Key Takeaway:

Global markets ended the day mixed as the recent rally paused. The Nikkei 225 soared to new highs, but US and UK indices slipped, and only one major US sector finished positive. Precious metals stole the spotlight—silver hit an all-time high above $51/oz and gold hovered near $4,055/oz. Defensive positioning increased amid muted trading, ongoing data delays, and easing geopolitical tensions.

🗺️ Major Global Indices – Closing Snapshot

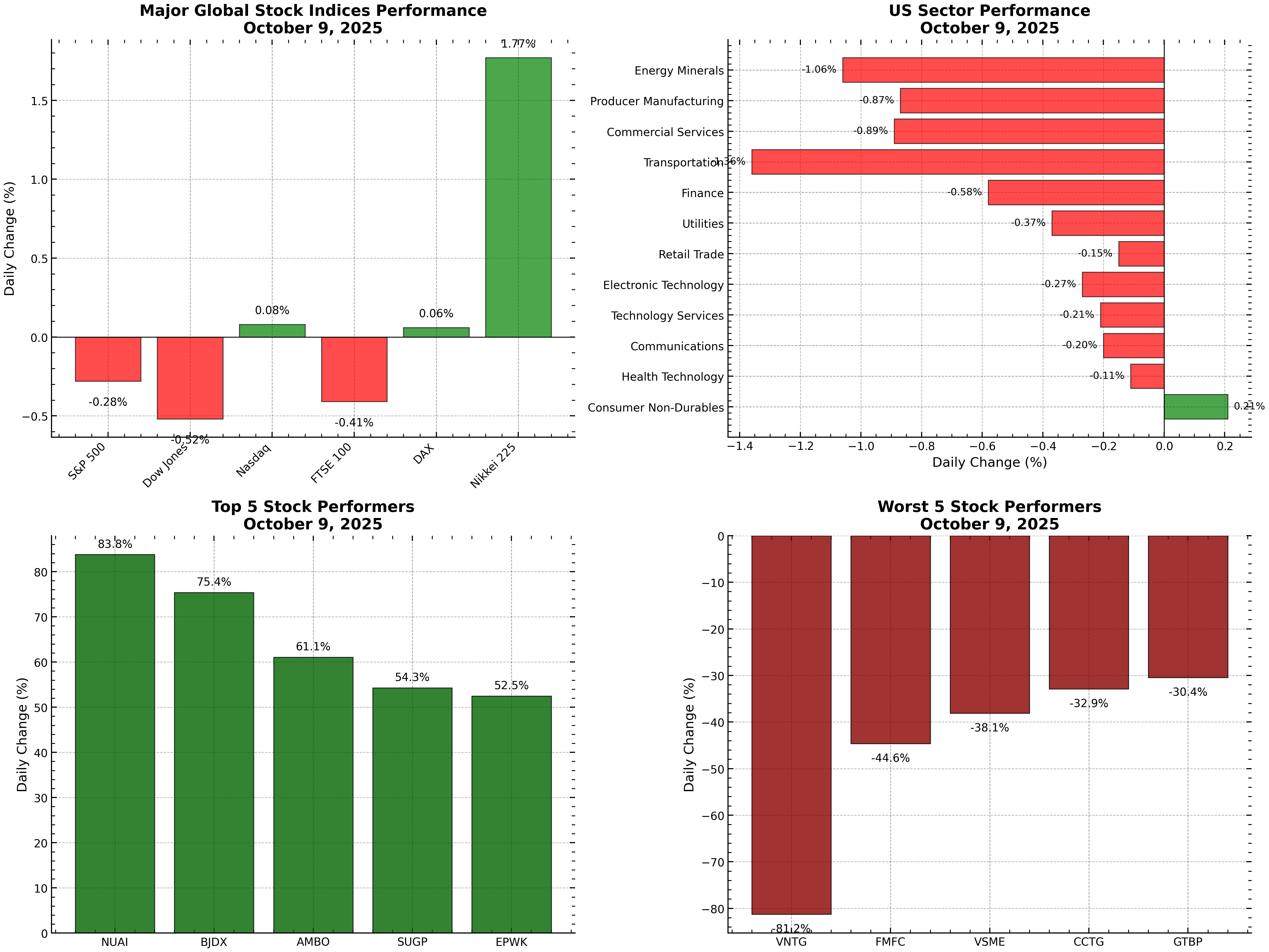

| Index | Close | Change (Points) | Change (%) | Region |

|---|---|---|---|---|

| S&P 500 | 6,735.11 | -18.61 | -0.28% | US |

| Dow Jones | 46,358.42 | -243.36 | -0.52% | US |

| Nasdaq | 23,024.63 | +18.75 | +0.08% | US |

| FTSE 100 | 9,509.40 | -39.47 | -0.41% | UK |

| DAX | 24,611.25 | +14.12 | +0.06% | Germany |

| Nikkei 225 | 48,580.44 | +845.45 | +1.77% | Japan |

Nikkei 225 led global gains, while US and UK markets closed lower. The Nasdaq eked out a small gain, contrasting with declines in the S&P 500 and Dow Jones.

📊 Visual: Global Market & Sector Performance

Figure 1: Major global indices and US sector performance, October 9, 2025. Nikkei 225 outperformed, while most US sectors declined.

