Key Takeaways:

- Global markets are mixed, with notable strength in France’s CAC 40 and Japan’s Nikkei 225.

- Non-Energy Minerals, Utilities, and Consumer Durables lead sector gains.

- Genprex, Inc. (GNPX) headlines stock movers with a +232% surge.

- US-China trade tensions and a prolonged US government shutdown are driving volatility.

- Economic data shows gradual cooling in the US, with inflation easing but still above target.

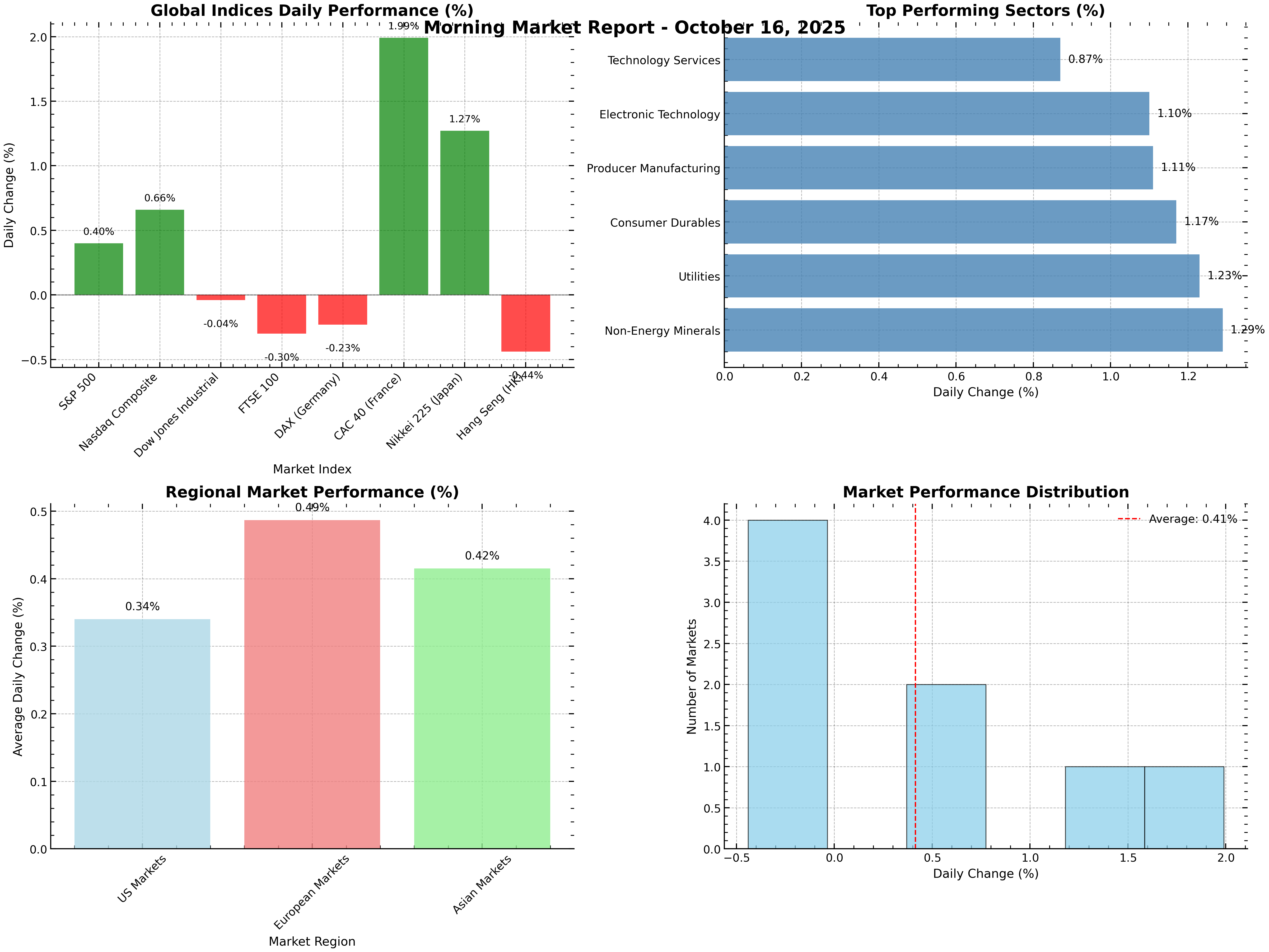

📈 Global Market Performance Snapshot

| Index | Last Value | Change | % Change |

|---|---|---|---|

| S&P 500 | 6,671.06 | +26.75 | +0.40% |

| Nasdaq Composite | 22,670.08 | +148.38 | +0.66% |

| Dow Jones Industrial | 46,253.31 | -17.15 | -0.04% |

| FTSE 100 | 9,424.75 | -28.02 | -0.30% |

| DAX (Germany) | 24,181.37 | -55.57 | -0.23% |

| CAC 40 (France) | 8,077.00 | +157.38 | +1.99% |

| Nikkei 225 (Japan) | 48,276.39 | +603.72 | +1.27% |

| Hang Seng (HK) | 25,797.31 | -113.29 | -0.44% |

- US indices: S&P 500 and Nasdaq up modestly; Dow flat.

- Europe: France’s CAC 40 outperforms, while UK and Germany slip.

- Asia: Nikkei rallies; Hang Seng declines.

🏆 Top-Performing Sectors

| Sector | Daily Change (%) |

|---|---|

| Non-Energy Minerals | +1.29 |

| Utilities | +1.23 |

| Consumer Durables | +1.17 |

| Producer Manufacturing | +1.11 |

| Electronic Technology | +1.10 |

| Technology Services | +0.87 |

Key Finding: Non-Energy Minerals and Utilities are leading the market, signaling a defensive tilt amid global uncertainty.

