Key Takeaway:

Global markets closed the day with a resilient tone, led by a powerful rally in Japan and continued strength in U.S. equities, even as political uncertainty and a U.S. government shutdown kept volatility elevated. Technology, gold, and select industrials outperformed, while investors remain focused on upcoming earnings and central bank signals.

🌍 Global Market Overview

| Index | Close | % Change | Performance Category |

|---|---|---|---|

| S&P 500 | 6,741.35 | +0.38% | Neutral |

| Dow Jones | 46,710.36 | -0.10% | Neutral |

| Nasdaq Comp. | 22,941.67 | +0.71% | Positive |

| IBEX 35 | 15,556.70 | +0.57% | Positive |

| DAX | 24,378.29 | 0.00% | Neutral |

| FTSE 100 | 9,479.14 | -0.13% | Neutral |

| Nikkei 225 | 47,944.76 | +4.75% | Strong Positive |

Japan’s Nikkei 225 led global gains, surging nearly 5% on political optimism and stimulus hopes. U.S. indices held near record highs, while Europe was mixed with Spain’s IBEX 35 outperforming.

🔥 Key Market Drivers

- U.S. Government Shutdown: Entered its sixth day, delaying key economic data and raising uncertainty. Despite this, the S&P 500 and Nasdaq closed at new all-time highs, supported by strong tech and healthcare performance.

- Tech & AI Rally: AMD (+27.7%), Micron (+6.1%), and Palantir (+5.0%) were among the session’s top gainers, driven by AI optimism and major chip deals.

- Commodities: Gold soared toward $4,000/oz on safe-haven demand, while oil prices fell sharply (Brent below $65/bbl) due to oversupply concerns.

- Cryptocurrencies: Bitcoin hovered near $120,000 after setting a new all-time high, reflecting risk-hedging flows.

- Europe: Political uncertainty in France weighed on sentiment, but Spain’s IBEX 35 continued its strong run.

- Asia: The Nikkei’s rally was fueled by leadership changes and expectations of continued fiscal support.

📊 Sector & Stock Highlights

| Sector | Performance | Notes |

|---|---|---|

| Technology | Underperformed | Nasdaq up, but S&P 500 tech lagged |

| Utilities, Health Care | Outperformed | Defensive rotation amid volatility |

| Financials | Positive | Supported by stable rates |

| Industrials | Strong | Machinery, defense stocks gained |

| Consumer Sectors | Weak | Ongoing pressure from cautious spending |

Notable Movers:

- AMD (+27.7%): Surged on OpenAI chip deal

- Super Micro Computer (+6.8%), Micron (+6.1%), Palantir (+5.0%)

