Key Takeaway:

Global markets are opening with a bullish tone, led by strong gains in Asia and continued resilience in Europe and the US. Gold remains above $4,030/oz after setting new records, oil is steady, and tech stocks continue to drive momentum. Volatility persists amid macro and geopolitical uncertainty, but risk appetite is robust.

🗺️ Global Market Overview – Latest Prices

| Index | Last Price | Daily Change (%) | YTD Change (%) | Region |

|---|---|---|---|---|

| KOSPI (S. Korea) | 3,549.21 | +2.70 | +47.95 | Asia |

| Nikkei 225 (Japan) | 48,580.44 | +1.77 | +23.59 | Asia |

| NASDAQ 100 | 25,136.62 | +1.19 | +19.84 | US |

| NASDAQ Composite | 23,043.38 | +1.12 | +19.51 | US |

| CAC 40 (France) | 8,080.29 | +0.25 | +9.29 | Europe |

| SMI (Switzerland) | 12,647.22 | -0.01 | +8.80 | Europe |

| IBEX 35 (Spain) | 15,678.30 | +0.97 | +34.27 | Europe |

| DAX (Germany) | 24,692.02 | +0.39 | +23.31 | Europe |

| FTSE 100 (UK) | 9,528.13 | -0.22 | +15.35 | Europe |

| S&P 500 | 6,753.72 | +0.58 | +15.08 | US |

| Dow Jones | 46,601.78 | 0.00 | +9.93 | US |

| Russell 2000 | 2,500.30 | 0.00 | +11.14 | US |

| Shanghai Comp. (China) | 3,882.78 | +0.52 | +19.01 | Asia |

| SENSEX (India) | 81,773.66 | -0.19 | +2.29 | Asia |

| Hang Seng (HK) | 26,829.46 | -0.48 | +36.72 | Asia |

Asia and Europe are leading the global rally, with South Korea’s KOSPI and Japan’s Nikkei 225 as top performers. U.S. tech indices continue to set the pace, while Hong Kong and India lag.

