In the fast-evolving world of digital finance, central bank digital currencies (CBDCs) like a potential US digital dollar or EU digital euro aren’t just about modernizing payments – they’re poised to reshape how governments handle debt. This isn’t some abstract theory; it’s grounded in ongoing policy debates and tech innovations.

Drawing from congressional hearings, ECB preparations, and economic analyses, this piece dives into the debt financing angle of CBDCs, weighing the upsides for governments (think lower interest costs) against the downsides for everyday people (like eroded privacy and financial freedom).

Along the way, I’ll challenge some overly pessimistic takes and float a fresh framework that could spark real breakthroughs in economic thinking.

The Debt Financing Element: Breaking It Down

Let’s start with the basics. The «debt financing element» here means how CBDCs could transform government borrowing – not by directly printing money to cover deficits, but by enabling smarter, more efficient debt issuance and management.

Neither the US nor the EU has rolled out a full CBDC yet, but the groundwork is telling. The ECB’s digital euro project, in prep mode since late 2023, is pitched as a retail tool for everyday payments, but it opens doors to wholesale uses like tokenized bonds on distributed ledger technology (DLT) . This could let governments issue digital securities directly, cutting out middlemen and boosting market liquidity.

Over in the US, a 2023 congressional hearing made it clear the Fed needs explicit legislation to move forward, framing a digital dollar more as a payment upgrade than a debt tool . Still, ideas like tokenized Treasuries could indirectly streamline borrowing, with Fed studies hinting at preserving the dollar’s global role without shaking up existing markets.

What This Means for Governments: The Appeal of Lower Interest Burdens

For governments, the real draw is efficiency. Imagine issuing bonds via blockchain – it could slash transaction costs and attract a broader pool of investors, potentially dropping interest rates by 10-20% through streamlined processes and AI-driven auctions.

The digital euro is seen as a «strategic safeguard» for Europe, helping maintain monetary autonomy in a cashless future and reducing reliance on foreign systems like the USD . This ties into debt financing by making euro-denominated reserves more appealing, which could lower borrowing costs on international markets.

In the US, while the Fed’s cautious (no go without Congress’s nod ), a CBDC could modernize payments through systems like FedNow, indirectly supporting Treasury efficiency without messing with banks’ roles.

Bottom line: less interest paid on debt means more fiscal breathing room for things like infrastructure or social programs. It’s a win for state resilience in an uncertain world.

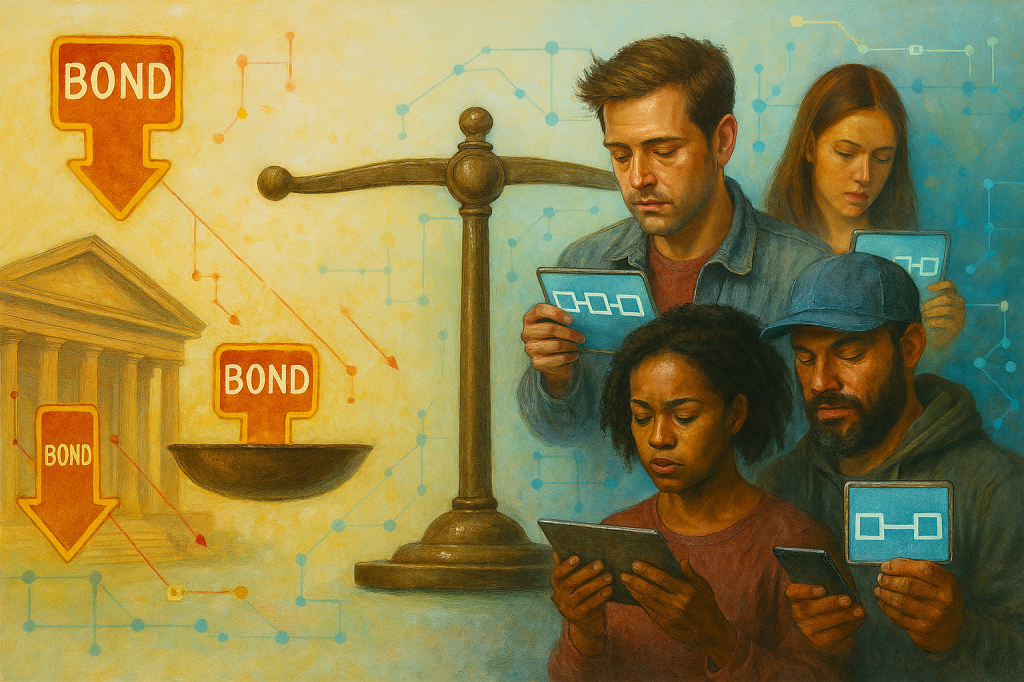

The Flip Side: Risks to the Public’s Financial Independence and Privacy

But here’s where it gets thorny – for ordinary folks, CBDCs could mean a serious hit to personal freedoms. A fully digital currency on a central ledger would track every transaction, ditching the anonymity of cash and opening the door to surveillance. Programmable features (like money that expires or has spending limits) might sound efficient, but they could strip away financial independence, turning your wallet into a tool for control .

