Key Takeaway:

As the US trading session powers into its final hours, markets are holding their ground with a risk-on tone. Equities are in the green, gold is shining, and crypto is steady—investors are balancing optimism from strong earnings with caution around macro and geopolitical uncertainties.

1. US Markets: Rally in Progress as Closing Bell Approaches

| Index | Current Price | Change | % Change |

|---|---|---|---|

| S&P 500 | 6,743.20 | +35.19 | +0.53% |

| Nasdaq | 22,991.37 | +311.39 | +1.37% |

| Dow Jones | 46,190.61 | +238.37 | +0.52% |

- Tech and financials are leading the charge, with the Nasdaq outperforming as investors cheer robust earnings and a softer tone on US-China trade.

- Regional banks are rebounding after last week’s credit scare, while the “Magnificent 7” tech names are in focus ahead of a heavy earnings week.

2. Forex & Commodities: Dollar Steady, Gold Surges, Oil Soft

| Asset/Pair | Latest Price | Change | Trend/Commentary |

|---|---|---|---|

| EUR/USD | 1.1646 | -0.0005 | Slightly weaker, rangebound |

| GBP/USD | 1.3411 | -0.0013 | Mild pressure, UK data in focus |

| USD/JPY | 150.68 | +0.09 | Yen soft, BoJ policy in play |

| Gold | $4,361.60/oz | +2.61% | Strong safe-haven demand |

| WTI Oil | $57.22/bbl | -0.66 | Demand concerns, supply glut |

| Brent Oil | $60.97/bbl | -0.60 | Follows WTI lower |

- Gold is surging as investors hedge against ongoing uncertainty.

- Oil is under pressure, reflecting persistent demand worries and rising inventories.

- The dollar is steady, with minor moves across major pairs.

3. Cryptocurrencies: Steady as She Goes

| Cryptocurrency | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

| Bitcoin | $110,922.69 | +1.32% | $2.21T |

| Ethereum | $3,971.28 | -0.85% | $479.33B |

| BNB | $1,098.60 | -2.26% | $152.90B |

| Solana | $188.27 | -0.97% | $102.89B |

| XRP | $2.47 | +2.53% | $148.25B |

| Dogecoin | $0.2016 | +6.75% | $30.53B |

- Bitcoin is holding above $110,000, showing resilience after recent volatility.

- Altcoins are mixed, with Dogecoin and XRP outperforming.

- Total crypto market cap is near $3.74 trillion, with Bitcoin dominance at 54%.

4. Macro & Newsflow: Earnings, Policy, and Geopolitics

- Earnings Season: Strong results from regional banks and tech are fueling optimism. Over 80 S&P 500 companies, including Netflix and Tesla, are set to report this week.

- US-China Trade: A softer stance from the US is lifting sentiment, with high-level talks on the horizon.

- Government Shutdown: The ongoing data blackout is keeping investors cautious, as official economic releases remain on hold.

- Fed Policy: Markets are pricing in rate cuts, with Fed officials signaling support for incremental easing.

- Geopolitics: The Middle East remains tense but stable, and US-China relations are in focus.

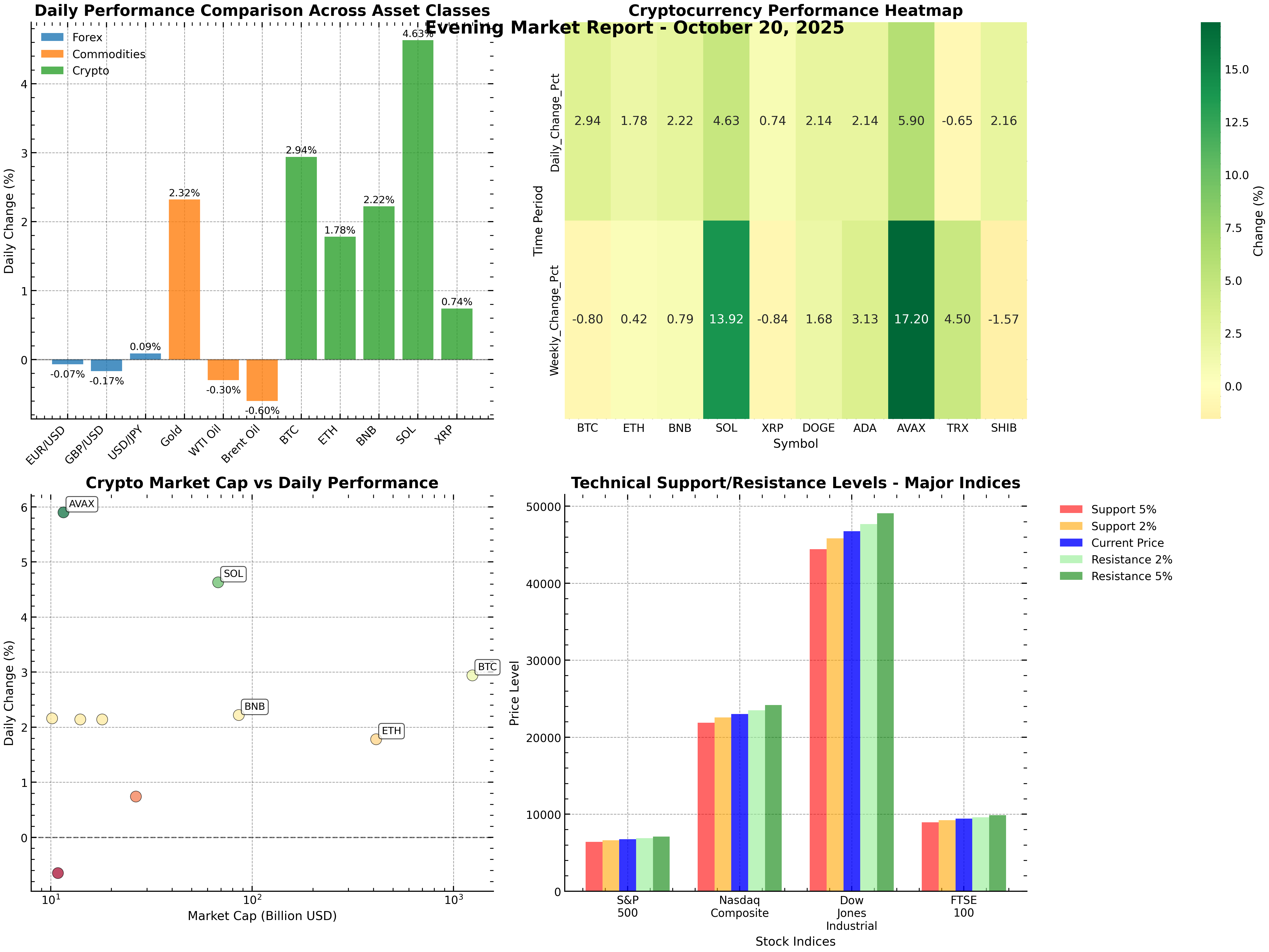

5. Visual Dashboard: Live Multi-Asset Performance

Figure: Multi-asset performance dashboard—live changes across forex, commodities, crypto, and technical levels for major indices.

6. Ramón’s Wrap-Up

As the sun sets on Wall Street, the mood is one of cautious confidence. Markets are climbing, but investors are keeping their guard up—balancing the promise of strong earnings and policy support against the ever-present risks of geopolitics and economic uncertainty. Tonight, the story is about resilience: the ability to keep moving forward, even when the path ahead is anything but clear.