Key Takeaway:

Global markets open with a cautiously optimistic tone: US index futures are slightly lower after a strong tech-led rally, European indices show broad gains, and commodities remain elevated. Forex markets are stable, with the dollar holding firm. Investors are watching for central bank signals and fresh economic data to set the tone for the day.

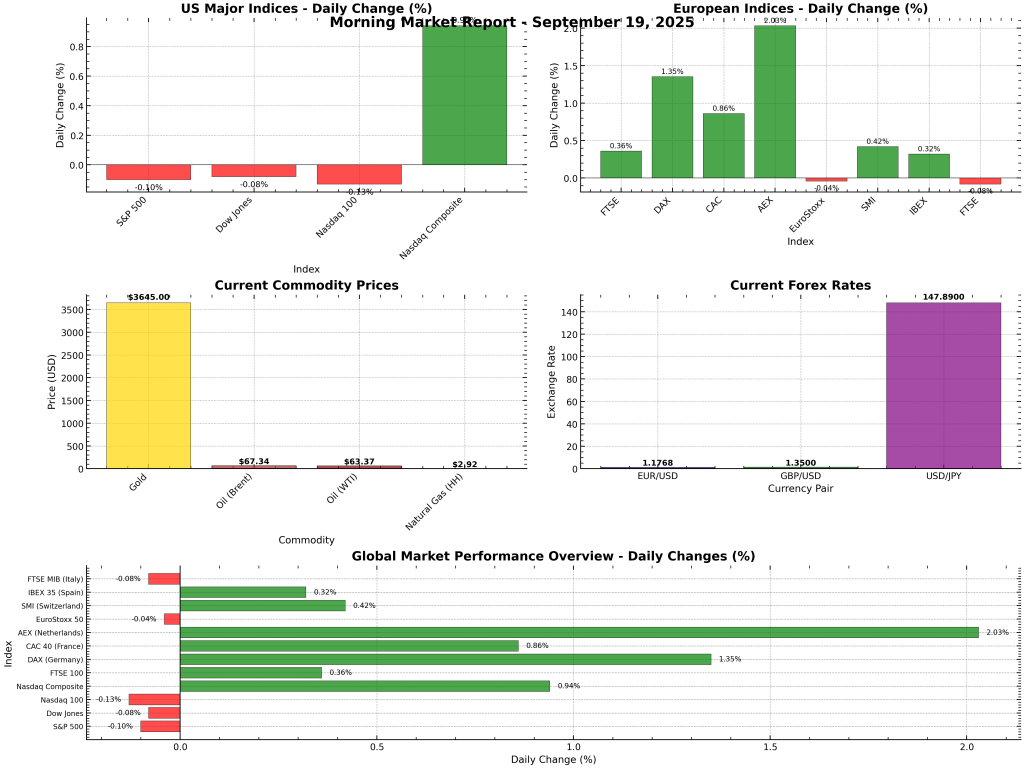

1. Global Indices: Pre-Market & Latest Performance

| Index | Latest Value | Daily Change | % Change | Status |

|---|---|---|---|---|

| S&P 500 Futures | 6,625.50 | –6.46 | –0.10% | Slightly down |

| Dow Jones Futures | 46,105.00 | –37.42 | –0.08% | Slightly down |

| Nasdaq 100 Fut. | 24,422.00 | –32.89 | –0.13% | Slightly down |

| Nasdaq Composite | 22,470.73 | +209.40 | +0.94% | Up (prev. close) |

| FTSE 100 | 9,243.00 | +33.50 | +0.36% | Up |

| DAX (Germany) | 23,674.53 | +315.35 | +1.35% | Up |

| CAC 40 (France) | 7,856.10 | +67.10 | +0.86% | Up |

| AEX (Netherlands) | 933.52 | +18.53 | +2.03% | Up |

| EuroStoxx 50 | 5,457.00 | –2.00 | –0.04% | Flat |

| IBEX 35 (Spain) | 15,175.40 | +48.20 | +0.32% | Up |

Highlight:

European indices are broadly higher, led by the AEX and DAX. US futures are modestly lower after a strong tech rally yesterday.

2. Forex Market: Major Pairs

| Pair | Latest Rate | Trend |

|---|---|---|

| EUR/USD | 1.1768 | Stable |

| GBP/USD | 1.3500 | Stable |

| USD/JPY | 147.89 | Stable |

- The US dollar remains firm, with no major overnight moves.

3. Commodities: Gold, Oil & Natural Gas

| Commodity | Latest Price | Trend/Notes |

|---|---|---|

| Gold (spot) | $3,645.00/oz | Elevated, consolidating |

| Oil (Brent) | $67.34/bbl | Slightly lower, range-bound |

| Oil (WTI) | $63.37/bbl | Slightly lower, range-bound |

| Natural Gas (HH) | $2.92/MMBtu | Stable, after recent volatility |

4. Visual Dashboard

5. Key Overnight News & Market Drivers

- Tech Rally Fades: US futures are slightly lower after a strong tech-led rally yesterday, with profit-taking in focus.

- Central Banks: The Fed, ECB, and BoE all signaled a cautious approach, with the ECB leading on rate cuts. The BoJ remains on hold but is watching inflation risks.

- Economic Data: US PPI and CPI both surprised to the downside, reinforcing expectations for gradual rate cuts. Eurozone and UK inflation remain near target, supporting a positive tone in Europe.

- Commodities: Gold holds near highs as a safe haven; oil is range-bound amid mixed supply/demand signals.

6. Market Sentiment & Outlook

| Market Segment | Avg. Daily Change | Trend/Status |

|---|---|---|

| US Indices (avg) | +0.16% | Mixed (slight positive) |

| European Indices (avg) | +0.65% | Positive |

| Forex | — | Stable |

| Commodities | — | Elevated, consolidating |

Key Takeaway:

The mood is cautiously optimistic: Europe is leading gains, US futures are consolidating, and commodities remain firm. Watch for central bank commentary and economic data to drive the next move.

Summary Box:

Markets open with a positive European lead and stable US futures. Stay tuned for central bank signals and economic data to set the tone for the day.