Key Takeaway:

Global markets closed mixed as US indices posted modest gains, European stocks diverged, the US dollar remained strong, and commodities—especially oil—led the day’s performance. Crypto assets rebounded, with Binance Coin and Bitcoin among the top gainers. Volatility remains elevated as investors digest earnings, sanctions news, and central bank signals.

1. Major Indices: Closing Prices & Daily Performance

US Markets

| Index | Closing Price | % Change |

|---|---|---|

| S&P 500 | 6,699.40 | +0.6% |

| Dow Jones | 46,590.41 | +0.3% |

| Nasdaq Composite | 22,740.40 | +0.9% |

European Markets

| Index | Closing Price | % Change |

|---|---|---|

| DAX | 24,207.79 | +0.20% |

| FTSE 100 | 9,578.57 | +0.10% |

| CAC 40 | 8,225.78 | +0.15% |

| IBEX 35 | 15,792.20 | +0.05% |

Highlight:

US indices advanced, led by the Nasdaq, while European markets saw modest, broad-based gains.

2. Forex Market – Major Pairs

| Pair | Rate | Change (%) |

|---|---|---|

| EUR/USD | 1.16154 | +0.04% |

| GBP/USD | 1.33210 | –0.25% |

| USD/JPY | 152.578 | +0.46% |

| AUD/USD | 0.65120 | +0.34% |

| USD/CAD | 1.39868 | –0.04% |

| USD/CHF | 0.79529 | +0.04% |

| NZD/USD | 0.57519 | +0.21% |

Insight:

The US dollar strengthened, especially against the yen and pound, as safe-haven demand persisted.

3. Cryptocurrency Market – Top 10 Coins

| Cryptocurrency | Price (USD) | 24h Change (%) |

|---|---|---|

| Bitcoin (BTC) | $109,648.68 | +1.19% |

| Ethereum (ETH) | $3,890.01 | +0.50% |

| Tether (USDT) | $1.00 | 0.00% |

| Binance Coin (BNB) | $1,103.31 | +2.96% |

| XRP | $2.41 | +0.03% |

| Solana (SOL) | $186.72 | +0.90% |

| USD Coin (USDC) | $0.9999 | +0.01% |

| TRON (TRX) | $0.3225 | –0.12% |

| Dogecoin (DOGE) | $0.1937 | +0.92% |

| Cardano (ADA) | $0.6381 | +0.05% |

Crypto Highlight:

Binance Coin led the crypto rebound, with Bitcoin and Solana also posting solid gains.

4. Commodities – Key Movers

| Commodity | Price | % Change |

|---|---|---|

| WTI Crude Oil | $61.70/bbl | +5.4% |

| Brent Crude Oil | $66.00/bbl | +5.0% |

| Gold | $4,135/oz | +2.0% |

| Silver | — | +1.0% |

Highlight:

Oil prices surged on new US sanctions against Russian energy giants, while gold rebounded as a safe-haven asset.

