Key Takeaway:

Global markets are off to a strong start: US and European indices are broadly higher, volatility is low, and the US dollar is steady. While risk appetite remains robust, traders should watch for central bank moves, inflation surprises, and geopolitical headlines as potential catalysts.

1. Global Stock Indices: Momentum Remains Strong

| Index | Last Value | Daily Change | YTD Change | Momentum Signal |

|---|---|---|---|---|

| S&P 500 | 6,738.44 | +0.58% | +14.82% | Strong Buy |

| Dow Jones | 46,734.61 | +0.31% | +10.24% | Buy |

| Nasdaq Composite | 22,941.80 | +0.89% | +18.99% | Strong Buy |

| FTSE 100 (UK) | 9,578.57 | +0.67% | +15.96% | Strong Buy |

| DAX (Germany) | 24,207.79 | +0.23% | +20.89% | Buy |

| Nikkei 225 (Japan) | 49,299.65 | +1.35% | +25.42% | Strong Buy |

| Hang Seng (HK) | 25,967.98 | +0.72% | +32.33% | Strong Buy |

| IBEX 35 (Spain) | 15,792.20 | +0.07% | +35.24% | Buy |

Market Breadth: 90% of tracked indices are positive, with Asia-Pacific and South America leading gains.

Volatility: VIX at 17.3 (−6.99%) signals a calm, risk-on environment.

2. Forex Majors: Dollar Steady, Yen Weak, Euro Under Pressure

| Pair | Key Level 1 | Key Level 2 | Sentiment | Bias | Market Driver |

|---|---|---|---|---|---|

| EUR/USD | 1.0800 | 1.0750 | Downward pressure | Bearish | US Treasury yields |

| GBP/USD | 1.2650 | 1.2500 | Extended losses | Bearish | BoE policy stance |

| USD/JPY | 150.00 | 155.00 | Yen weak, near highs | Bullish USD | Yield differential |

| AUD/USD | 0.6700 | 0.6500 | Bullish | Bullish | RBA steady rates |

| NZD/USD | 0.6145 | 0.6148 | Consolidating | Neutral | Oil price correlation |

| USD/CAD | 1.3500 | 1.3800 | Stable | Neutral | Oil inventory |

Technical Outlook:

- USD/JPY remains in focus as the yen weakens; intervention risk is rising.

- EUR/USD and GBP/USD are under pressure from strong US yields and dovish European/UK policy.

- AUD and NZD show resilience, supported by commodity trends.

3. Cryptocurrency: High Volatility, Selective Risk

| Asset | Monthly Change | Volatility | Risk Level | Notable Event |

|---|---|---|---|---|

| Bitcoin | −10.0% | 10.0% | Low | Mt. Gox repayments pending |

| Ethereum | −10.0% | 10.0% | Low | SEC ended investigation |

| Solana | −12.0% | 12.0% | Medium | Developer interest up |

| Polygon | −22.0% | 22.0% | High | MiCA compliance |

| Dogecoin | −24.0% | 24.0% | High | Meme coin volatility |

Summary:

Crypto markets remain volatile, with altcoins facing the most risk. Bitcoin and Ethereum are consolidating, while regulatory and institutional flows shape sentiment.

4. Macro & Geopolitics: What’s Moving Markets

- Fed Policy: The US Federal Reserve is expected to cut rates again at its October 28–29 meeting, as inflation ticks up to 2.8% (from 2.3%) and labor market data softens .

- US-China Trade: 100% tariffs on Chinese imports and China’s rare earth export restrictions are fueling inflation and supply chain concerns .

- Energy & Sanctions: New US sanctions on Russian oil majors and China’s response are creating jitters in energy markets .

- Global Growth: IMF projects 3.2% global GDP growth for 2025, with the US leading G7 peers at 2% .

- Volatility: VIX at 17.3 (low), US Dollar Index at 99.0 (down 9.38% YTD), supporting risk assets.

