Key Takeaway:

Global equity markets closed at or near record highs, led by strong gains in technology and materials sectors, while gold soared above $4,000/oz. Investors shrugged off the ongoing U.S. government shutdown, focusing on resilient earnings, central bank signals, and robust sector rotation. Volatility remains elevated, but risk appetite is strong.

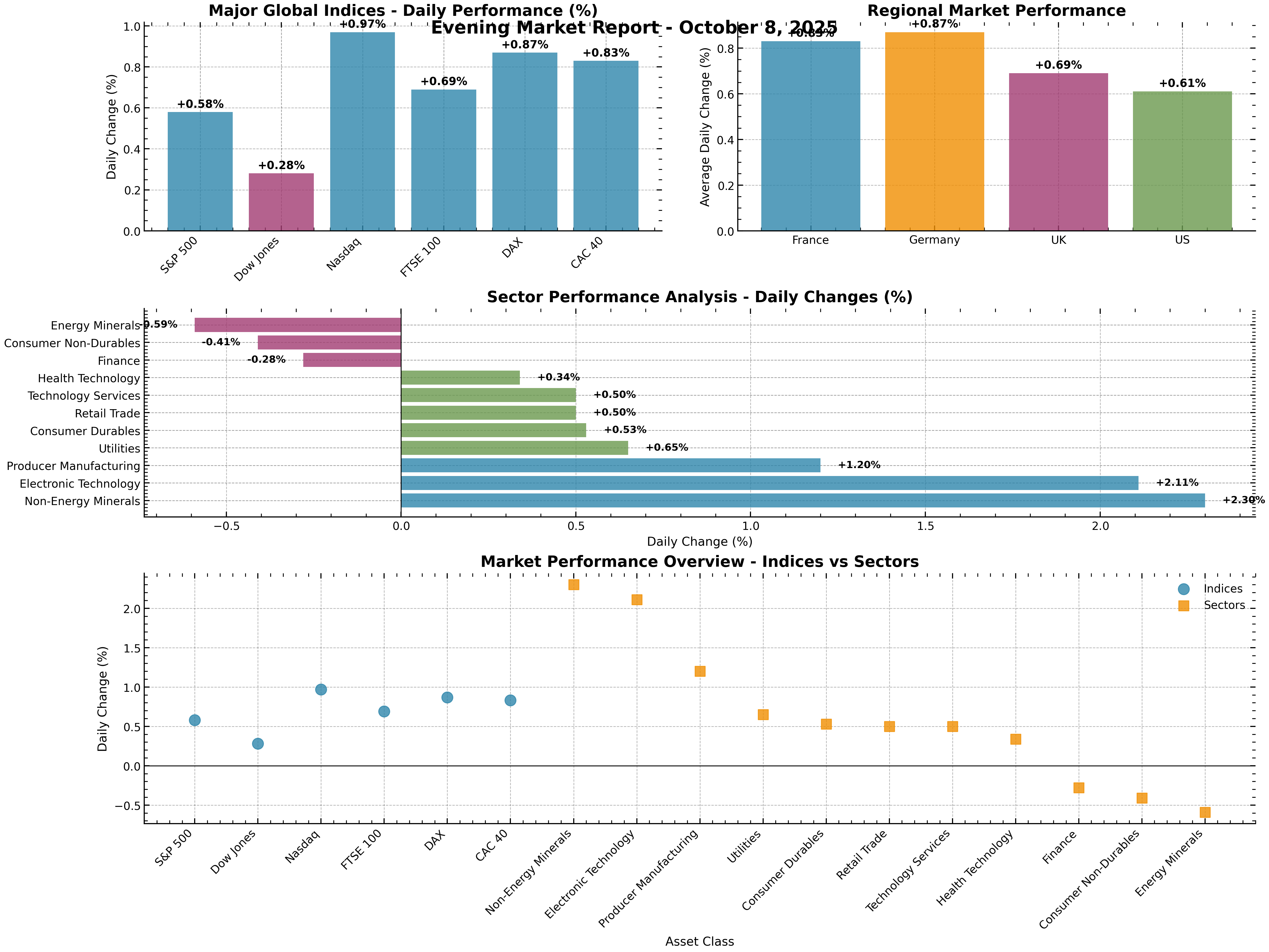

📈 Major Global Indices – Closing Snapshot

| Index | Close | Change (%) | Points Change |

|---|---|---|---|

| S&P 500 | 6,753.72 | +0.58% | +38.95 |

| Dow Jones | 46,733.10 | +0.28% | +130.49 |

| Nasdaq | 23,009.32 | +0.97% | +221.05 |

| FTSE 100 | 9,548.87 | +0.69% | +65.44 |

| DAX | 24,597.13 | +0.87% | +212.15 |

| CAC 40 | 8,060.14 | +0.83% | +66.35 |

All major indices closed in the green, with the Nasdaq leading gains. European markets outperformed, and the S&P 500 notched another record close.

