Key Takeaway:

Global markets closed mixed today, with defensive sectors leading gains amid ongoing U.S. government shutdown uncertainty, record gold prices, and a sharp divergence between tech and consumer stocks. European indices showed resilience, while U.S. markets saw a modest pullback, and commodities reflected persistent macroeconomic crosscurrents.

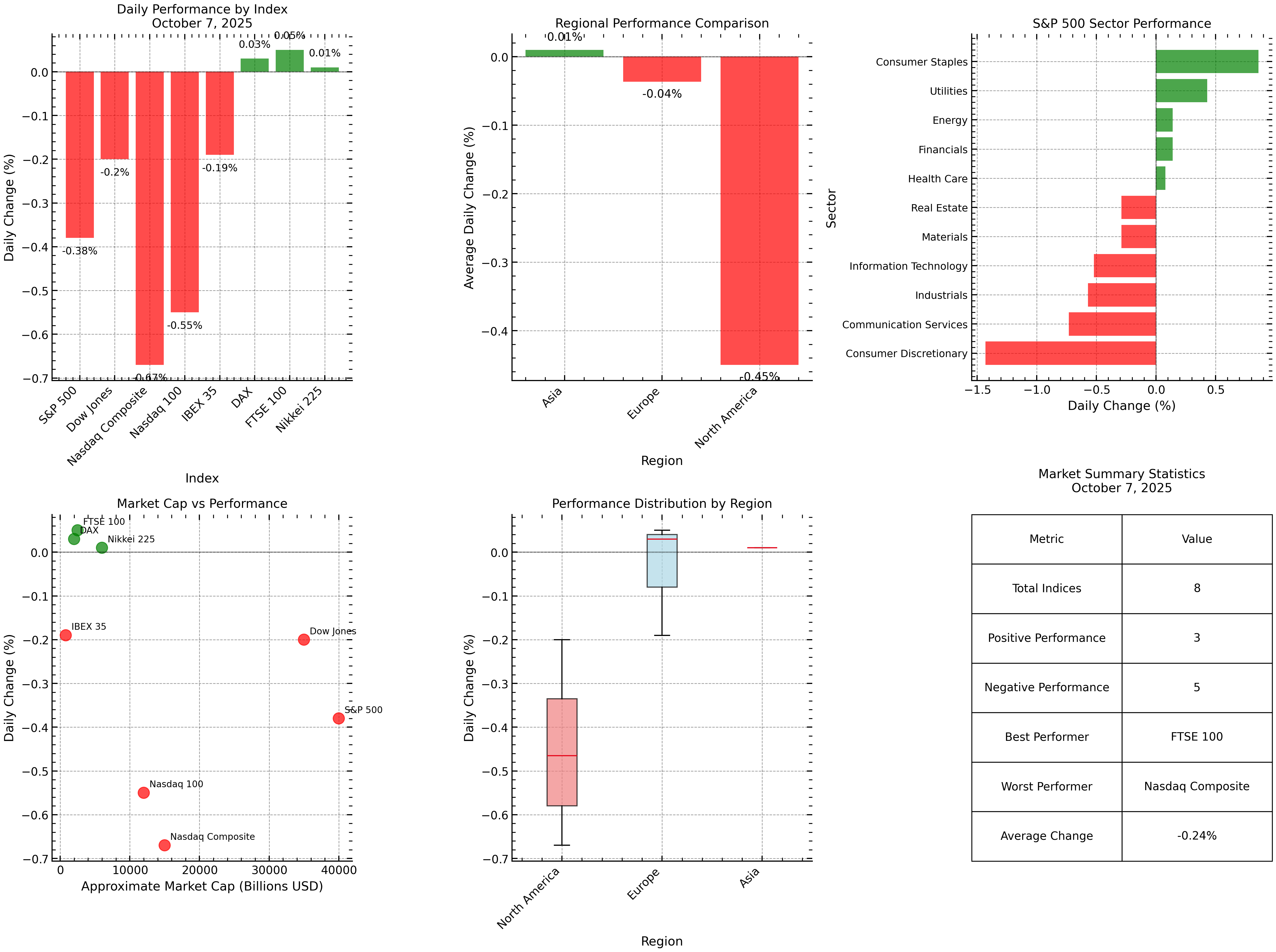

📈 Major Global Indices – Closing Snapshot

| Index | Close | Change (pts) | Change (%) |

|---|---|---|---|

| S&P 500 | 6,714.59 | -25.69 | -0.38% |

| Dow Jones | 46,602.98 | -91.99 | -0.20% |

| Nasdaq Composite | 22,788.36 | -153.30 | -0.67% |

| Nasdaq 100 | 24,840.23 | -138.33 | -0.55% |

| IBEX 35 | 15,527.00 | -29.70 | -0.19% |

| DAX | 24,385.78 | +7.49 | +0.03% |

| FTSE 100 | 9,483.58 | +4.44 | +0.05% |

| Nikkei 225 | 47,950.88 | +6.12 | +0.01% |

Insight:

Europe’s DAX and FTSE 100 eked out small gains, while U.S. indices and Spain’s IBEX 35 slipped. The Nasdaq led declines, reflecting tech sector weakness.

🏦 Key Market Drivers

- U.S. Government Shutdown: The ongoing shutdown delayed key economic data, fueling uncertainty and risk aversion. Markets leaned on private data, which showed weaker-than-expected U.S. job growth, increasing bets on Fed rate cuts .

- Defensive Rotation: Investors favored Consumer Staples (+0.86%) and Utilities (+0.43%), while Consumer Discretionary (-1.43%) and Communication Services (-0.73%) lagged.

- Commodities: Gold soared to a record $4,001/oz, driven by inflation fears and safe-haven demand. Oil prices stabilized (WTI $61.86, Brent $65.71) amid supply/demand uncertainty.

- Currencies: The U.S. dollar weakened against the euro and pound but strengthened versus the yen. EUR/USD closed at 1.1747, USD/JPY at 151.96.

- Europe: The STOXX 600 and major indices held firm, buoyed by tech optimism and expectations of lower U.S. rates. Political uncertainty in France and sector rotation shaped sentiment.

📊 Sector Performance (S&P 500)

| Sector | Change (%) |

|---|---|