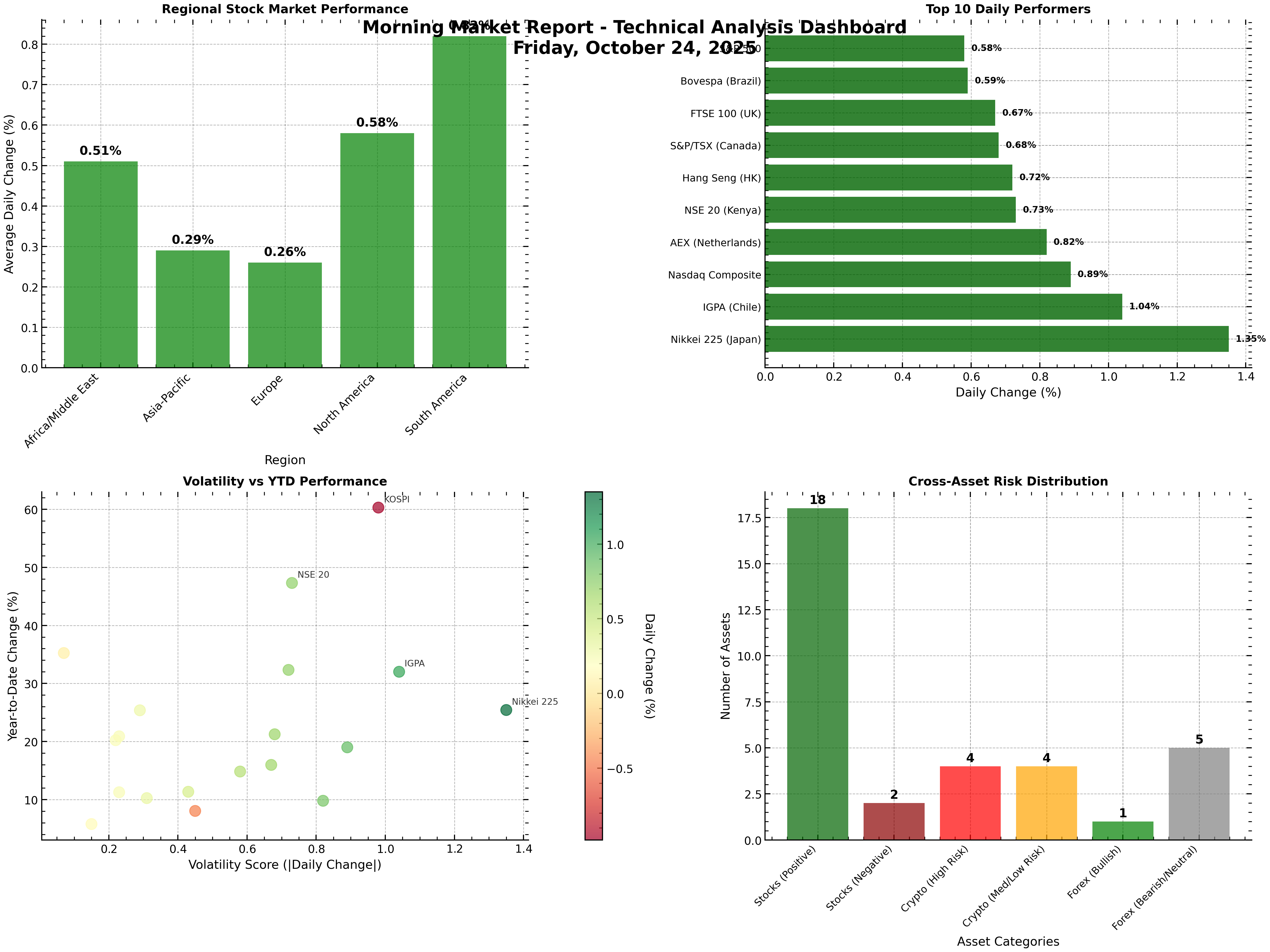

5. Visual Dashboard: Cross-Asset Technicals & Risk

Figure: Morning Market Dashboard – Regional performance, top movers, volatility, and cross-asset risk.

6. Executive Summary Table

| Metric | Value/Level | Signal/Comment |

|---|---|---|

| Market Breadth | 90% positive | Strong risk appetite |

| VIX | 17.3 | Low volatility |

| USD Index | 99.0 (−9.38% YTD) | Dollar weakness YTD |

| Best Daily Performer | Nikkei 225 (+1.35%) | Asia-Pacific momentum |

| Worst Daily Performer | KOSPI (−0.98%) | Korea underperforms |

| Strongest YTD | KOSPI (+60.3%) | Tech/AI sector boom |

| Crypto Risk | High in altcoins | BTC/ETH consolidating |

| Key Macro Driver | Fed, tariffs, energy | Policy & geopolitics |

📝 Ramón’s Wrap-Up

This morning, markets are humming with optimism—stocks are climbing, volatility is low, and the dollar is holding steady. But beneath the surface, traders are watching for the next move from central banks, inflation surprises, and the ever-present risk of geopolitical shocks. Stay nimble, keep your eyes on key technical levels, and remember: in a low-volatility world, opportunity and risk can change in a heartbeat.