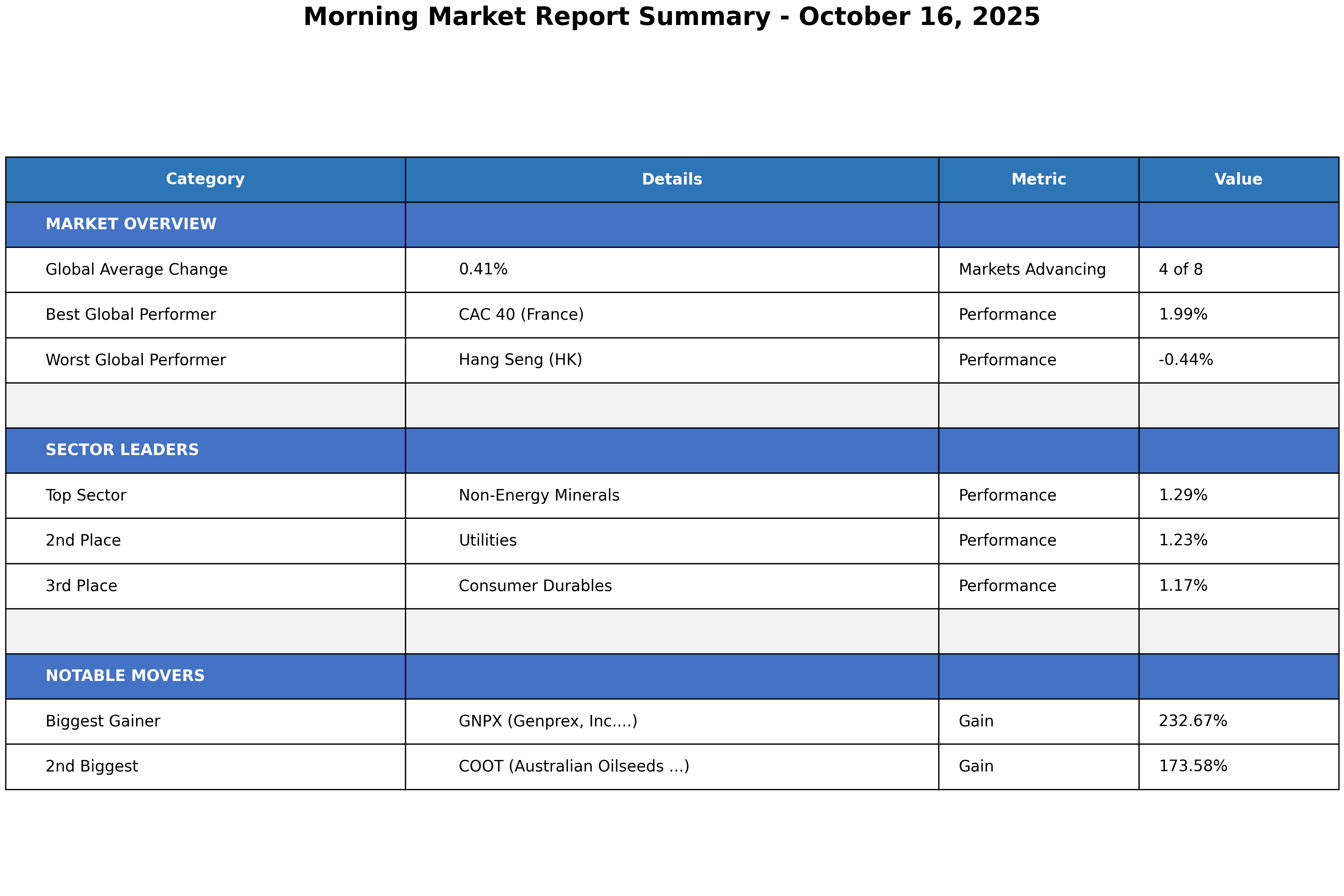

🚀 Notable Stock Movers – Top Gainers

| Symbol | Company Name | % Change | Price (USD) |

|---|---|---|---|

| GNPX | Genprex, Inc. | +232.67% | 0.84 |

| COOT | Australian Oilseeds Holdings Ltd | +173.58% | 2.64 |

| OMER | Omeros Corporation | +154.15% | 10.42 |

| PFAI | Pinnacle Food Group Limited | +139.27% | 4.57 |

| TOVX | Theriva Biologics, Inc. | +92.09% | 0.84 |

| TRUE | TrueCar, Inc. | +62.16% | 2.40 |

| SLNH | Soluna Holdings, Inc. | +53.76% | 4.29 |

| VERI | Veritone, Inc. | +53.66% | 8.39 |

| SDOT | Sadot Group Inc. | +48.75% | 7.72 |

| RKDA | Arcadia Biosciences, Inc. | +47.70% | 5.45 |

Highlight: Genprex, Inc. (GNPX) soared over 230%, topping the day’s gainers.

🌍 Regional Market Performance

| Region | Avg. Change (%) | Best Performer | Worst Performer |

|---|---|---|---|

| US Markets | +0.34 | Nasdaq Composite | Dow Jones Industrial |

| European Markets | +0.49 | CAC 40 (France) | FTSE 100 |

| Asian Markets | +0.42 | Nikkei 225 (Japan) | Hang Seng (HK) |

| Global Average | +0.41 | CAC 40 (France) | Hang Seng (HK) |

📊 Key Market Metrics

| Metric | Value |

|---|---|

| Markets Advancing | 4 |

| Markets Declining | 4 |

| Markets Unchanged | 0 |

| Average Daily Change (%) | 0.41% |

| Market Volatility (Std Dev) | 0.86% |

| Range Spread (%) | 2.43% |

| Strongest Sector Performance | 1.29% |

| Top Stock Gainer (%) | 232.67% |

📰 Major Market-Moving News

- US-China Trade War Escalates:

US imposes 130% tariffs on Chinese imports, sparking a global selloff and retaliatory Chinese sanctions . - US Government Shutdown:

Now in its second week, with no resolution in sight, adding to market uncertainty . - Bank Earnings Beat:

Major US banks report strong Q3 results, supporting S&P 500 earnings growth forecasts of +8% YoY . - Fed & Central Banks:

Fed holds rates steady; ECB and Bank of Canada begin easing cycles. US rate cut expected in September if inflation cools further . - Commodities:

Silver hits record highs (safe haven demand); oil drops to 5-month lows on supply/demand shifts .

📅 Latest Economic Data

| Indicator | Latest Value (June) | Year-over-Year |

|---|---|---|

| Personal Income | +0.2% | — |

| Disposable Personal Income | +0.2% | — |

| Personal Consumption Expenditures | +0.3% (nominal), +0.2% (real) | — |

| PCE Price Index | +0.1% MoM, +2.5% YoY | +2.5% |

| Core PCE Price Index | +0.2% MoM, +2.6% YoY | +2.6% |

| CPI (May) | 0.0% MoM, 3.3% YoY | +3.3% |

| Payrolls (May) | +272,000 | — |

| Unemployment Rate (May) | 4.0% | — |

| GDP Growth (Q1, annualized) | 1.3% | — |

| Fed Funds Rate | 5.25%–5.50% | — |

📊 Visual Market Overview

Global Indices Daily Performance

Figure 1: Daily percentage change for major global indices.

Morning Market Summary Table

Figure 2: Key highlights and leaders across markets, sectors, and stocks.

📝 Conclusion

Today’s markets reflect a tug-of-war between strong sector/stock outperformance and macro headwinds from geopolitics and policy uncertainty. Defensive sectors are in favor, and select stocks are seeing outsized moves. Keep an eye on further developments in US-China relations, the US government shutdown, and central bank policy signals for the next market catalysts.