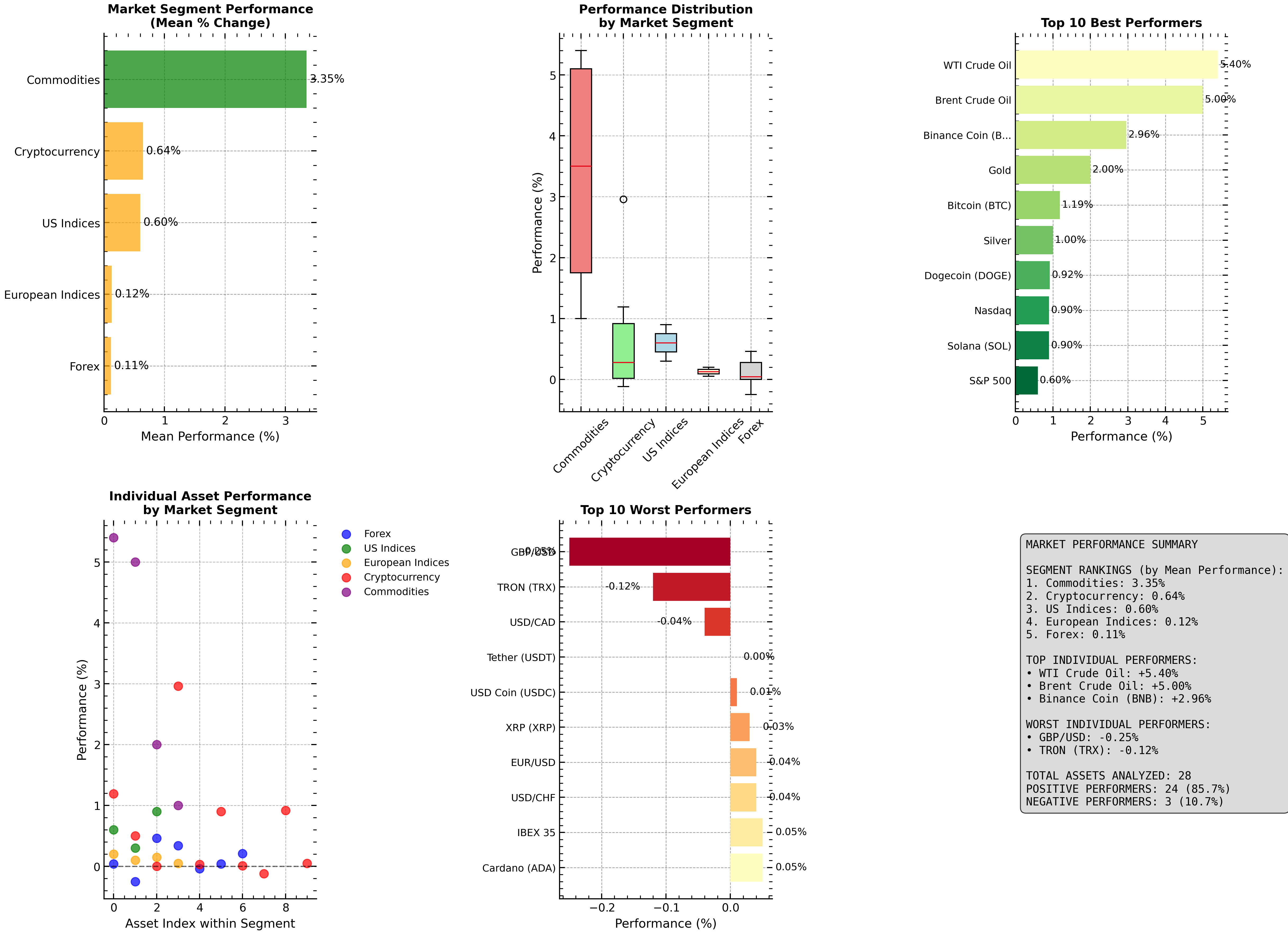

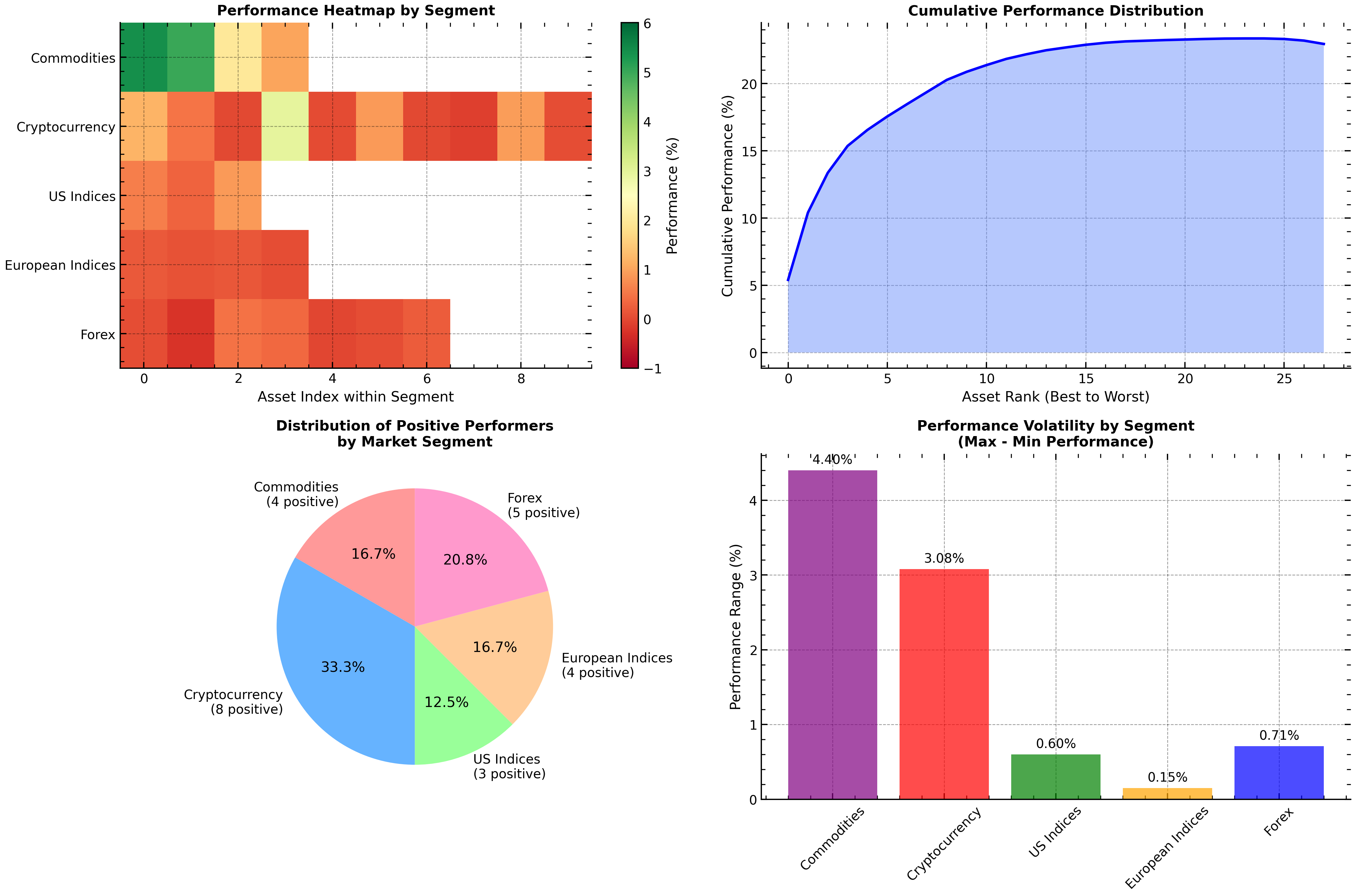

5. Visual Dashboard

Figure 1: Market Segment Performance, Top Movers, and Distribution (Oct 23, 2025)

Figure 2: Heatmap, Cumulative Trends, and Positive Performer Distribution by Segment

6. Performance Highlights & Analysis

Segment Rankings (by Mean Performance)

| Rank | Segment | Mean % Change |

|---|---|---|

| 1 | Commodities | +3.35% |

| 2 | Cryptocurrency | +0.64% |

| 3 | US Indices | +0.60% |

| 4 | European Indices | +0.13% |

| 5 | Forex | +0.11% |

Top 5 Best Performing Assets

| Asset | Segment | % Change |

|---|---|---|

| WTI Crude Oil | Commodities | +5.40% |

| Brent Crude Oil | Commodities | +5.00% |

| Binance Coin (BNB) | Crypto | +2.96% |

| Gold | Commodities | +2.00% |

| Bitcoin (BTC) | Crypto | +1.19% |

Top 3 Worst Performing Assets

| Asset | Segment | % Change |

|---|---|---|

| GBP/USD | Forex | –0.25% |

| TRON (TRX) | Crypto | –0.12% |

| USD/CAD | Forex | –0.04% |

Key Finding:

Commodities dominated the day, with oil and gold leading gains. Crypto assets rebounded, while forex was mixed.

7. Key News & Market Drivers

- Tech & Energy Earnings: Oracle and Alibaba surged on strong results and positive news; Dow and Las Vegas Sands also posted double-digit gains.

- US Sanctions on Russia: New sanctions on Lukoil and Rosneft sent oil prices sharply higher, boosting energy stocks.

- Gold & Silver Rebound: Precious metals bounced back as investors sought safety amid volatility and inflation concerns.

- US-China Trade Optimism: Announcement of a Trump-Xi meeting next week lifted risk sentiment.

- Central Bank Watch: Markets are pricing in a 97% chance of a Fed rate cut, with Friday’s US CPI in focus.

- Volatility Elevated: The VIX rose 4.1% to 18.6, reflecting ongoing uncertainty.

8. Market Outlook for Tomorrow

- Earnings Watch: More S&P 500 and European blue chips report, with tech and consumer sectors in focus.

- Macro Data: US CPI and global PMIs could drive volatility.

- Currency Watch: USD strength may continue to pressure emerging markets and commodities.

- Crypto Focus: Watch for follow-through in altcoins after today’s rebound.

Summary Box:

Commodities led global markets, US indices advanced, and crypto rebounded. Volatility remains high as investors await key earnings and macro data. Stay tuned for actionable insights and real-time updates on http://www.ramonmorell.com.