Tuesday, September 30, 2025

Key Takeaway:

Markets open the final day of September with a cautiously optimistic tone. Gold remains near record highs, oil prices are steady, and global equities are mixed as investors digest robust US economic data, new tariff headlines, and the looming risk of a US government shutdown. Today’s focus: Fed speeches, US housing data, and ongoing trade policy developments.

📊 Global Market Snapshot

Overnight Asian Market Closings

| Index | Last Close | Change | % Change |

|---|---|---|---|

| Nikkei 225 | 44,932.63 | -111.12 | -0.25% |

| Hang Seng | 26,622.88 | +494.68 | +1.89% |

| Shanghai Composite | 3,862.53 | +34.43 | +0.90% |

| KOSPI | 3,431.21 | +45.16 | +1.33% |

| SENSEX | 80,364.94 | -61.52 | -0.08% |

European & US Futures (Pre-Market)

| Index | Futures Price | Change | % Change |

|---|---|---|---|

| DAX | 23,745.06 | +5.59 | +0.02% |

| FTSE 100 | 9,346.50 | -4.50 | -0.05% |

| CAC 40 | 7,879.00 | +16.70 | +0.21% |

| EuroStoxx 50 | 5,525.00 | +1.00 | +0.02% |

| S&P 500 | 6,711.75 | +3.25 | +0.05% |

| Dow Jones | 46,585.00 | -2.00 | 0.00% |

| Nasdaq 100 | 24,838.00 | +26.75 | +0.11% |

Forex & Commodities

| Asset | Price | Change |

|---|---|---|

| EUR/USD | 1.17384 | +0.10% |

| GBP/USD | 1.3449 | +0.17% |

| USD/JPY | 148.068 | -0.35% |

| Gold (oz) | $3,859.00 | +0.68% |

| Silver (oz) | $46.74 | -0.23% |

| Brent Oil | $67.64 | -0.01 |

| WTI Oil | $63.13 | -0.08 |

📰 Top Market-Moving News

- US Economic Strength:

- Core PCE inflation held steady at 2.9% YoY in August, matching expectations.

- Q2 GDP was revised up to 3.8% annualized, driven by strong consumer spending.

- Weekly jobless claims fell to 218,000, signaling labor market resilience.

- Fed & Policy Outlook:

- Fed officials remain divided: Chair Powell is cautious, while others push for rate cuts.

- Markets expect at least one more rate cut this year, but timing is uncertain.

- Tariffs & Trade:

- President Trump announced new 100% tariffs on foreign-made movies and branded drugs, plus plans for tariffs on imported furniture.

- These moves have sparked volatility in media, pharma, and retail sectors, especially in Asia.

- Commodities:

- Gold continues its record climb, trading near $3,860/oz.

- Oil prices are steady as Russian export cuts and Middle East tensions offset demand concerns.

- Corporate Movers:

- Intel surged nearly 9% on Apple investment rumors.

- CarMax plunged 20% after disappointing earnings.

- EA (Electronic Arts) is the subject of a record leveraged buyout.

- Political Risk:

- The risk of a US government shutdown remains high, with no funding deal in place as the fiscal year ends today.

📅 Economic Calendar: Key Events Today

| Time (ET) | Event/Release |

|---|---|

| 7:30 AM | Fed Governor Waller Speaks |

| 10:00 AM | Pending Home Sales Index |

| 10:30 AM | Dallas Fed Manufacturing Survey |

| 1:30 PM | NY Fed President Williams Speaks |

| 6:00 PM | Atlanta Fed President Bostic Speaks |

Watch for:

Fed commentary, US housing data, and any developments on the government funding front.