📊 Market Performance Dashboard

Figure: Comprehensive dashboard of major index and sector performance, October 8, 2025. Technology and materials sectors led, with all major indices positive.

🏦 Sector Performance Highlights

| Sector | Change (%) | Performance |

|---|---|---|

| Non-Energy Minerals | +2.30% | Best performer |

| Electronic Technology | +2.11% | Strong |

| Producer Manufacturing | +1.20% | Strong |

| Utilities | +0.65% | Defensive gains |

| Finance | -0.28% | Weakest sector |

| Energy Minerals | -0.59% | Underperformed |

8 of 11 sectors closed higher. Materials and technology led, while finance and energy lagged.

🚀 Notable Stock Movers

Top Gainers

| Symbol | Company Name | % Change | Price (USD) |

|---|---|---|---|

| NCL | Northann Corp. | +649.60% | $0.94 |

| XBIO | Xenetic Biosciences, Inc. | +142.66% | $10.41 |

| NXL | Nexalin Technology, Inc. | +100.38% | $1.88 |

Top Losers

| Symbol | Company Name | % Change | Price (USD) |

|---|---|---|---|

| CENN | Cenntro Inc. | -57.12% | $0.265 |

| COCH | Envoy Medical, Inc. | -41.30% | $0.933 |

| GLTO | Galecto, Inc. | -40.01% | $10.75 |

Small-cap and biotech names saw outsized moves, with Northann Corp. surging nearly 650%.

💹 Commodities, Bonds & Currencies

Commodities

- Gold: $4,039.97 (+1.41%) – New all-time high, driven by safe-haven demand.

- Silver: $48.86 (+2.13%)

- Oil (Brent): $66.14 (+0.62%)

- Copper: $10,642.85 (+0.32%)

Bond Yields

- US 10-Year Treasury: 4.11% (-1 bps)

- US 30-Year Treasury: 4.70% (-2 bps)

Currencies

- USD/EUR: 0.8598 (+0.24%)

- USD/JPY: 152.71 (+0.56%)

- USD/GBP: 0.7461 (+0.17%)

Gold and silver outperformed, while the US dollar strengthened modestly. Treasury yields edged lower ahead of Fed minutes.

📰 Key Market Drivers & News

- U.S. Government Shutdown: Entered its second week, delaying official economic data and fueling safe-haven flows into gold .

- Fed Rate Cut Expectations: Markets are pricing in further rate cuts this year, with Fed officials’ speeches closely watched .

- Tech & AI Boom: Technology stocks led gains, supported by strong AI investment and major deals (e.g., AMD-OpenAI partnership) .

- European Politics: French political uncertainty weighed on sentiment, but European indices still closed higher .

- Commodities: OPEC+ output hikes were smaller than expected, supporting oil prices .

📋 Summary Table: Key Stats

| Metric | Value |

|---|---|

| Indices – Avg. Change | +0.70% |

| Best Index Performer | Nasdaq (+0.97%) |

| Worst Index Performer | Dow Jones (+0.28%) |

| Sectors – Avg. Change | +0.62% |

| Best Sector | Non-Energy Minerals |

| Worst Sector | Energy Minerals |

| Gold Price | $4,039.97 |

| US 10Y Treasury Yield | 4.11% |

| USD/EUR | 0.8598 |

🔮 Outlook & What to Watch

- Volatility may persist as the U.S. shutdown continues and official data remains scarce.

- Tech and materials are likely to remain in focus, with traders watching for sector rotation.

- Key events ahead:

- Fed minutes and speeches

- Ongoing earnings releases

- Political developments in Europe and the U.S.

🏁 Conclusion

Markets closed broadly higher, with technology and materials sectors leading the way. Gold’s record surge and resilient equity performance highlight strong risk appetite despite political and economic uncertainty. Stay tuned for further updates and actionable insights.