Key Takeaway:

Gold’s historic surge above $4,050/oz is the result of a rare convergence of geopolitical crises, central bank buying, macroeconomic instability, and technical momentum. While the uptrend remains powerful, overbought signals and crowded positioning suggest both opportunity and risk for traders and investors.

🚀 Executive Summary

- Gold has shattered records, trading above $4,050/oz for the first time in history.

- Drivers: Geopolitical turmoil, record central bank demand, inflation, US dollar weakness, and aggressive investor flows.

- Technical analysis: The uptrend is robust, but overbought conditions and resistance zones call for tactical caution.

- Outlook: Further upside is possible, but expect volatility and potential corrections. Gold’s strategic value as a portfolio hedge is stronger than ever.

1️⃣ Current Gold Price: The New Highs

| Metric | Value (USD) |

|---|---|

| Spot Price | $4,039–$4,049 |

| Recent High | $4,049–$4,060 |

| Weekly Change | +4% |

| Year-to-Date Change | +55% |

| Central Bank Buying | 1,000 metric tons |

| ETF Inflows (2025) | $64 billion |

| Technical RSI | Above 90 (overbought) |

Gold broke above $4,000 and $4,050 in rapid succession, with intraday highs above $4,060. The rally is historic, with the monthly RSI at its highest since the 1980s—signaling both strength and the risk of a near-term pullback.

2️⃣ Why Is Gold Soaring? The Fundamental Drivers

A. Geopolitical & Macro “Perfect Storm”

- US Government Shutdown: Ongoing, delaying key data and fueling safe-haven demand .

- Political Crises: Instability in France, Japan, and global trade tensions have driven investors to gold .

- Global Conflicts: Middle East and Ukraine wars keep risk premium high .

- US Dollar Weakness: The dollar index has dropped sharply, making gold more attractive globally .

- Inflation & Fiscal Concerns: Persistent inflation and ballooning US debt have made gold a hedge against currency debasement .

B. Central Bank & Institutional Demand

- Record Central Bank Buying: Over 1,000 tonnes purchased in 2025, led by China, Poland, Turkey, and India .

- ETF Inflows: $64 billion invested in gold ETFs this year, with $17.3 billion in September alone .

- De-dollarization: Central banks are diversifying away from US Treasuries and into gold .

C. Market Sentiment & FOMO

- Safe-Haven & Core Asset: Gold is now seen as both a crisis hedge and a core portfolio holding.

- Momentum Buying: The rapid ascent has triggered “fear of missing out” among traders and institutions .

3️⃣ Technical Analysis: Structure, Levels, and Signals

📊 Key Support & Resistance Levels

| Level (USD) | Type | Commentary |

|---|---|---|

| 4139 | Resistance | Extended target if bullish momentum continues |

| 4100–4150 | Resistance | Next major upside target after 4064–4076 breakout |

| 4064–4076 | Resistance | Immediate resistance zone |

| 4050 | Support | Now acts as short-term support, previously resistance |

| 4030 | Support | Lower bound of current oscillation range |

| 4026–4010 | Support | Key support/buy zone |

| 4000 | Support | Major psychological/technical support |

| 3980–3985 | Support | Short-term support for dip buying |

- Trend: Strongly bullish, with gold breaking out of an ascending channel and consolidating above $4,000.

- Momentum: RSI above 90 (overbought), suggesting risk of a short-term correction or sideways consolidation.

- Volume: High, confirming the strength of the breakout.

Trading Tactics:

- Buy on pullbacks to $4026–4010 or $4000, with stops below key support.

- Watch for breakout above $4076 for momentum trades toward $4100–$4150.

- Consider short-term profit-taking or hedges near resistance if reversal patterns emerge.

