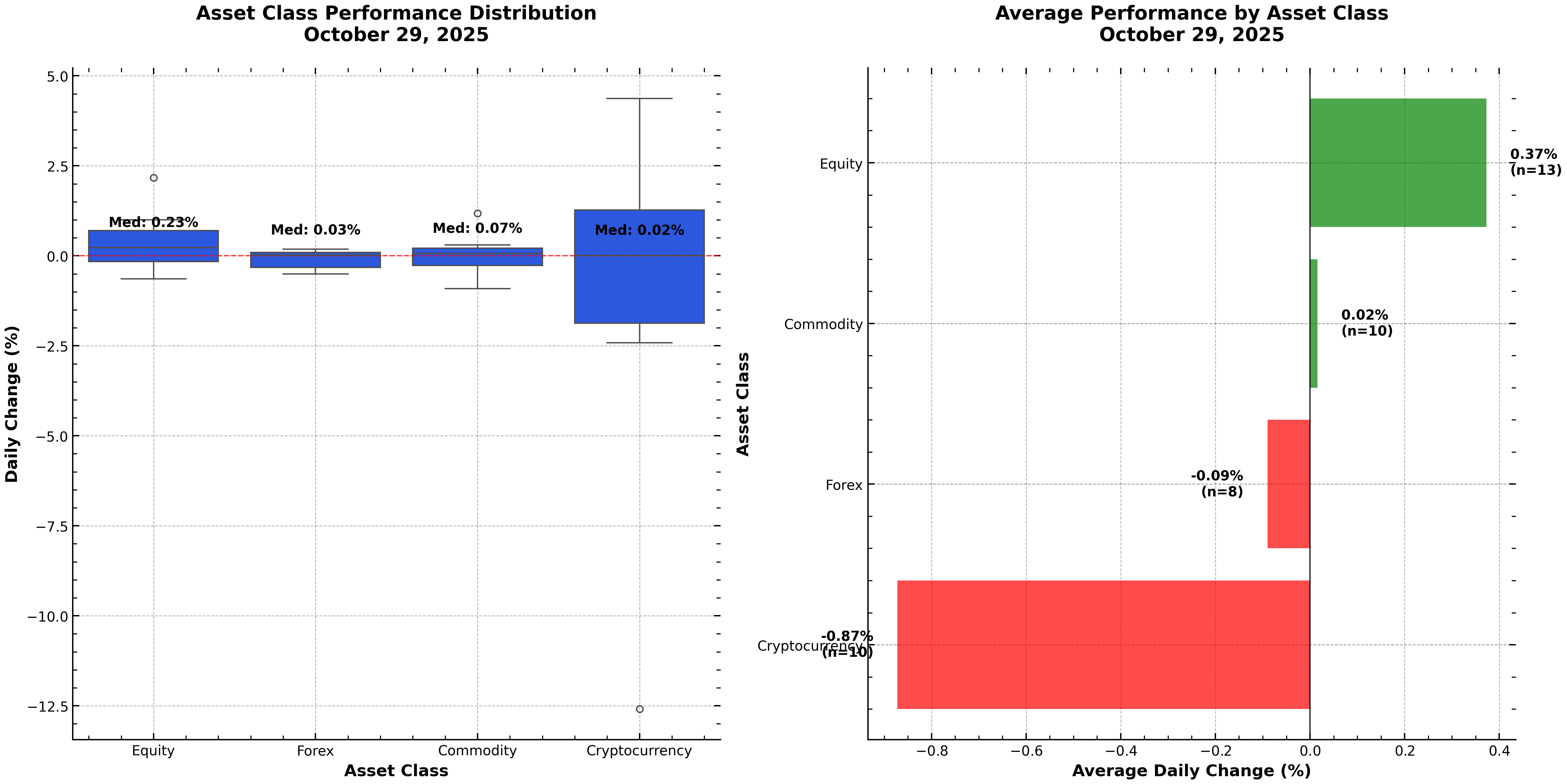

6. Visual Market Dashboard

Asset Class Performance Comparison

Asset Class Performance – October 29, 2025

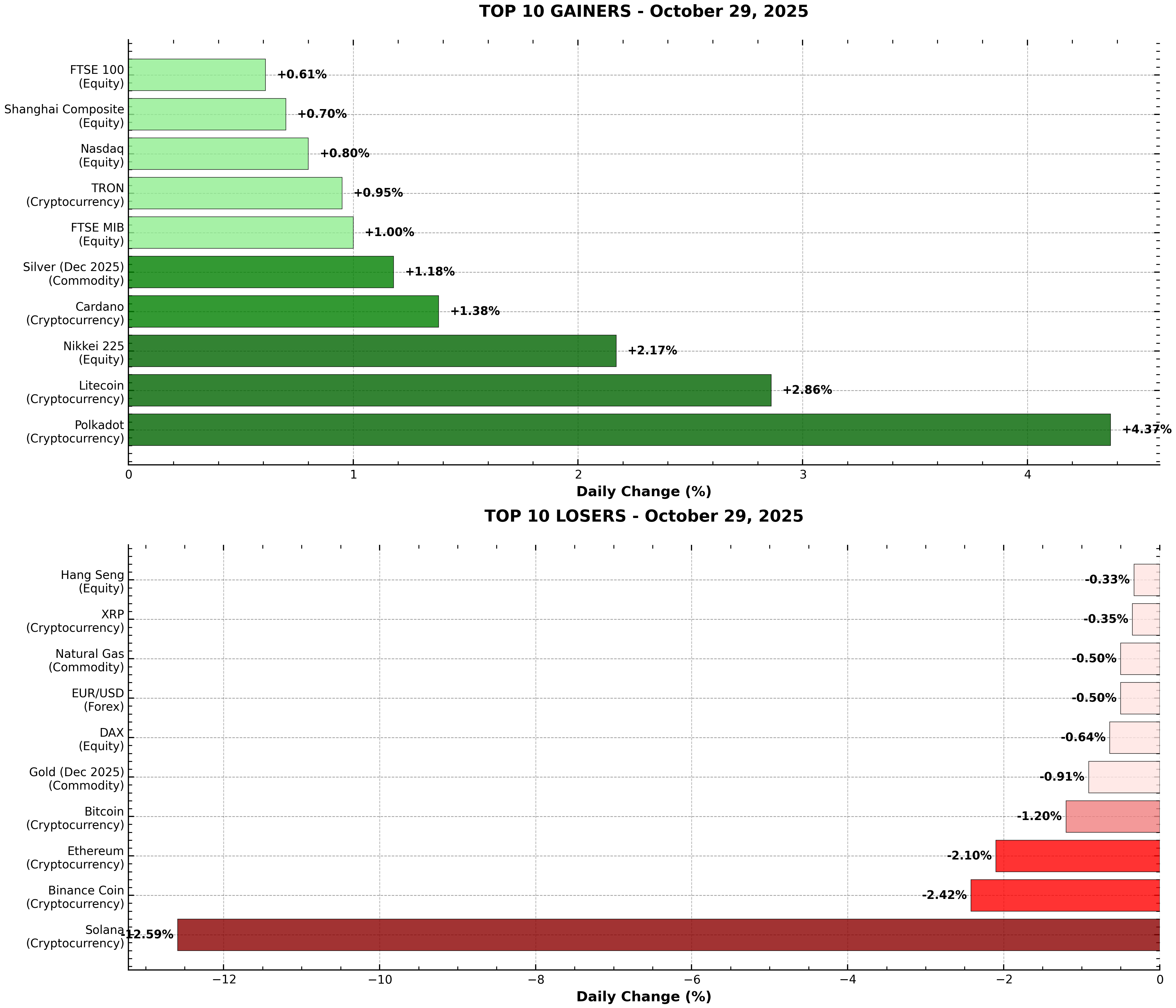

Top Gainers & Losers Heatmap

Top 10 Gainers and Losers Across All Markets

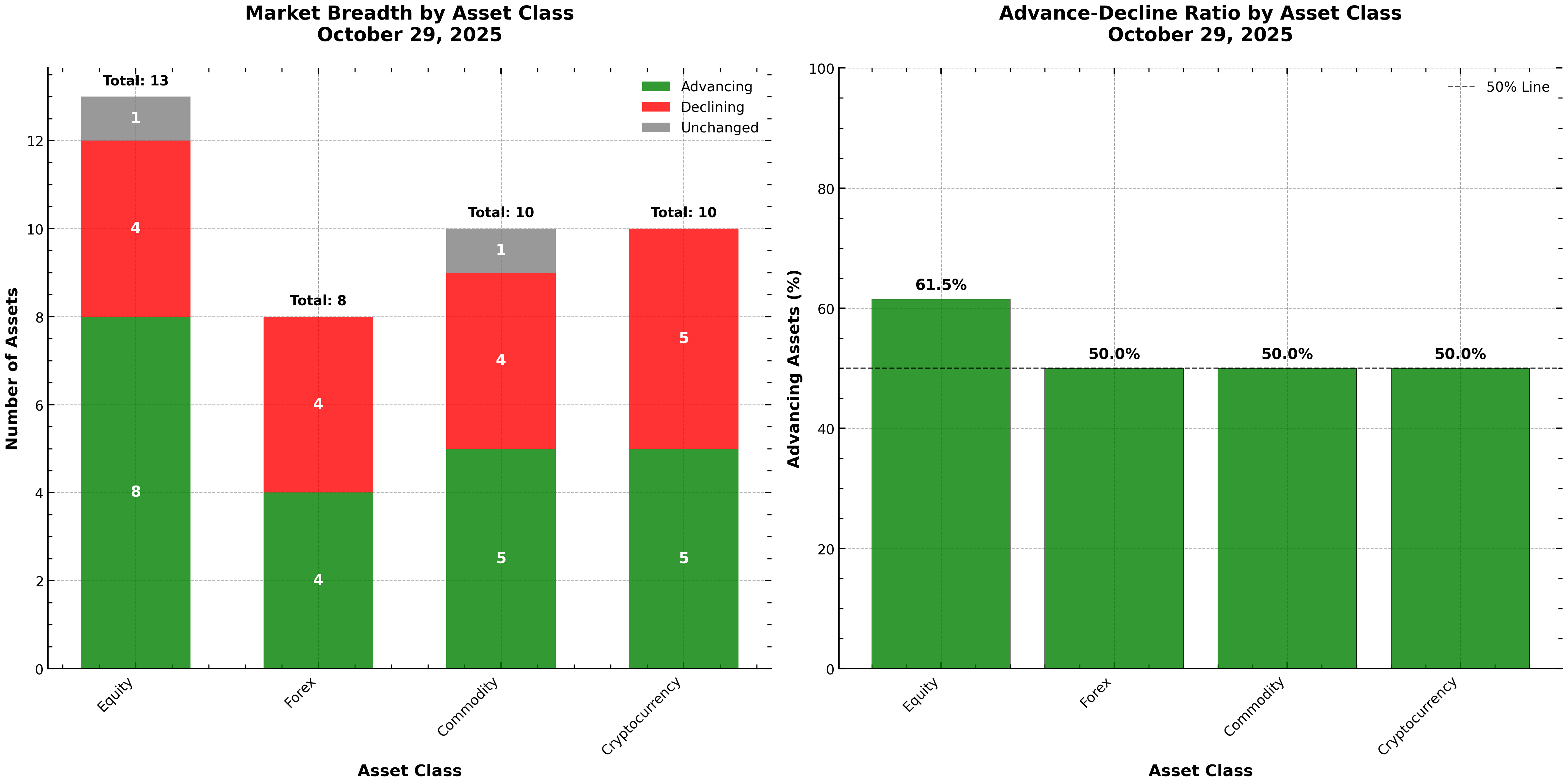

Market Breadth Analysis

Market Breadth – Advancing vs Declining Assets

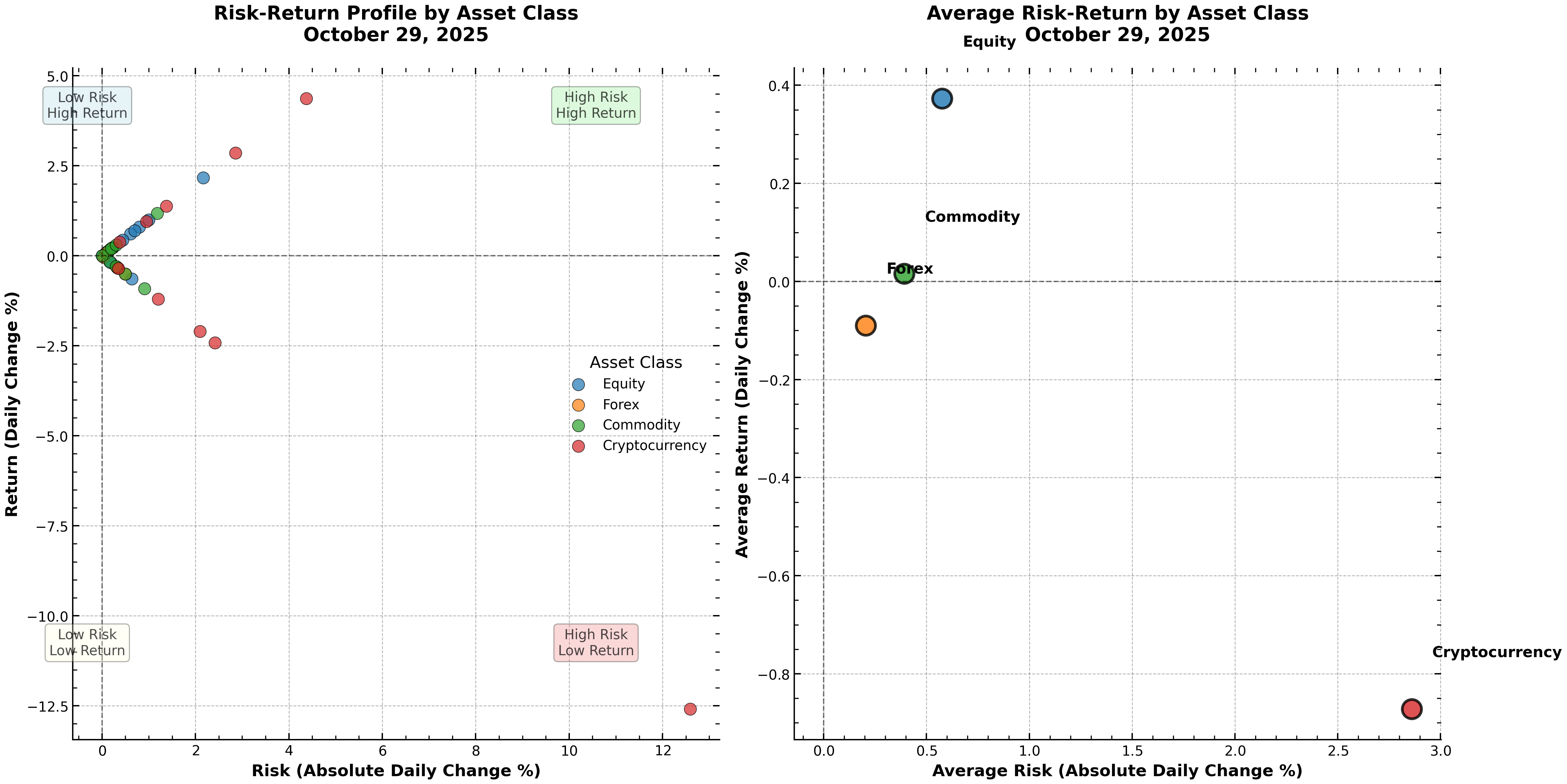

Risk-Return Scatter Plot

Risk-Return Analysis by Asset Class

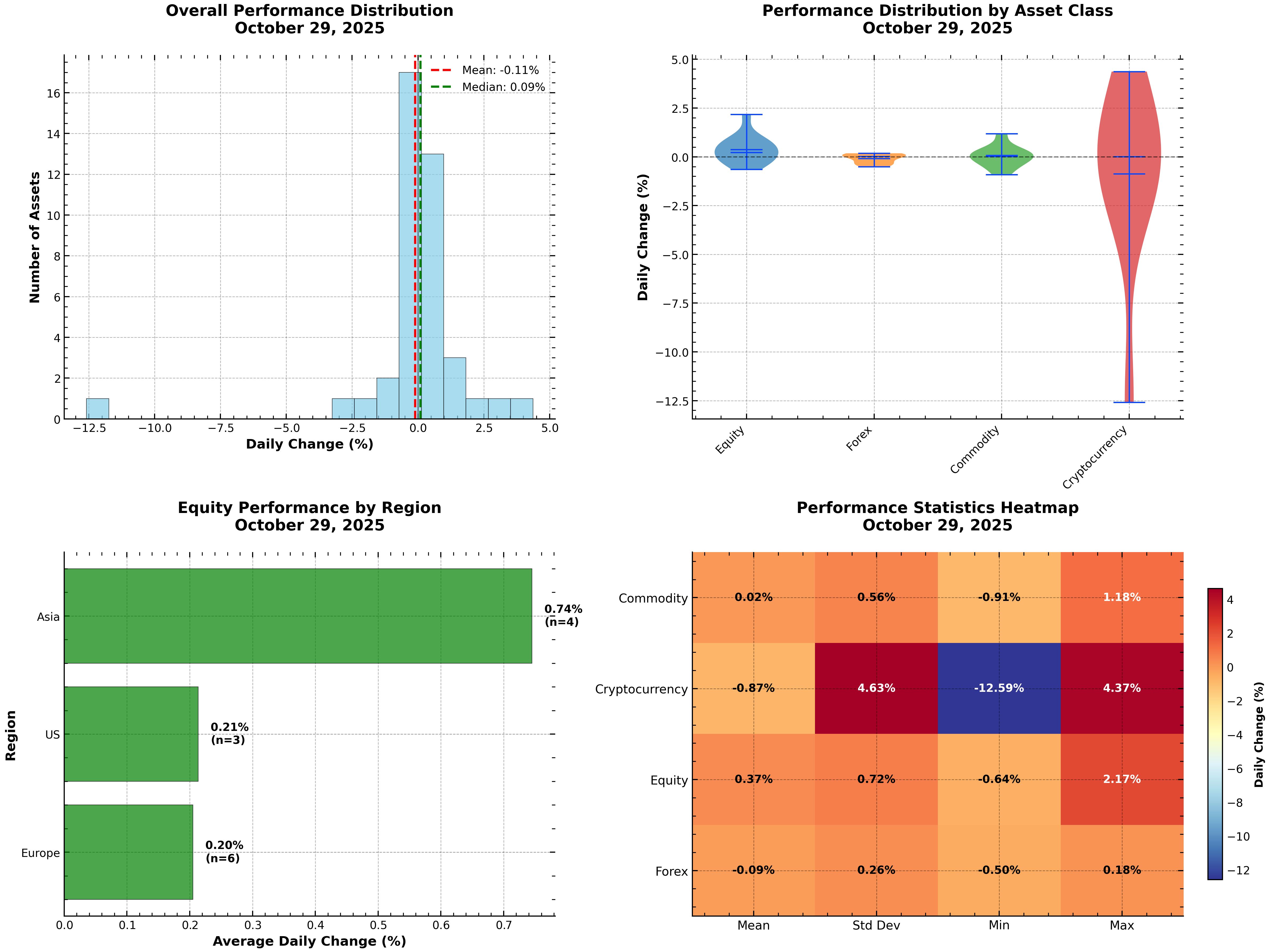