| Consumer Staples | +0.86 |

| Utilities | +0.43 |

| Financials | +0.14 |

| Energy | +0.14 |

| Health Care | +0.08 |

| Materials | -0.29 |

| Real Estate | -0.29 |

| Information Technology | -0.52 |

| Industrials | -0.57 |

| Communication Services | -0.73 |

| Consumer Discretionary | -1.43 |

Defensive sectors outperformed, while tech and consumer names faced pressure.

🚀 Notable Stock Movers

| Symbol | Company Name | % Change | Closing Price (USD) |

|---|---|---|---|

| GLTO | Galecto, Inc. | +383.02% | 17.92 |

| TMQ | Trilogy Metals Inc. | +211.00% | 6.50 |

| COCH | Envoy Medical, Inc. | +97.07% | 1.59 |

| BURU | Nuburu, Inc. | +86.27% | 0.475 |

| CISS | C3is Inc. | +84.16% | 4.07 |

Galecto, Inc. (GLTO) surged over 380% on positive biotech news, leading a wave of small-cap and biotech rallies.

🏅 Regional & Sector Performance Overview

Figure: Global index and sector performance, October 7, 2025. Defensive sectors led, with Europe showing relative resilience.

📰 Other Key Headlines

- Fed Outlook: Officials signaled caution on rate cuts amid data blackout, but weak private jobs data increased market conviction for easing.

- Europe: Eurozone retail sales stabilized; ECB President Lagarde called inflation risks “contained.”

- Commodities: Copper jumped 7% on manufacturing optimism; oil remained range-bound.

- Earnings: McCormick missed estimates and cut guidance, weighing on consumer staples sentiment.

🔮 Outlook & What to Watch

- Volatility likely to persist as the U.S. shutdown continues and official data remains scarce.

- Defensive positioning may continue if macro uncertainty lingers.

- Watch for:

- Fed commentary and any progress on the U.S. budget impasse

- Key earnings reports and sector guidance

- Currency and commodity swings as global risk appetite shifts

🏁 Summary

Markets closed mixed, with defensive sectors and European indices showing resilience. Tech and consumer stocks lagged, gold hit new highs, and macro uncertainty remains elevated. Stay tuned for further updates and actionable insights.