📊 US Weekly Jobless Claims (Sep 18, 2025): Data, Market Reactions & Strategic Implications

Key Takeaway:

US initial jobless claims fell sharply to 231,000 this week—well below expectations—signaling labor market resilience after last week’s spike. Stocks responded positively, the dollar firmed modestly, but historical analysis shows that while such surprises can move markets in the short term, their direct impact is often limited. The real driver remains the Fed’s policy outlook and broader economic trends.

1. Today’s Jobless Claims: The Numbers at a Glance

| Metric | Value (week ending Sep 13, 2025) |

|---|---|

| Initial Jobless Claims | 231,000 |

| Change from Previous Week | –33,000 |

| Previous Week (Revised) | 264,000 |

| Market Forecast | 241,000 |

| 4-Week Moving Average | 240,000 |

| Continuing Claims | 1.92 million |

- Interpretation:

This week’s figure is a sharp drop from last week’s four-year high, and well below consensus. The labor market appears to have stabilized, with the spike likely an anomaly rather than a new trend .

2. Market Reactions: Stocks & Forex

📈 Stock Markets

- S&P 500: +0.4%

- Nasdaq: +0.8%

- Dow Jones: –0.1%

Analysis:

The better-than-expected claims number reassured investors, supporting risk appetite and helping the S&P 500 notch another record high. Cyclical sectors (industrials, consumer discretionary) outperformed, as the data reduced fears of an imminent recession and reinforced hopes for a “soft landing” .

💱 Forex Markets

- US Dollar Index (DXY): Modest strengthening

- EUR/USD, USD/JPY: Dollar gained slightly against major peers

Analysis:

The USD firmed on the news, as the data suggested the US economy remains robust. However, the move was limited—markets are still focused on the Fed’s dovish tilt and the likelihood of further rate cuts, which could cap the dollar’s upside .

3. Historical & Quantitative Context

- Last week’s spike (264,000) was the highest since 2021, but this week’s drop to 231,000 brings claims back to the post-pandemic norm (200,000–250,000).

- The 4-week average (240,000) is stable, indicating no sustained deterioration.

- Historically, claims above 400,000 signal recession risk; current levels are far from that threshold .

4. Expert & Quantitative Insights

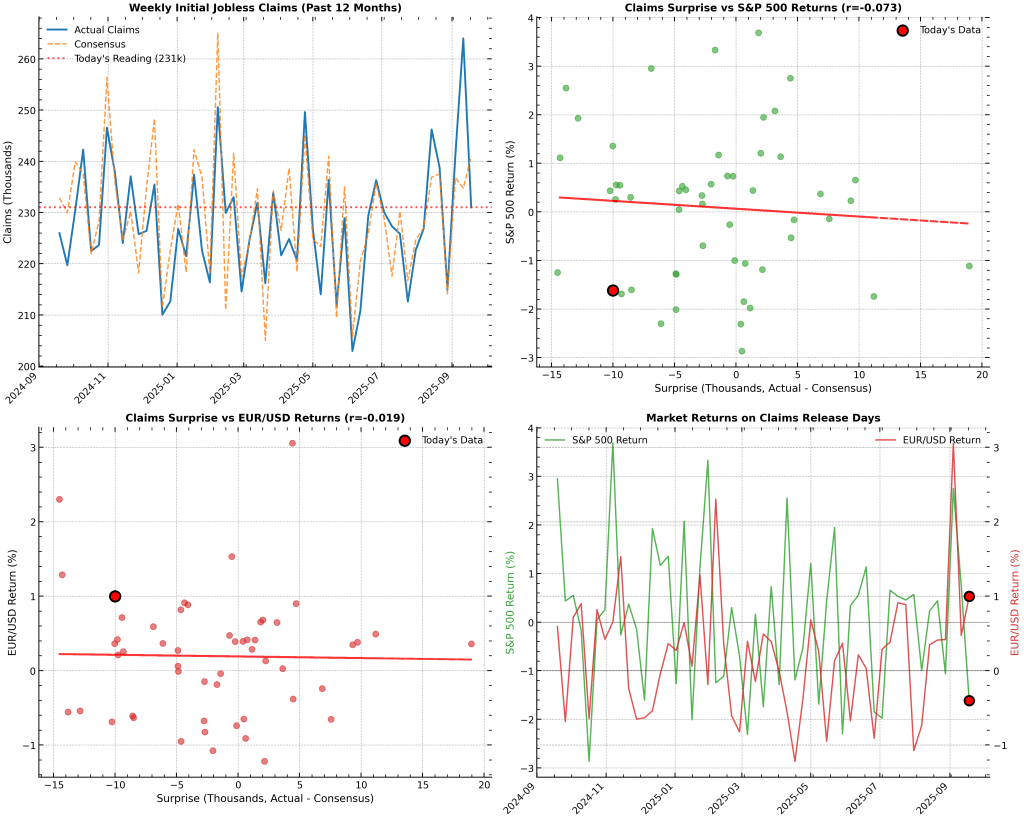

📉 Correlation Analysis (Past 12 Months)

- Jobless Claims Surprise vs. S&P 500 Return:

Correlation: –0.07 (not statistically significant) - Jobless Claims Surprise vs. EUR/USD Return:

Correlation: –0.02 (not statistically significant)

Key Finding:

While big surprises in claims can trigger short-term moves, over the past year, their direct impact on stocks and forex has been weak. Broader macro trends and Fed policy dominate market direction.

5. Visual Dashboard

Figure: Jobless Claims, Market Surprises, and S&P 500/EUR-USD Reactions (Sep 2024–Sep 2025)

6. Strategic Implications for Investors

📈 For Stock Markets

- Short-term:

Positive surprise supports equities, especially cyclicals, as it reduces immediate recession fears and aligns with Fed easing expectations. - Medium-term:

The labor market remains “soft but not collapsing.” Sustained improvement in claims could delay further Fed cuts, while renewed weakness would likely accelerate them. - Tactical:

Use claims data as a sentiment gauge, but don’t overreact—market moves are more sensitive to Fed guidance and broader economic signals.

💱 For Forex Markets

- Short-term:

USD gains on positive labor data, but upside is capped by dovish Fed outlook. - Medium-term:

Expect the dollar to weaken if the Fed continues to cut rates and global growth stabilizes. Non-USD assets may benefit as rate differentials narrow.

Key Takeaway:

Today’s jobless claims drop is a relief for markets, but not a game-changer. For stocks, it supports the “soft landing” narrative and cyclical outperformance. For forex, it gives the dollar a short-lived boost, but the Fed’s dovish stance remains the main story. Stay focused on the bigger macro picture and Fed policy signals.