The ECB is trying to mitigate this with caps on holdings (€3,000-€4,000) and promises of cash coexistence, but critics point to risks of data breaches or overreach, especially in crises.

In the US, hearing witnesses warned of a «digital dollar dilemma» where privacy evaporates, potentially leading to government monitoring that erodes trust . It’s not just about convenience; it’s a shift toward a system where financial privacy feels like a relic.

A Balanced Take: Opportunity Over Overreach

Not everyone sees this as all doom and gloom, though. While the risks are legit, they’re not set in stone. Designs like the digital euro’s non-interest-bearing structure aim to avoid disrupting banks or becoming a surveillance nightmare, and US discussions emphasize private-sector alternatives like stablecoins for faster innovation without central control .

CBDCs could actually boost inclusion for the unbanked, offering low-cost, instant payments that enhance – not erase – independence.

The key is smart regulation: privacy tech like zero-knowledge proofs could keep transactions anonymous while letting governments reap debt efficiencies.

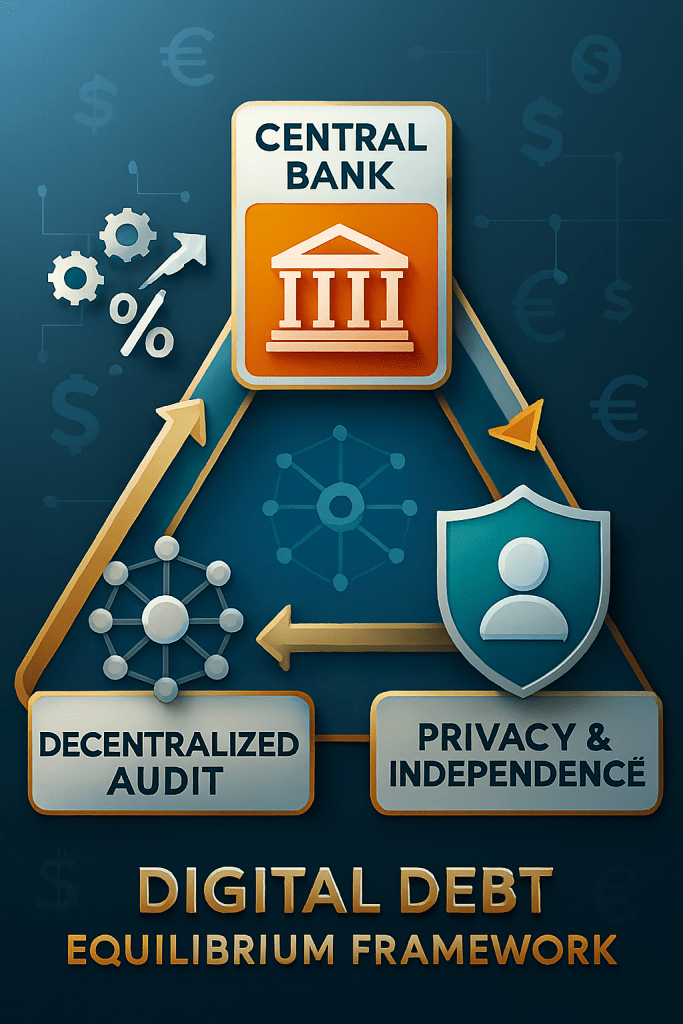

To take this further, consider a new idea: the Digital Debt Equilibrium Framework (DDEF). This would treat CBDCs as a balanced ecosystem with three pillars – government efficiency (e.g., tokenized bonds for lower interest costs), public privacy options (opt-in anonymity layers), and decentralized checks (blockchain audits to curb abuse). It’s inspired by game theory, aiming to harmonize fiscal gains with individual rights, much like how past economic models reshaped policy. If fleshed out, it could redefine monetary sovereignty in the digital age, maybe even earning recognition for advancing equitable finance.

In the end, CBDCs like the digital dollar or euro aren’t inherently good or bad – they’re tools shaped by choices. Governments stand to gain from leaner debt financing, but only if we safeguard public freedoms. This equilibrium approach could be the way forward, turning potential perils into progress.