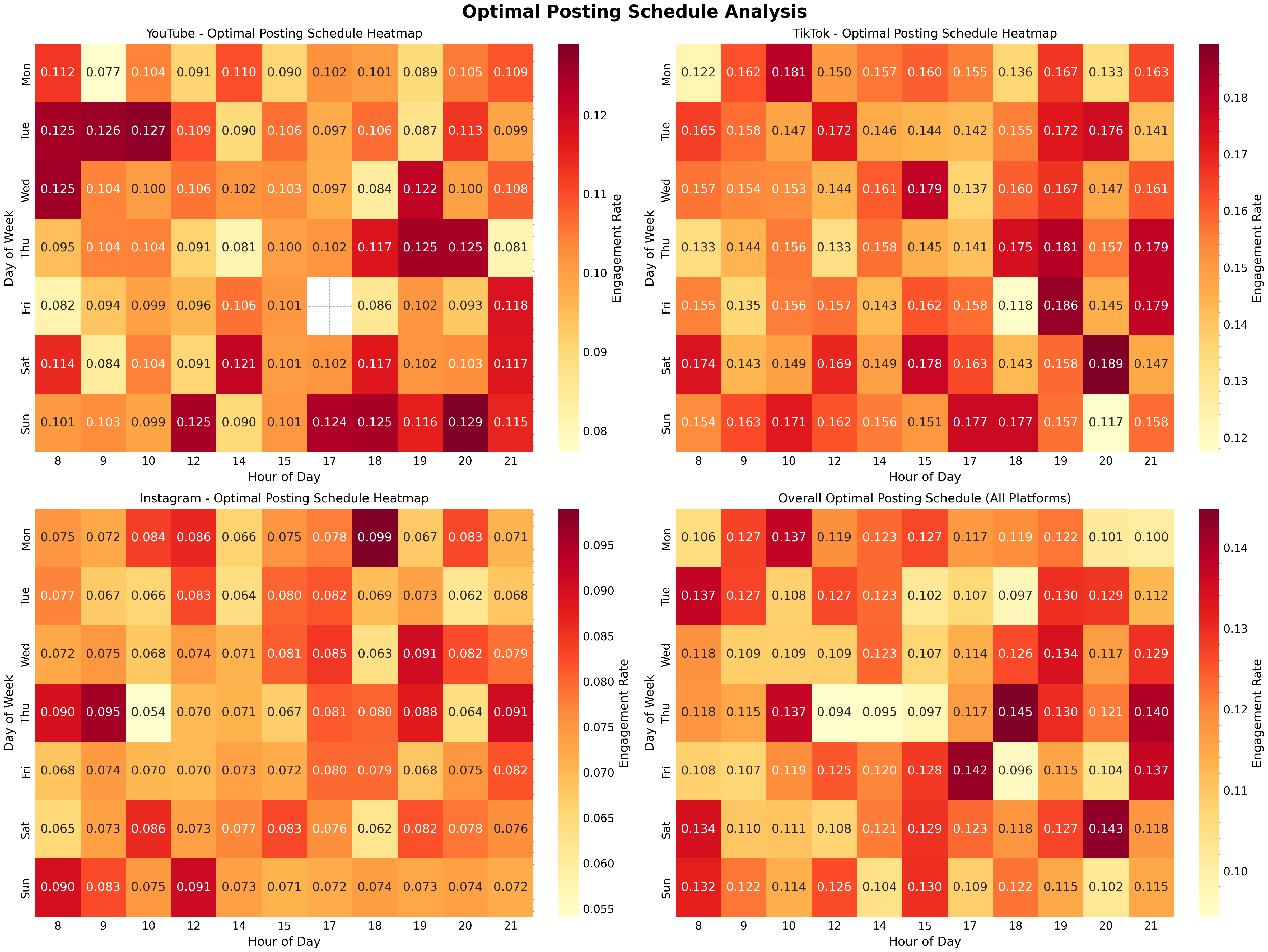

📈 Visual: Global Market Performance

Figure: Gold and oil remain in focus as political and trade risks drive volatility.

🔎 Analysis & Outlook

Key Takeaway:

Markets are steady but alert as September ends. Resilient US data and strong tech earnings support equities, but trade tensions and shutdown risk could spark volatility. Gold and oil remain the barometers for risk sentiment.

🟢 Conclusion & Recommendation

With the quarter ending and political risks in focus, stay nimble. Watch for opportunities in gold, energy, and tech, but be ready to adjust if headlines shift. “In markets, flexibility and vigilance are your best allies.”