- Oklo Inc. (+13.3%): Small modular reactor optimism

- HIVE Digital (+25.3%): Crypto-linked rally

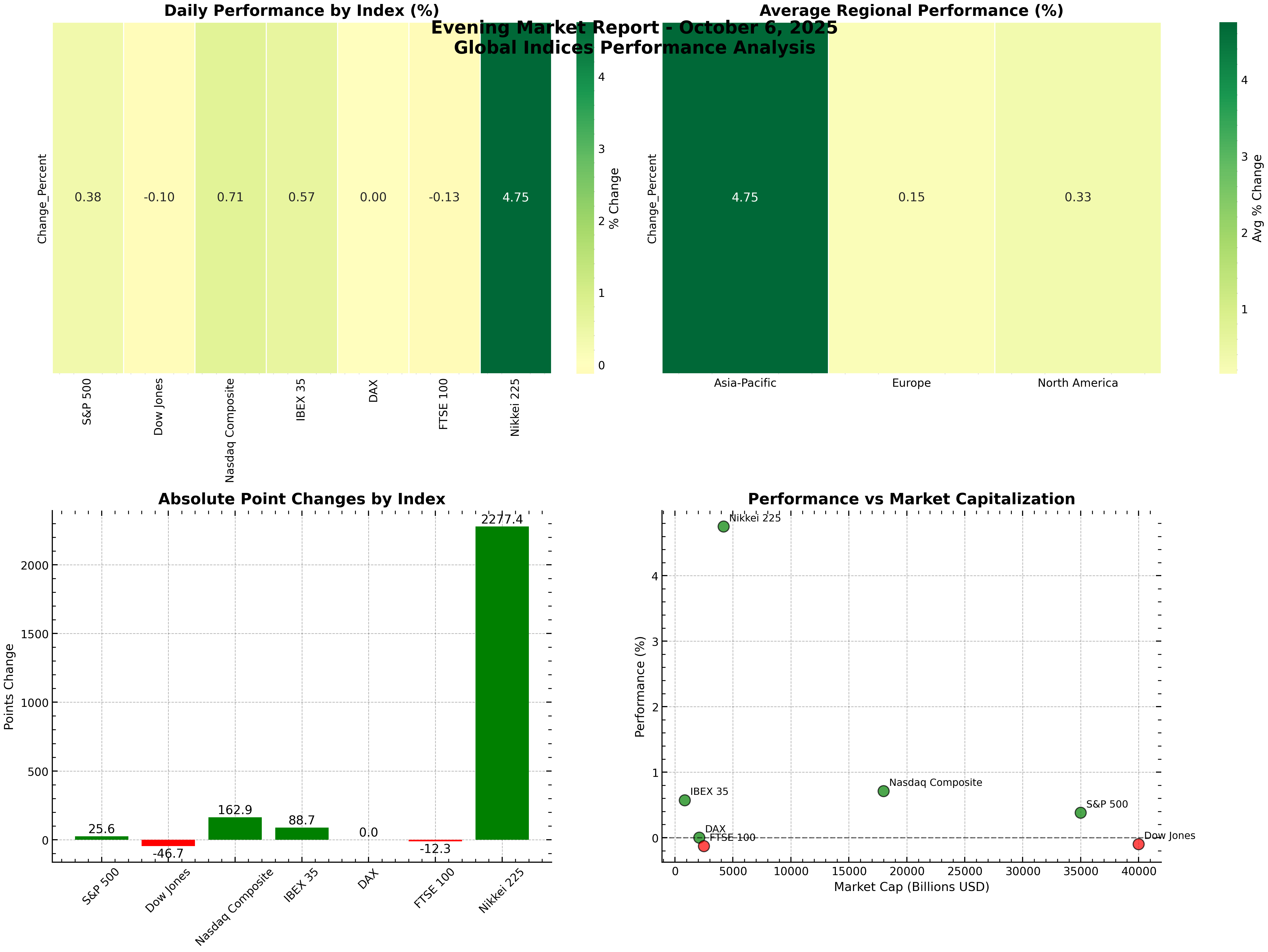

🗺️ Visual: Global Indices Performance Heatmap

Figure: Daily performance of major global indices (October 6, 2025). Nikkei 225 stands out with a strong positive move; U.S. and Spanish markets also in the green.

🏦 Central Bank & Macro Updates

- Federal Reserve: Held a closed meeting to review discount rates; officials reiterated commitment to 2% inflation and policy flexibility.

- ECB: Reaffirmed its 2% inflation target and highlighted digital euro initiatives.

- Economic Data: U.S. trade balance and consumer expectations released; Eurozone investor confidence improved but remains cautious. UK car sales surged to a five-year high.

🔮 Outlook

- Volatility remains elevated due to the U.S. data blackout and political risks.

- Earnings season begins this week, with Delta, PepsiCo, and others reporting—expect heightened stock-specific moves.

- Watch for central bank commentary and any resolution to the U.S. government shutdown, which could shift market sentiment quickly.

🏁 Summary

Markets remain resilient, with tech and Japan leading gains. Defensive sectors are in favor, and volatility is likely to persist as investors await earnings and macro clarity. Stay tuned for further updates and actionable insights.