🏦 US Sector Performance

| Sector | Daily Change (%) |

|---|---|

| Consumer Non-Durables | +0.21 |

| Health Technology | -0.11 |

| Communications | -0.20 |

| Technology Services | -0.21 |

| Electronic Technology | -0.27 |

| Retail Trade | -0.15 |

| Utilities | -0.37 |

| Finance | -0.58 |

| Transportation | -1.36 |

| Commercial Services | -0.89 |

| Producer Manufacturing | -0.87 |

| Energy Minerals | -1.06 |

Only Consumer Non-Durables finished in the green. Transportation and Energy Minerals led sector declines.

🚀 Top Movers: Stocks of the Day

Top 5 Gainers

| Symbol | Company Name | % Change |

|---|---|---|

| NUAI | New Era Energy & Digital | +83.77 |

| BJDX | Bluejay Diagnostics | +75.40 |

| AMBO | Ambow Education | +61.06 |

| SUGP | SU Group Holdings | +54.28 |

| EPWK | EPWK Holdings | +52.46 |

Top 5 Losers

| Symbol | Company Name | % Change |

|---|---|---|

| VNTG | Vantage Corp | -81.25 |

| FMFC | Kandal M Venture | -44.63 |

| VSME | VS MEDIA Holdings | -38.10 |

| CCTG | CCSC Technology | -32.91 |

| GTBP | GT Biopharma | -30.45 |

New Era Energy & Digital (NUAI) soared nearly 84%, while Vantage Corp (VNTG) plunged over 81%.