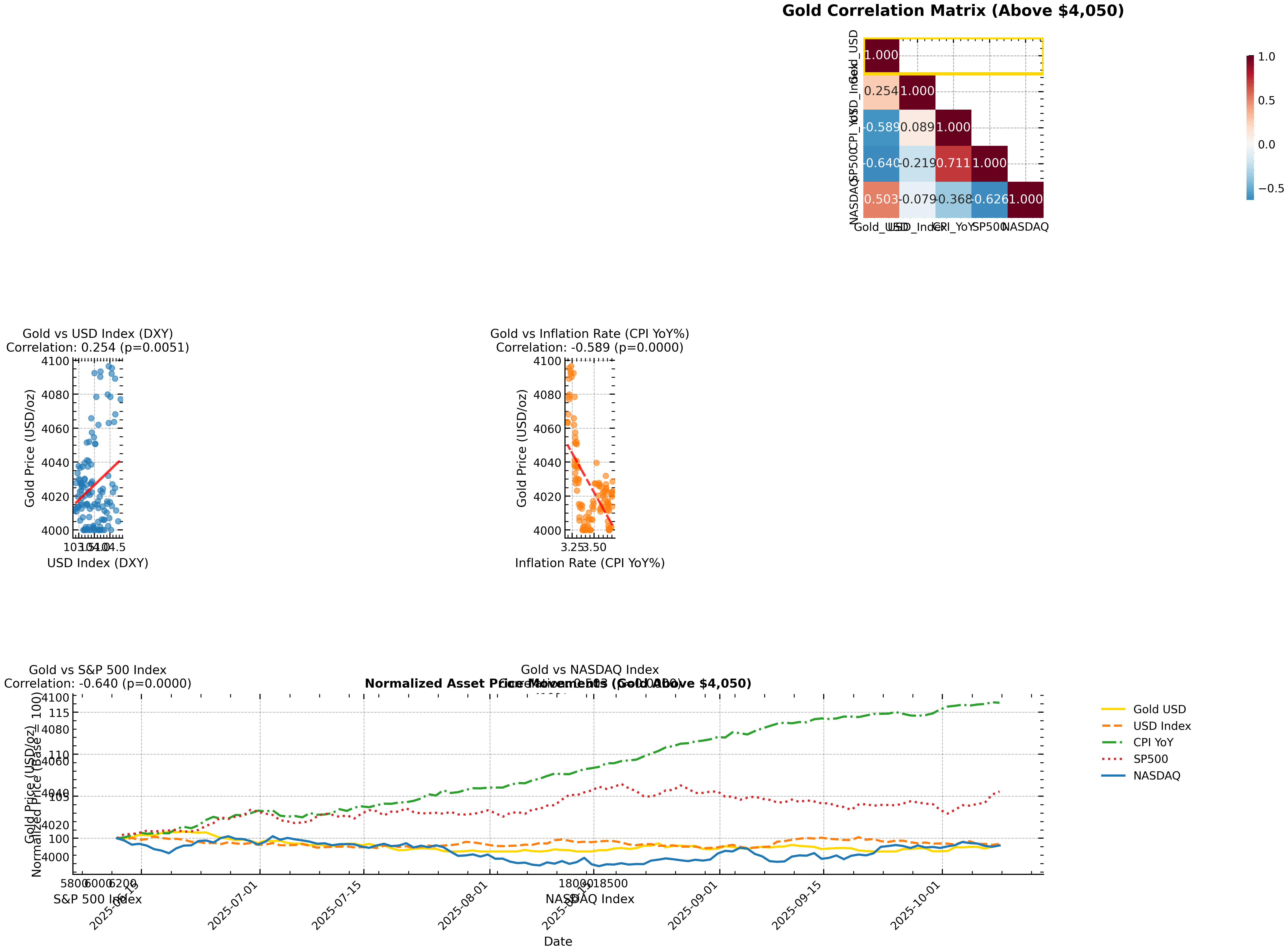

📈 Visual: Gold’s Correlation with Key Markets

Figure: Gold’s correlation with USD Index, inflation, S&P 500, and NASDAQ (June–October 2025).

Key Insights from Correlation Analysis

| Asset | Correlation w/ Gold | Interpretation |

|---|---|---|

| USD Index (DXY) | +0.25 | Weak positive (recently flipped) |

| CPI Inflation | -0.59 | Strong negative |

| S&P 500 | -0.64 | Strong negative |

| NASDAQ | +0.50 | Strong positive |

- Gold’s correlation with the USD Index has recently turned positive, reflecting complex market dynamics.

- Negative correlation with inflation and S&P 500 signals gold’s role as a hedge against both inflation and equity risk.

4️⃣ Central Bank & Institutional Sentiment

- Central banks: 43% plan to increase gold reserves in 2025; 95% expect global reserves to rise .

- Top buyers: China (+225t), Poland (+130t), Turkey (+95t), India (+70t).

- Institutional investors: Allocations to gold have risen to 8–20% of portfolios, with record ETF inflows .

- Motivations: Diversification, inflation hedge, protection from sanctions, and de-dollarization .

5️⃣ Short-Term & Long-Term Outlook

Short-Term (1–3 Months)

- Momentum remains bullish, but overbought signals suggest a risk of correction or consolidation.

- Key triggers: US dollar moves, Fed policy, geopolitical headlines, ETF flows.

- Trading strategy: Tighten stops, consider partial profit-taking at resistance, and look for buying opportunities on pullbacks to $4026–4010 or $4000.

Long-Term (6–24 Months)

- Structural bull market likely to persist, driven by central bank demand, global uncertainty, and portfolio rebalancing.

- Upside targets: $4,200–$4,500 (2025–2026), with some analysts projecting $5,000+ if macro risks intensify.

- Risks: Sudden reversal in Fed policy, peace deals, or a sharp USD rebound could trigger corrections, but fundamental support remains strong.

6️⃣ Investment Implications & Portfolio Strategy

For Professional Investors & Traders:

- Diversify with gold as a core hedge.

- Use technical levels for tactical entries/exits.

- Monitor central bank flows and macro headlines for trend confirmation.

- Manage risk with disciplined position sizing and stop-losses.

For General Investors:

- Consider a 5–15% gold allocation for portfolio resilience.

- Stay informed on macro and technical signals.

- Avoid chasing parabolic moves; wait for pullbacks to key support.

🏁 Conclusion & Action Points

Gold’s rally above $4,050 is rooted in deep macro and geopolitical shifts, not just speculation. While short-term corrections are possible, the long-term case remains robust. Both professionals and retail investors should treat gold as a core portfolio asset, not just a trade.