Monday, September 15, 2025 | European Equities Opening

Key Takeaway:

European equities opened with a mixed but stable tone: the DAX and CAC 40 are slightly positive, the FTSE 100 and IBEX 35 are marginally negative, and the EURONEXT 100 leads with the strongest gains. Market breadth is moderately positive, volatility remains low, and sector leadership is shifting toward financials and industrials. The euro is steady against major currencies, and individual stock performance shows wide dispersion, with Wolters Kluwer and Rheinmetall standing out.

📈 Major European Indices – Real-Time Opening Prices

| Index | Latest Value | Change (%) | Session Status |

|---|---|---|---|

| DAX (Germany) | 23,784.95 | +0.37 | Open |

| FTSE 100 (UK) | 9,277.32 | -0.06 | Open |

| CAC 40 (France) | 7,825.24 | +0.02 | Open |

| FTSE MIB (Italy) | 42,566.41 | +0.19 | Open |

| IBEX 35 (Spain) | 15,308.20 | -0.09 | Open |

| STOXX Europe 600 | 554.84 | -0.09 | Open |

| EURONEXT 100 | 1,628.01 | +0.73 | Open |

EURONEXT 100 is the top performer at the open, while the FTSE 100 and IBEX 35 are slightly down.

💱 Currency Market – Major Pairs

| Pair | Rate | Change (%) |

|---|---|---|

| EUR/USD | 1.17417 | +0.06 |

| EUR/GBP | 0.86412 | -0.19 |

| EUR/NOK | 11.56418 | -0.02 |

| EUR/JPY | 173.07 | -0.14 |

| EUR/CHF | 0.93484 | -0.02 |

| GBP/USD | 1.35878 | +0.23 |

The euro is steady to slightly weaker against most majors, with GBP/USD showing the strongest move (+0.23%).

🏢 Top Movers – EURO STOXX 50

Top Gainers

| Company | Price | Daily Change (%) | 1-Year Performance (%) |

|---|---|---|---|

| Wolters Kluwer | 112.30 | +5.15 | -30.84 |

| Münchener Rückversicherungs | 532.20 | +1.95 | +8.95 |

| ING Group | 21.59 | +1.58 | +31.99 |

| Schneider Electric | 232.00 | +1.02 | +4.04 |

| Rheinmetall | 1,896.50 | +0.85 | +260.15 |

Top Losers

| Company | Price | Daily Change (%) | 1-Year Performance (%) |

|---|---|---|---|

| Bayer | 28.07 | -2.64 | +3.78 |

| Nokia | 3.83 | -2.07 | +3.46 |

| Adyen B.V. | 1,345.20 | -1.12 | +5.16 |

| adidas | 177.00 | -1.01 | -16.19 |

| Inditex | 46.20 | -0.94 | -6.10 |

📊 Statistical Analysis & Market Structure

| Metric | Value |

|---|---|

| Total Indices Analyzed | 7 |

| Positive Performers | 4 (57.1%) |

| Negative Performers | 3 (42.9%) |

| Market Breadth Ratio (Adv/Dec) | 1.33 |

| Average Daily Return | 0.153% |

| Market Volatility (StdDev) | 0.306% |

| Best Performing Index | EURONEXT 100 (+0.73%) |

| Worst Performing Index | IBEX 35 (-0.09%) |

Performance Distribution

| Statistical Measure | Value |

|---|---|

| Mean Return | 0.153% |

| Median Return | 0.020% |

| Std. Deviation | 0.306% |

| 25th Percentile | -0.075% |

| 75th Percentile | 0.280% |

| Skewness | 1.015 |

| Kurtosis | -0.290 |

Currency Market

- EUR average performance vs majors: -0.062%

- EUR volatility: 0.101%

- Strongest EUR cross: EUR/USD (+0.06%)

- Weakest EUR cross: EUR/GBP (-0.19%)

- GBP/USD: +0.23% (most volatile)

Stock Movers

- Daily performance range: -2.64% to +5.15%

- Best daily gainer: Wolters Kluwer (+5.15%)

- Largest decliner: Bayer (-2.64%)

