Key Takeaway:

European markets are opening higher this morning, led by gains in Switzerland, France, and the UK, while US indices remain under mild pressure and Asia trades mixed. Gold has surged to a new record above $4,000/oz, the US dollar is strong, and investors are bracing for a packed day of economic data and central bank commentary.

🗺️ Global Market Snapshot

| Index | Last Price | Change | % Change | Region |

|---|---|---|---|---|

| Dow Jones | 46,602.98 | -91.99 | -0.20% | US |

| S&P 500 | 6,714.59 | -25.69 | -0.38% | US |

| Nasdaq 100 | 24,840.23 | -138.33 | -0.55% | US |

| Russell 2000 | 2,481.40 | +4.30 | +0.17% | US |

| DAX (Germany) | 24,425.59 | +39.81 | +0.16% | Europe |

| CAC 40 (France) | 7,997.89 | +23.04 | +0.29% | Europe |

| FTSE 100 (UK) | 9,508.37 | +24.79 | +0.26% | Europe |

| EuroStoxx 50 | 5,627.00 | +10.00 | +0.18% | Europe |

| SMI (Switzerland) | 12,576.91 | +55.12 | +0.44% | Europe |

| Nikkei 225 (Japan) | 47,734.99 | -215.89 | -0.45% | Asia |

| Hang Seng (HK) | 26,957.77 | -183.15 | -0.67% | Asia |

| SENSEX (India) | 81,926.75 | +136.63 | +0.17% | Asia |

| Shanghai Comp. (China) | 3,882.78 | +20.25 | +0.52% | Asia |

Europe leads the morning with all major indices in positive territory, while US and Asian markets are more mixed. Shanghai and Switzerland are today’s top performers; Hong Kong and US tech lag.

