Key Takeaway:

The global markets closed the week on a cautiously optimistic note, with most major indices in positive territory, but underlying volatility and sector rotation signal that investors remain alert to shifting economic and geopolitical winds.

📈 Executive Summary

- Most major indices posted gains: Nasdaq (+2.4%), S&P 500 (+1.3%), Hang Seng (+2.2%), while small caps (Russell 2000) lagged (-2.1%).

- Sector rotation: Real Estate (+8.28%) and Communication Services (+5.0%) led, while Materials (-2.5%) and Utilities (-0.75%) underperformed.

- Economic data: U.S. inflation cooled slightly, unemployment ticked up to 4.1%, and Q2 GDP growth beat expectations at 2.8%.

- Geopolitical & policy drivers: Central banks held rates steady, Middle East tensions persisted, and political shifts in the U.S. and Europe added uncertainty.

- Outlook: The coming week is expected to maintain a bullish bias, but with moderate volatility and key risks from central bank policy and geopolitics.

🌐 Market Performance Overview

| Index | Weekly Change (%) | Closing Value | Region |

|---|---|---|---|

| Nasdaq | +2.4 | 17,133.13 | US |

| S&P 500 | +1.3 | 5,346.99 | US |

| Hang Seng | +2.2 | 18,476.8 | Asia |

| Nikkei 225 | +0.6 | 38,703.5 | Asia |

| DAX (Germany) | +0.8 | 18,646.5 | Europe |

| CAC 40 (France) | +0.6 | 8,040.1 | Europe |

| FTSE 100 | +0.1 | 8,285.3 | Europe |

| Dow Jones | +0.3 | 38,798.99 | US |

| Russell 2000 | -2.1 | 2,026.55 | US |

Key Finding:

8 out of 9 major indices closed higher, with the U.S. and Asia leading gains. Small caps underperformed, reflecting risk aversion beneath the surface.