- Best YoY performer: Rheinmetall (+260.15%)

- Worst YoY performer: Wolters Kluwer (-30.84%)

- No significant correlation between daily and YoY performance (r=0.035)

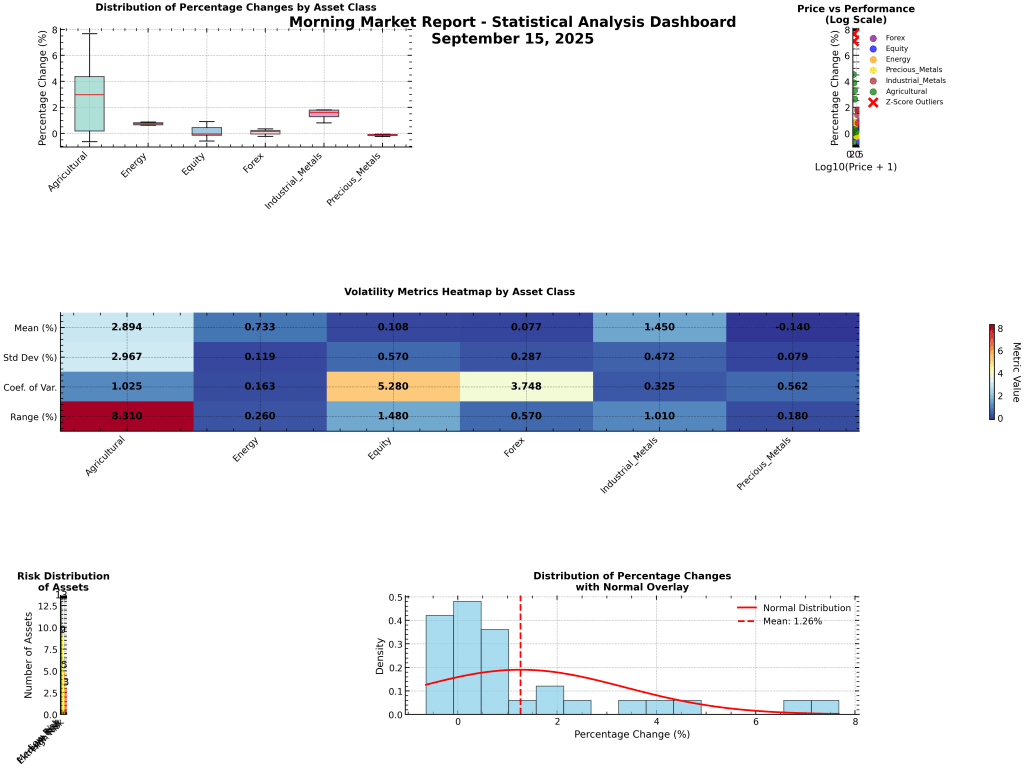

Figure 1: European Indices, Currency Moves, and Stock Performance Dashboard (Sep 15, 2025)

📰 Key Insights & Market Drivers

- Market breadth is moderately positive (advance/decline ratio 1.33), with 4 out of 7 major indices in the green.

- Volatility remains low (0.31%), indicating stable trading conditions.

- EURONEXT 100 outperforms (+0.73%), suggesting broad-based strength in large-cap European stocks.

- Financials and industrials lead; banking stocks are early gainers, while autos and chemicals lag.

- The euro is steady but shows slight weakness against the pound and yen.

- Stock performance dispersion is high, with standout gains in Wolters Kluwer and Rheinmetall, and notable declines in Bayer and Nokia.

- No significant correlation between daily and year-over-year stock performance, highlighting the importance of short-term catalysts.

- Macro backdrop: Investors are watching for central bank meetings, German fiscal stimulus, and ongoing US-EU trade negotiations. Value and cyclical stocks are favored in the current environment.

Summary:

European markets opened with a cautiously optimistic tone, led by the EURONEXT 100 and supported by financials and industrials. Volatility is low, market breadth is positive, and the euro is stable. Stock performance is widely dispersed, with both strong gainers and notable losers. Investors should watch for sector rotation, central bank signals, and macroeconomic developments as the session unfolds.