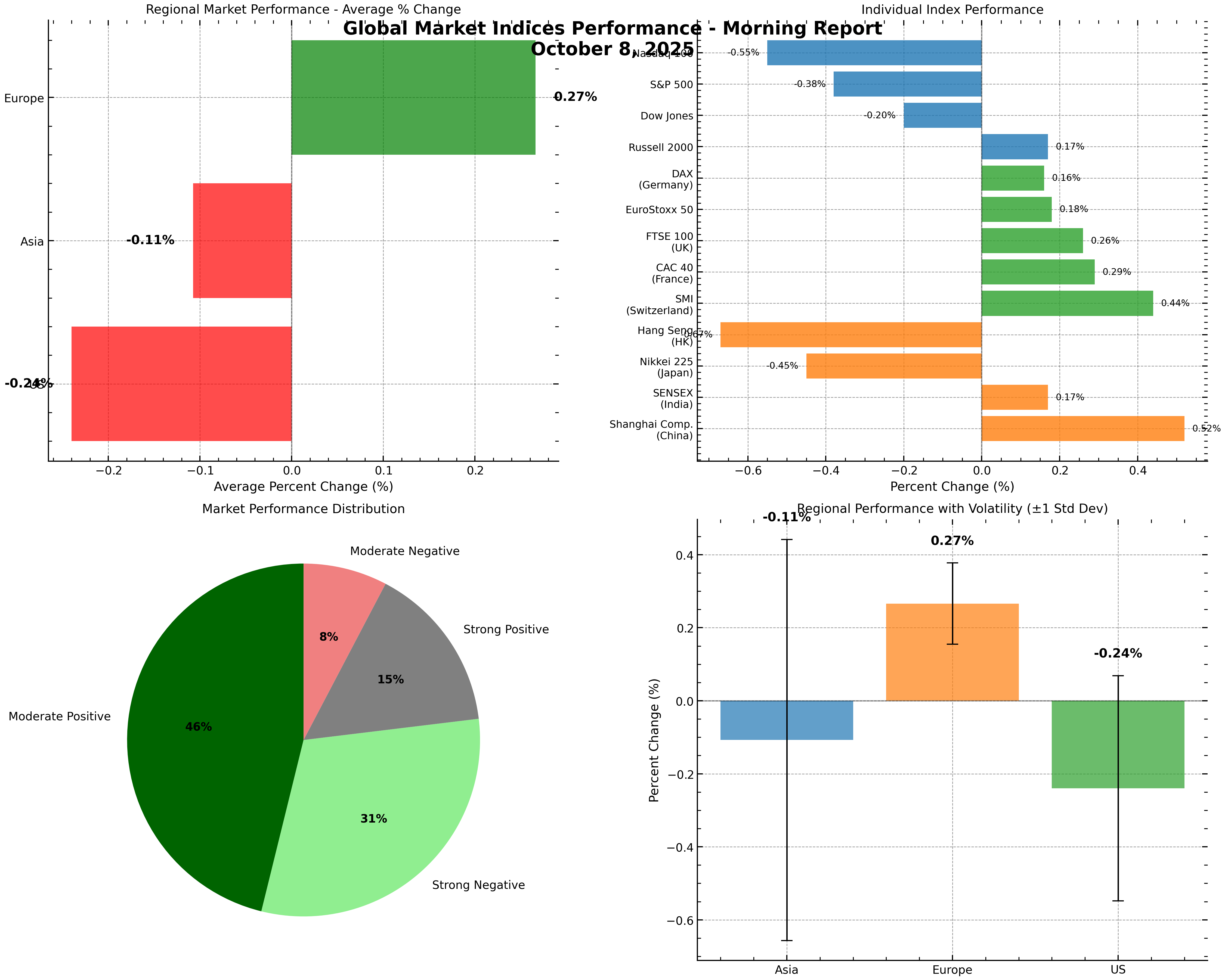

📊 Visual: Global Market Performance

Figure: Global market indices performance as of October 8, 2025. Europe is broadly positive, Asia and the US are mixed.

🏦 Key Market Drivers

- Commodities:

- Gold hits a new all-time high at $4,036.73/oz (+1.33%), reflecting safe-haven demand and macro uncertainty.

- Oil prices are modestly higher (Brent $65.96/bbl, WTI $62.27/bbl), while copper and agricultural commodities are steady.

- Currencies:

- The US dollar remains strong, especially against the yen (USD/JPY 152.42) and euro (EUR/USD 0.8596).

- Bond Yields:

- US 10-year Treasury yield is elevated at 4.18%, with the 30-year at 4.79%.

- Macro:

- The US government shutdown continues, delaying key data and causing operational disruptions in sectors like air travel.

- Investors are watching for the US trade balance, FOMC minutes, and a series of Fed speeches throughout the day.

📰 Corporate & Economic News

- Tesla launched lower-priced Model 3 and Model Y variants, but shares fell on investor disappointment.

- AMD announced a major AI chip deal with OpenAI, boosting sentiment in the tech sector.

- Exxon Mobil is cutting 2,000 jobs globally as part of a restructuring plan.

- M&A: Fifth Third Bancorp and Comerica announced a $10.9B merger, set to create the 9th largest US bank by assets.

- Earnings: Lifecore Biomedical and AZZ Inc. beat expectations, while VinFast and Golden Matrix missed.

🌍 Regional Performance Breakdown

| Region | Avg. % Change | # Positive Indices / Total | Best Performer | Worst Performer |

|---|---|---|---|---|

| Europe | +0.27% | 5 / 5 | SMI (Switzerland) +0.44% | DAX (Germany) +0.16% |

| US | -0.24% | 1 / 4 | Russell 2000 +0.17% | Nasdaq 100 -0.55% |

| Asia | -0.11% | 2 / 4 | Shanghai Comp. +0.52% | Hang Seng -0.67% |

Europe is the clear leader this morning, with all indices in the green. US and Asia are more mixed, with tech and Hong Kong underperforming.

📅 Today’s Economic Calendar & Central Bank Events

- US:

- MBA Mortgage Applications (7:00 AM ET)

- International Trade in Goods & Services (8:30 AM ET)

- EIA Petroleum Status Report (10:30 AM ET)

- FOMC Minutes (2:00 PM ET)

- Multiple Fed speeches throughout the day

- Europe:

- ECB Monetary Policy Conference continues in Frankfurt, with a keynote by Lawrence J. Christiano and closing remarks by ECB officials.

🧭 Outlook & What to Watch

- Volatility may remain elevated as the US shutdown delays official data and central bank signals take center stage.

- Defensive sectors and gold are likely to stay in favor if uncertainty persists.

- Key focus:

- US trade data and FOMC minutes for policy clues

- European macro and political developments

- Ongoing corporate earnings and M&A activity

🏁 Summary

European markets are off to a strong start, gold is at record highs, and the US dollar remains robust. With a busy economic calendar and ongoing macro uncertainty, expect active trading and sector rotation as investors digest new data and central bank commentary.