Performance Distribution

Performance Distribution Across All Markets

7. Performance Highlights

Top 5 Gainers (All Markets)

| Asset | Class | % Change |

|---|---|---|

| Polkadot | Crypto | +4.37% |

| Litecoin | Crypto | +2.86% |

| Nikkei 225 | Equity (Asia) | +2.17% |

| Cardano | Crypto | +1.38% |

| Silver | Commodity | +1.18% |

Top 5 Losers

| Asset | Class | % Change |

|---|---|---|

| Solana | Crypto | –12.59% |

| Binance Coin | Crypto | –2.42% |

| Ethereum | Crypto | –2.10% |

| Bitcoin | Crypto | –1.20% |

| Gold | Commodity | –0.91% |

Market Breadth

| Asset Class | Advancing | Declining | Unchanged | % Advancing |

|---|---|---|---|---|

| Equity | 8 | 4 | 1 | 61.5% |

| Forex | 4 | 4 | 0 | 50.0% |

| Commodity | 5 | 4 | 1 | 50.0% |

| Cryptocurrency | 5 | 5 | 0 | 50.0% |

| Overall | 22 | 17 | 2 | 53.7% |

8. Key Market Drivers & News

- Fed Rate Cut: The Federal Reserve cut rates by 25bp to 3.75–4.00%, signaling a data-dependent approach amid a government data blackout.

- Earnings: 70% of S&P 500 companies are beating sales forecasts; tech giants (Microsoft, Alphabet, Meta) reported strong results.

- Geopolitics: New US sanctions on Russian energy companies created oil volatility; US-China trade talks planned.

- Commodities: Gold corrected from record highs, oil is volatile, and silver outperformed.

- Crypto: Sector rotation with altcoins like Polkadot and Litecoin outperforming, while Solana and BNB saw sharp declines.

9. Market Outlook

- Equities: Watch for continued tech leadership, but rotation into cyclicals and financials is possible.

- Forex: USD strength may persist, but commodity currencies could rebound if risk appetite holds.

- Crypto: Expect further sector rotation and volatility, especially in altcoins.

- Commodities: Gold and oil may consolidate; silver and industrial metals could benefit from renewed demand.

Summary Box:

Markets are consolidating at highs, with healthy breadth and sector rotation. Central bank policy, earnings, and geopolitical headlines will drive the next moves. Stay tuned for actionable insights and real-time updates on http://www.ramonmorell.com.