🌅 Morning Market Report: European Stocks Rally, US Futures Steady Amid Data Blackout

Thursday, October 2, 2025

Key Takeaway:

European markets open with strong gains, led by the DAX and FTSE 100, while US futures are steady after Wall Street’s record highs. The US government shutdown has halted official economic data releases, increasing uncertainty and shifting market focus to private reports and sector news. Gold remains near record highs, oil is stable, and Bitcoin is flat. Expect heightened volatility as investors navigate a data vacuum and political headlines.

📊 Market Snapshot: Latest Prices & Daily Moves

🏦 Major European Indices (vs. today’s open)

| Index | Current Price | Change (pts) | Change (%) |

|---|---|---|---|

| DAX | 24,113.62 | +232.90 | +0.98% |

| FTSE 100 | 9,467.34 | +20.91 | +0.22% |

| CAC 40 | 7,966.95 | +71.01 | +0.90% |

| IBEX 35 | 15,538.80 | +63.80 | +0.41% |

🇺🇸 US Index Futures (vs. previous close)

| Index | Current Price | Change (pts) | Change (%) |

|---|---|---|---|

| S&P 500 | 6,711.20 | +22.74 | +0.34% |

| Dow Jones | 46,441.10 | +43.21 | +0.09% |

| Nasdaq | 22,755.16 | +95.15 | +0.42% |

💱 Forex

| Pair | Current Price | Change (%) |

|---|---|---|

| EUR/USD | 1.1749 | -0.18% |

| GBP/USD | 1.3497 | +0.22% |

| USD/JPY | 147.16 | +0.06% |

🪙 Commodities

| Asset | Current Price | Change (%) | Unit |

|---|---|---|---|

| Gold | $3,872.74 | +0.15% | USD/oz |

| WTI Crude | $61.77 | +0.03% | USD/bbl |

| Brent | $65.49 | +0.08% | USD/bbl |

₿ Crypto

| Asset | Current Price | Change (%) | Unit |

|---|---|---|---|

| Bitcoin | $118,580 | USD |

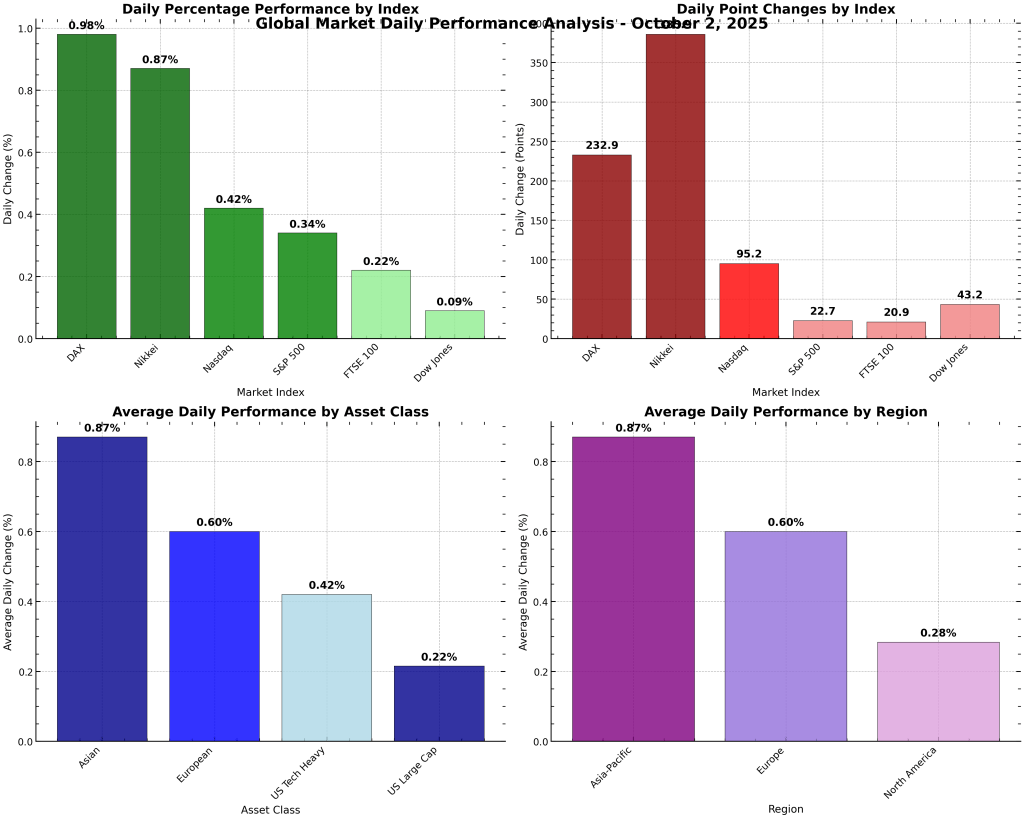

📈 Visual: Global Market Daily Performance

Figure: Daily percentage change for major indices. DAX leads, Dow lags, all indices in positive territory.

📰 News Drivers & Market Trends

- US Government Shutdown:

The shutdown has suspended key economic data releases (jobs, factory orders), leaving markets to rely on private reports and Fed commentary. This data blackout increases volatility and uncertainty . - European Optimism:

European stocks are rallying, led by the DAX and FTSE 100, as investors bet on continued monetary support and resilience in industrial and health sectors . - Wall Street at Highs:

US indices hit new records yesterday, driven by tech, AI, and infrastructure stocks. The S&P 500 is up 13% YTD, with gains concentrated in a handful of large-cap leaders . - Gold & Oil:

Gold remains near all-time highs as a safe haven. Oil prices are stable, with Brent and WTI holding recent gains amid OPEC+ supply discipline and global demand concerns. - Bitcoin:

Bitcoin is flat, consolidating after recent volatility and reflecting a cautious risk appetite in crypto.

🗓️ Economic Calendar & Data Watch

| Time (CET) | Event/Indicator | Status | Market Impact |

|---|---|---|---|

| 14:30 | US Jobless Claims | Delayed | High (data blackout) |

| 16:00 | US Factory Orders | Delayed | High (data blackout) |

| — | Private US PMI/ADP data | Released | Moderate |

| — | ECB/Fed Speeches | Scheduled | High |

| — | Eurozone CPI, PMI | Released | Supportive |

Export as CSV

With official US data suspended, markets will react more sharply to private reports, central bank speeches, and political headlines.

🔎 Analysis & Forecast

Trend:

European equities are leading global gains, buoyed by strong sector performance and hopes for continued monetary support. US futures are steady, but the lack of official data due to the shutdown could spark volatility and sudden moves on any news.

Forecast:

- Europe: Upside momentum likely to continue if no negative surprises emerge.

- US: Expect choppy trading and possible profit-taking as investors navigate the data vacuum and political risk.

- Forex: EUR/USD and GBP/USD may remain firm if the shutdown drags on.

- Commodities: Gold should stay supported; oil likely to trade sideways.

- Crypto: Bitcoin stable, but sensitive to shifts in risk sentiment.

Recommendation:

Stay diversified and defensive. Focus on sectors with strong momentum (tech, health, industrials), keep an eye on gold as a hedge, and be ready to adjust positions quickly in response to headlines or private data releases.