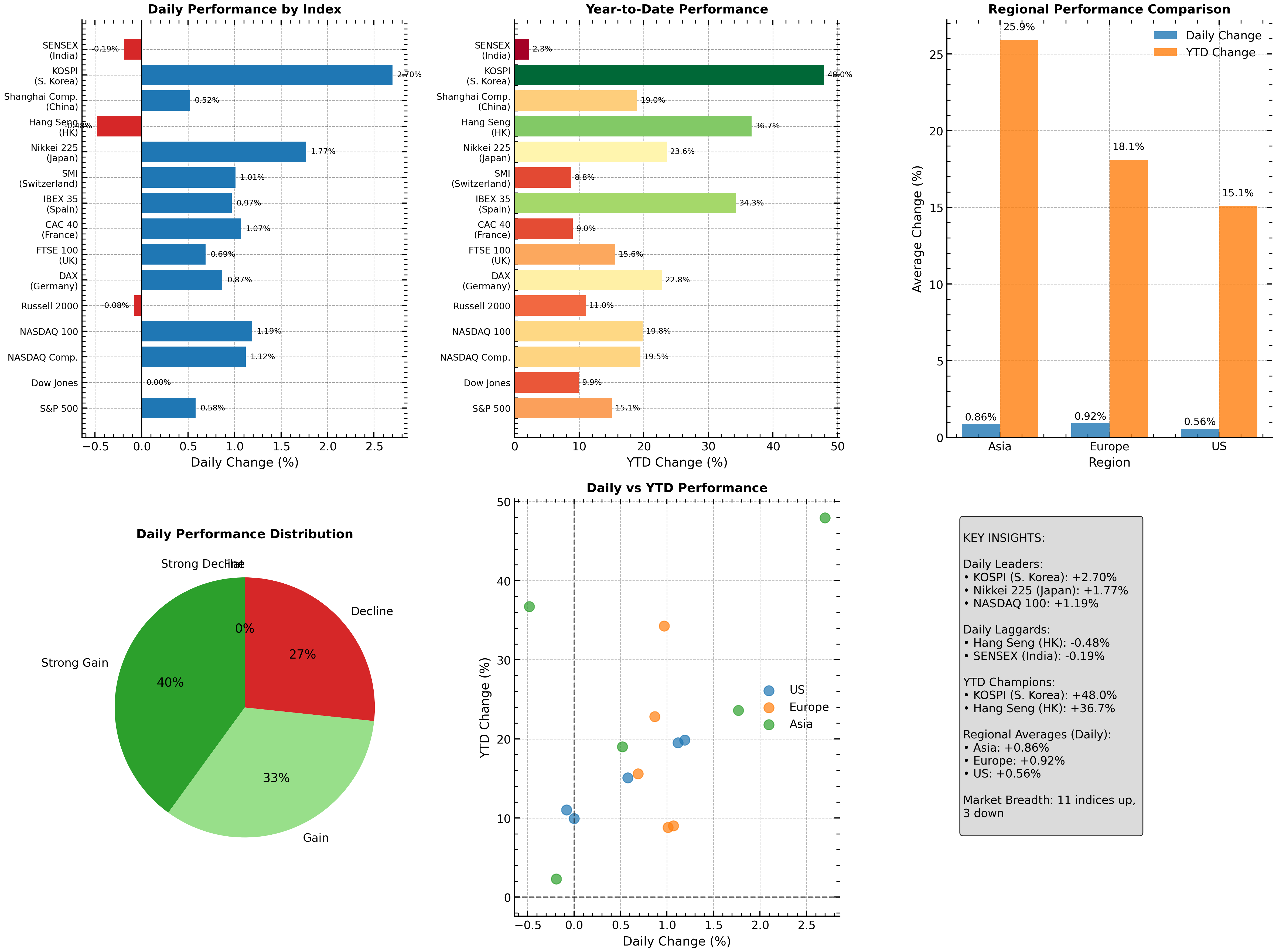

📊 Visual: Global Market Performance & Rankings

Figure: Comprehensive global index performance – daily and year-to-date. Asia and Europe show strong momentum, with tech-heavy U.S. indices close behind.

💹 Commodities, Currencies & Bonds – Live Quotes

| Asset | Price/Rate | Change (%) | Notes |

|---|---|---|---|

| Gold (oz) | $4,030.26 | -0.21 | Above $4,000, safe-haven bid |

| Silver (oz) | $49.15 | +0.51 | |

| Copper (ton) | $10,737.60 | +0.89 | |

| WTI Crude Oil | $62.73 | +0.71 | Stable |

| Brent Crude | $66.37 | +0.44 | |

| Natural Gas | $3.30 | -1.08 | |

| Wheat (bushel) | $5.11 (Dec futures) | +3.75 | |

| Corn (bushel) | $4.23 | +0.12 | |

| Soybeans | $10.27 | -0.27 | |

| Platinum (oz) | $1,661.00 | -0.84 | |

| Palladium (oz) | $1,475.50 | +1.55 |

Currencies

| Pair | Rate | Notes |

|---|---|---|

| EUR/USD | 0.8609 | Euro weaker |

| USD/JPY | 152.9983 | Yen at multi-decade lows |

| GBP/USD | 0.7484 | Pound softer |

| USD/CNY | 7.1274 | Yuan stable |

Bonds

| Country | 10-Year Yield |

|---|---|

| US | 4.12% |

| UK | 4.70% |

| Eurozone | 2.69% |

| Japan | 1.69% |

🏦 Key Market Drivers & Overnight Developments

- Tech & AI Boom: U.S. indices hit new highs, powered by mega-cap tech and AI stocks. Broadcom, Nvidia, and Super Micro Computer led the charge after strong earnings and bullish AI guidance.

- Fed & Inflation: Softer U.S. producer price data has increased expectations for a Federal Reserve rate cut, pushing Treasury yields lower and supporting equities.

- Europe: European stocks are up, but face headwinds from rising bond yields and new EU tariffs on Chinese electric vehicles, which are pressuring Chinese and global automakers.

- Asia: Japanese and Korean markets are surging on tech optimism, while Chinese stocks are mixed amid trade tensions and weak factory prices.

- Commodities: Gold remains above $4,030/oz, oil is steady, and copper is firm. The U.S. dollar is strong, especially against the yen and euro.

📰 Major Corporate & Economic News

- China tightens rare earth export curbs, impacting global tech and defense supply chains .

- Elon Musk settles with ex-Twitter execs over severance, closing a high-profile legal battle .

- Johnson & Johnson faces a $966M talc verdict, adding to ongoing legal risks .

- Tesla launches cheaper Model 3/Y to boost sales amid rising competition .

- OpenAI’s new AI push will run on AMD chips, challenging Nvidia’s dominance .

- Earnings to watch today: PepsiCo, Delta Air Lines, Levi Strauss, VinFast, and more.

📅 Today’s Economic Calendar

- US: International Trade (8:30 AM ET), Consumer Credit (3:00 PM ET), multiple Fed speakers, Treasury auctions .

- Europe: Ongoing ECB policy conference, focus on EU tariffs and bond yields.

- Asia: China’s rare earth export curbs and inflation data in focus.

🧭 Outlook & What to Watch

- Volatility remains elevated as markets digest Fed signals, tech earnings, and global trade tensions.

- Watch for:

- U.S. and European earnings results

- Fed commentary and bond market moves

- Geopolitical headlines and commodity swings

🏁 Summary

Global markets are off to a bullish start, with tech and Asia leading the way. Gold remains above $4,030, and volatility is high as investors navigate a packed day of earnings, economic data, and policy news. Stay tuned for actionable updates and sector rotation opportunities.