💹 Commodities, Currencies & Bonds

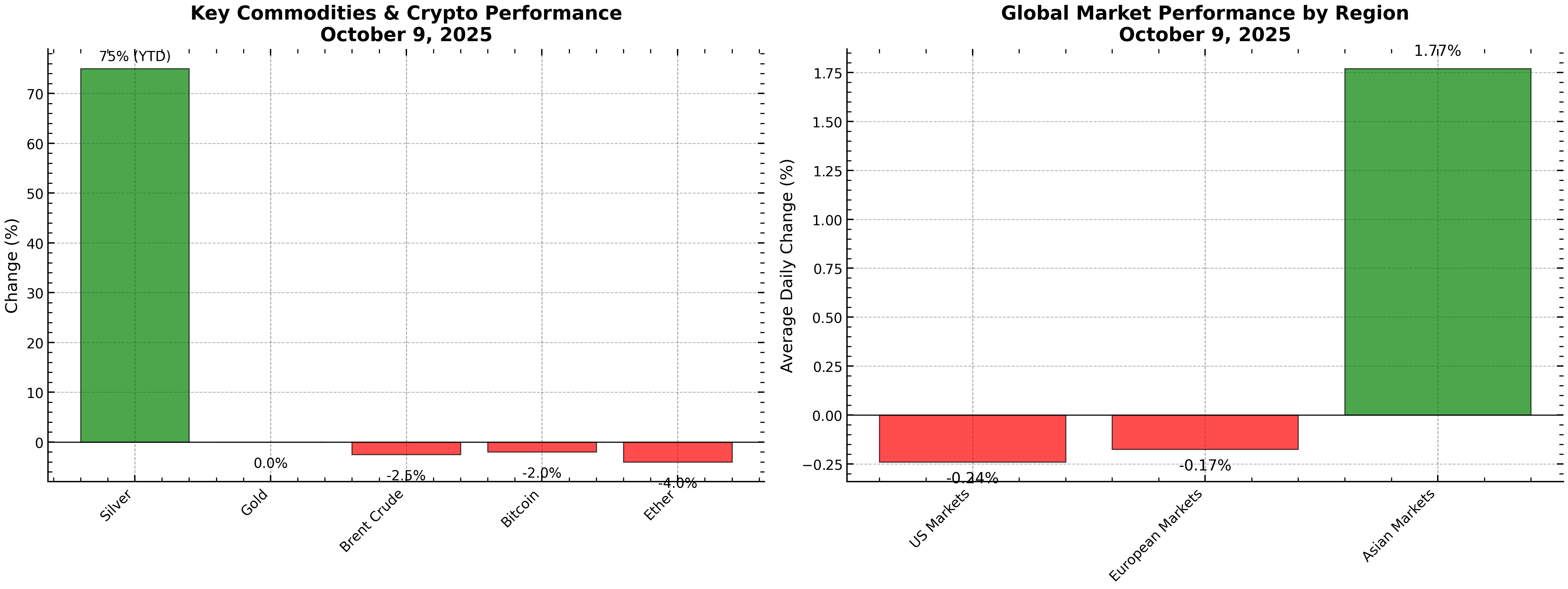

| Asset | Latest Value | Notable Moves/Details |

|---|---|---|

| Gold | $4,054.50/oz | Near record highs, safe-haven demand |

| Silver | $51.37/oz | All-time high, +75% YTD |

| Brent Crude | $66.07/bbl | Down on Middle East ceasefire |

| WTI Crude | $62.34/bbl | Lower on easing geopolitical risk |

| US 10Y Yield | 4.12% | Little changed, muted trading |

| USD Index | >99 | Highest since July 2025 |

| Bitcoin | -2% | Testing week’s lows |

| Ether | -4% | Bounced off $4,200 |

Silver’s historic rally and gold’s resilience were the day’s commodity highlights. Oil fell as Middle East tensions eased.

📰 Key Market Drivers & News

- Earnings:

- Delta Air Lines beat expectations and raised guidance, lifting airline stocks.

- PepsiCo topped Q3 revenue forecasts despite weak North American demand.

- Akero Therapeutics surged on a $4.7B acquisition by Novo Nordisk.

- Commodities:

- Silver hit a record high, driven by safe-haven flows and supply deficits.

- Gold remained near all-time highs, supported by macro uncertainty.

- Oil prices fell after Israel and Hamas agreed to pause fighting in Gaza.

- Macro & Geopolitics:

- US government shutdown delays key economic data, muting market moves.

- The US Dollar Index broke above 99, its highest since July.

- European markets were mixed; Italy’s FTSE MIB underperformed.

- Asian markets were led by Japan’s Nikkei, boosted by SoftBank’s $5.4B robotics deal.

📈 Market Performance Dashboard

Figure 2: Commodities, crypto, and regional market performance summary, October 9, 2025.

🔮 Outlook & What to Watch

- Volatility likely to persist as markets await delayed US economic data and further earnings.

- Precious metals may remain in focus amid safe-haven demand and supply constraints.

- Watch for:

- US and European earnings releases

- Fed commentary and bond market moves

- Geopolitical headlines and commodity swings

🏁 Conclusion

Markets paused after a strong run, with defensive sectors and precious metals outperforming. The Nikkei 225’s surge contrasted with US and UK declines. Silver’s record and gold’s resilience highlight ongoing risk aversion. Stay tuned for further updates and actionable insights.