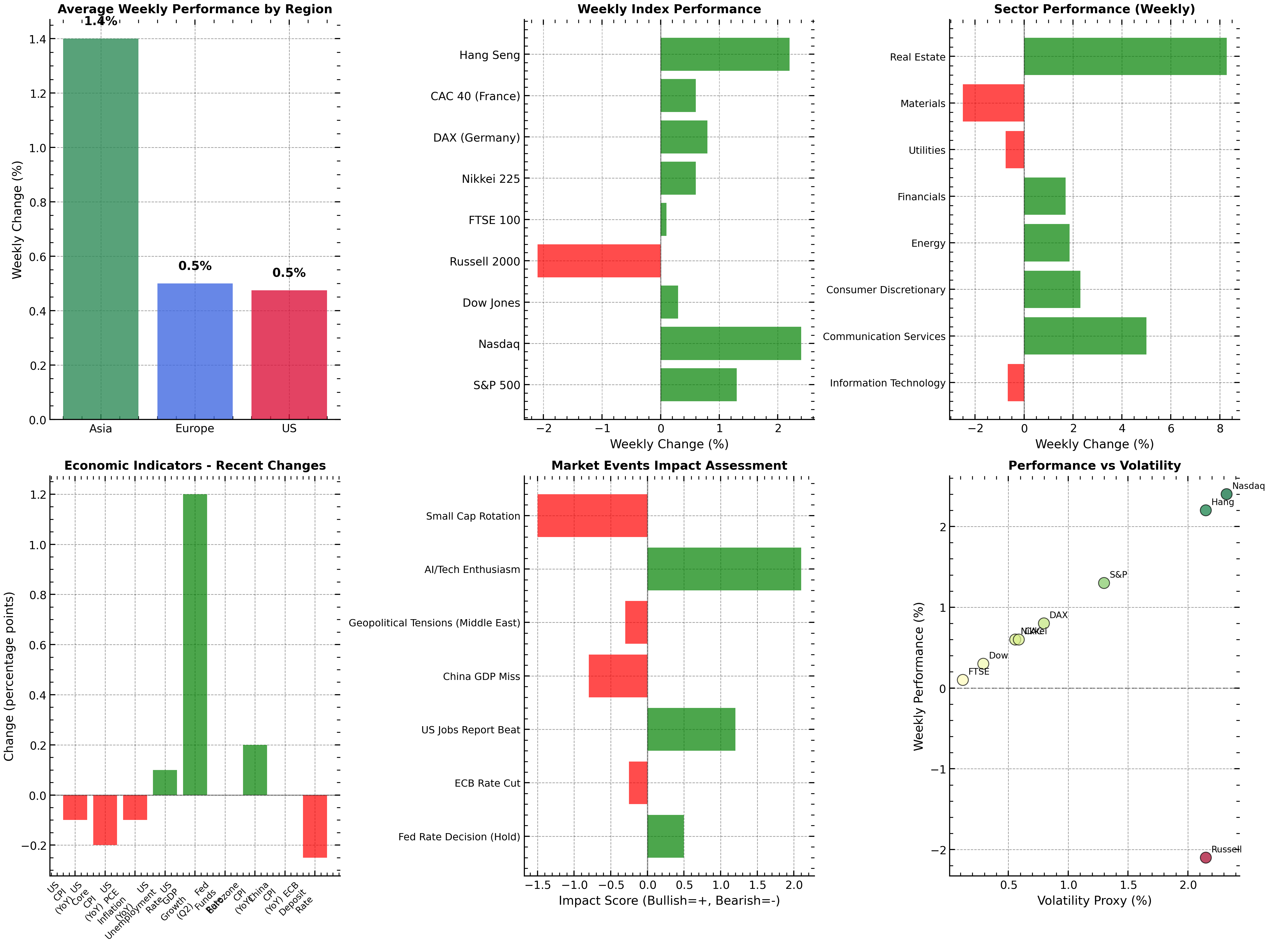

📊 Visual Market Dashboard

Figure: Multi-panel dashboard summarizing regional performance, index and sector returns, economic indicator changes, and event impact.

📰 Geopolitical & Economic News That Moved Markets

🔹 Central Bank Policy

- Fed, ECB, BoE: All held rates steady. The Fed is expected to cut in September; the ECB already made its first cut, and the BoE remains cautious.

- Bank of Japan: Raised rates to 0.25%, strengthening the yen.

🔹 Economic Data

- U.S. Inflation: CPI at 3.3% YoY (down from 3.4%), Core CPI at 3.4% (lowest since April 2021).

- U.S. Jobs: Unemployment rose to 4.1%, but job creation beat expectations.

- GDP: U.S. Q2 growth at 2.8% (above forecast); Eurozone Q1 at 0.3% QoQ; China Q1 at 5.4% YoY but Q2 slowing.

🔹 Geopolitics & Policy

- U.S. Election: President Biden’s exit from the race increased political uncertainty, but markets remain focused on economic fundamentals.

- Middle East: Ongoing tensions and cease-fire talks affected oil prices, which fell then rebounded on supply concerns.

- Europe: UK Labour Party’s win and French parliamentary dynamics added volatility.

🔹 Sector & Company Highlights

- Tech & AI: Amazon and Nvidia hit new highs on AI optimism.

- Real Estate: Top-performing sector in the S&P 500 (+8.28%).

- Small Caps: Russell 2000 lagged, reflecting risk-off sentiment in riskier assets.

🏆 Sector Winners & Losers

| Sector | Weekly Change (%) |

|---|---|

| Real Estate | +8.28 |

| Communication Services | +5.00 |

| Consumer Discretionary | +2.30 |

| Energy | +1.86 |

| Financials | +1.70 |

| Information Technology | -0.66 |

| Utilities | -0.75 |

| Materials | -2.50 |

📈 Economic Indicators Snapshot

| Indicator | Current Value | Change | Direction |

|---|---|---|---|

| US CPI (YoY) | 3.3% | -0.1 | Deteriorating |

| US Core CPI (YoY) | 3.4% | -0.2 | Deteriorating |

| US PCE Inflation (YoY) | 2.6% | -0.1 | Deteriorating |

| US Unemployment Rate | 4.1% | +0.1 | Deteriorating |

| US GDP Growth (Q2) | 2.8% | +1.2 | Improving |

🔮 Market Forecast & Outlook (Next Week)

| Forecast Component | Current Reading |

|---|---|

| Market Momentum | +0.69% (POSITIVE) |

| Volatility Level | 1.32% (MODERATE) |

| Sector Sentiment | 62.5% positive sectors |

| Market Breadth | 88.9% indices positive |

| S&P 500 Support | 5,240 |

| S&P 500 Resistance | 5,454 |

| Nasdaq Support | 16,790 |

| Nasdaq Resistance | 17,476 |

Risk Assessment:

- Inflation, Employment, Growth: Low risk

- Central Bank, Geopolitics: Medium risk

Key Takeaway:

The primary bias is bullish for the coming week, with upward momentum likely to continue, but watch for volatility from central bank communications, economic data, and geopolitical headlines.

📌 Trading & Investment Recommendations

- Favor broad market ETFs and leading sectors (Real Estate, Communication Services).

- Monitor small-cap performance for signs of broader risk appetite.

- Stay alert for sector rotation and potential reversals.

- Watch key catalysts: Fed/ECB/BoJ updates, inflation/employment data, and geopolitical news.

🧭 Conclusion

The global markets are closing the week with a positive tone, supported by resilient economic data and strong sector leadership in real estate and communication services. However, the underperformance of small caps and persistent geopolitical and policy risks mean that vigilance is warranted. The outlook for next week is bullish, but investors should remain nimble and responsive to new developments.