Key Takeaway:

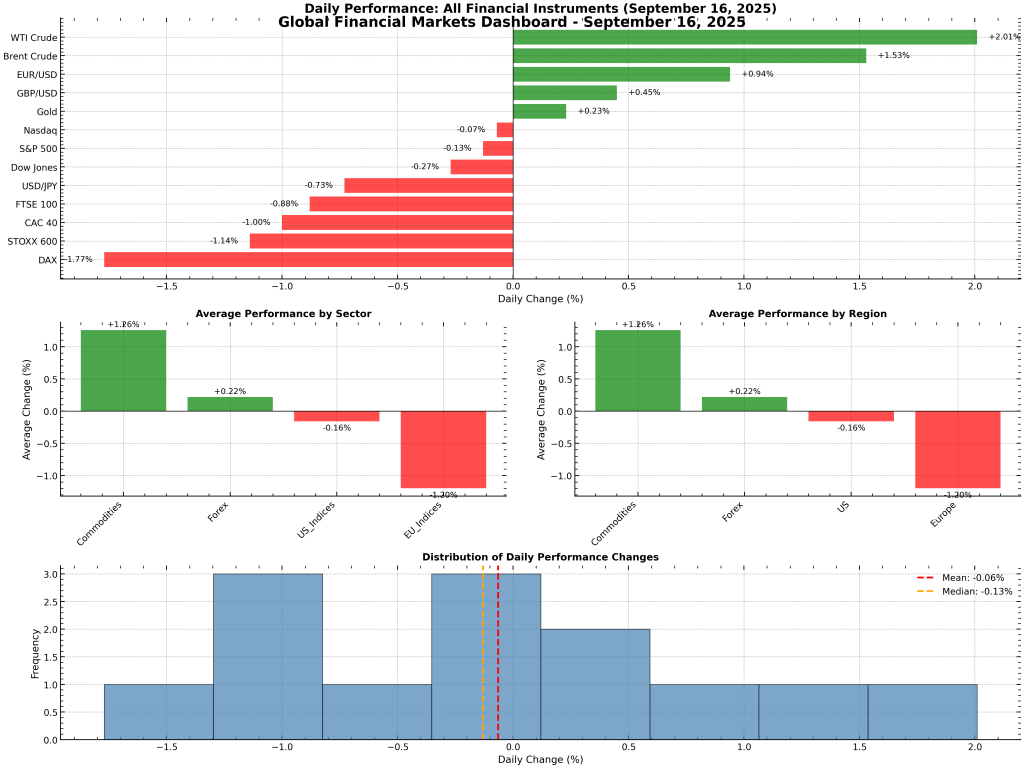

Commodities surged (oil and gold at highs), the US dollar weakened, and European equities led global declines as markets braced for major central bank decisions.

Executive Summary

Today’s global markets reflected a classic “risk-off” mood, with investors positioning ahead of pivotal central bank meetings. Commodities—especially oil—outperformed, while European stock indices saw the steepest declines. The US dollar weakened, boosting the euro and pound, and gold hit new record highs on safe-haven demand.

1. Major Indices: US & Europe

| Index | Closing Value | Daily Change (%) | Trend |

|---|---|---|---|

| S&P 500 | 6,615.28 | -0.13% | ▼ Slightly down |

| Dow Jones | 45,883.45 | -0.27% | ▼ Down |

| Nasdaq | 22,348.75 | -0.07% | ▼ Flat |

| FTSE 100 | 9,195.66 | -0.88% | ▼ Down |

| DAX | 23,329.24 | -1.77% | ▼ Sharply down |

| CAC 40 | 7,818.22 | -1.00% | ▼ Down |

| STOXX 600 | 550.79 | -1.14% | ▼ Down |

Key Finding:

European indices underperformed, with the DAX (-1.77%) and STOXX 600 (-1.14%) leading declines. US indices were more resilient but still closed slightly lower.

2. Forex: Major Pairs

| Pair | Latest Rate | Daily Change (%) | Direction |

|---|---|---|---|

| EUR/USD | 1.1871 | +0.94% | ▲ Up |

| GBP/USD | 1.3660 | +0.45% | ▲ Up |

| USD/JPY | 146.33 | -0.73% | ▼ Down |

- The US dollar weakened notably, with the euro and pound both gaining ground.

- The yen strengthened against the dollar, reflecting risk aversion and anticipation of US rate cuts.

3. Commodities: Gold & Oil

| Asset | Price | Daily Change (%) | Trend |

|---|---|---|---|

| Gold | $3,687.92/oz | +0.23% | ▲ Record high |

| Brent Oil | $68.50/bbl | +1.53% | ▲ Strong |

| WTI Oil | $64.56/bbl | +2.01% | ▲ Strongest |

- Gold hit a new all-time high, driven by safe-haven flows and expectations of a US Fed rate cut.

- Oil prices surged on supply risks from Russia and OPEC+ production talks.

4. Sector & Regional Performance

| Sector | Avg. Change (%) | Best Performer | Worst Performer |

|---|---|---|---|

| Commodities | +1.26% | WTI Crude | Gold |

| Forex | +0.22% | EUR/USD | USD/JPY |

| US Indices | -0.16% | Nasdaq | Dow Jones |

| EU Indices | -1.20% | FTSE 100 | DAX |

- Commodities led global gains, while European equities were the weakest sector.

5. Visual Dashboard

6. Key Market Drivers

- Central Bank Anticipation:

Markets are bracing for the US Federal Reserve’s policy meeting (expected rate cut), with the Bank of England and Bank of Japan also in focus this week. This has driven risk-off sentiment in equities and a weaker US dollar . - Commodities Rally:

Oil prices jumped on renewed supply risks from Russia and OPEC+ discussions, while gold soared to record highs on safe-haven demand and falling US yields . - European Weakness:

European stocks fell sharply as investors grew cautious ahead of central bank decisions and digested mixed economic data, including UK labor figures and a Fitch downgrade for France . - Forex Movements:

The US dollar’s decline reflects market expectations for imminent Fed easing, boosting the euro and pound to multi-month highs .

7. Detailed Sector Breakdown

US Indices:

All major indices closed slightly lower, with the Nasdaq the most resilient (-0.07%).European Indices:

All major indices declined, led by the DAX (-1.77%) and STOXX 600 (-1.14%).Forex:

EUR/USD and GBP/USD both gained, while USD/JPY fell.Commodities:

WTI Crude (+2.01%) and Brent (+1.53%) were the day’s top performers; gold also advanced.

8. Conclusion & Outlook

Summary Box:

- Commodities outperformed on supply risks and safe-haven demand.

- European equities lagged amid central bank uncertainty.

- US indices held up better but still closed in the red.

- The US dollar weakened, supporting gold and major forex pairs.

- Market sentiment: Risk-off, with focus on upcoming Fed and BoE decisions.