Key Takeaway:

Global markets are starting the day on a bullish note, with US and Asian indices at record highs, commodities showing mixed momentum, and the US dollar slightly weaker. Wheat stands out as the day’s top outlier with a double-digit surge, while oil prices are under mild pressure. Volatility is moderate, and investor sentiment is buoyed by expectations of imminent Fed rate cuts and strong tech sector performance.

📈 Major Indices – Real-Time Snapshot

| Index | Latest Value | Daily Change (%) |

|---|---|---|

| S&P 500 | 6,587.47 | +0.85 |

| Dow Jones | 46,108.00 | +1.36 |

| Nasdaq Comp. | 22,043.07 | +0.72 |

| FTSE 100 | 9,297.58 | +0.78 |

| Nikkei 225 | 44,768.12 | +0.89 |

Highlight: US indices are at all-time highs, led by the Dow Jones and S&P 500, reflecting optimism over Fed policy and tech sector strength.

💱 Forex Market – Major Pairs

| Pair | Rate | Daily Change (%) |

|---|---|---|

| EUR/USD | 1.1727 | -0.11 |

| GBP/USD | 1.3554 | -0.15 |

| USD/JPY | 147.53 | +0.26 |

Insight: The US dollar is slightly weaker against the euro and pound, but firmer versus the yen. Forex volatility remains low.

🏗️ Commodities – Real-Time Prices

| Commodity | Price | Change (%) | Note |

|---|---|---|---|

| Oil (Brent) | $65.76/barrel | -0.83 | Mild pullback |

| Oil (WTI) | $61.83/barrel | -0.66 | |

| Gold | $3,649.93/oz | +0.44 | Near record highs |

| Silver | $42.08/oz | +1.20 | |

| Copper | $9,926.20/ton | +0.81 | |

| Wheat | €189.50/ton | +11.14 | 🚨 Outlier! |

| Corn | $3.97/bushel | -0.44 |

Key Outlier: Wheat surges +11.14%, the day’s biggest mover across all asset classes.

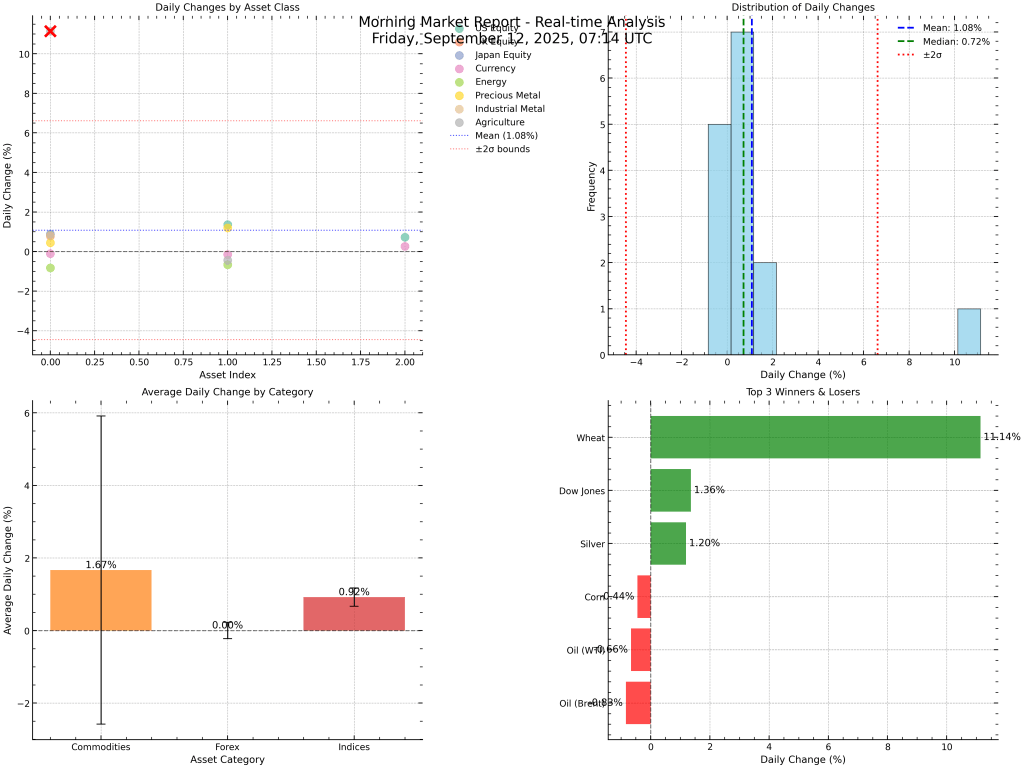

🚨 Outlier & Volatility Analysis

- Wheat is the clear outlier (+11.14%, Z-score 3.64), likely driven by supply shocks or geopolitical news.

- Oil is the weakest performer (-0.83% for Brent).

- Market Risk: Moderate (StdDev: 2.76%). Commodities are the most volatile category today.

📊 Performance by Asset Category

| Category | Mean % | Median % | StdDev % | Best Performer | Worst Performer |

|---|---|---|---|---|---|

| Commodities | 1.67 | 0.44 | 4.25 | Wheat (+11.14%) | Oil (Brent) (-0.83%) |

| Forex | 0.00 | -0.11 | 0.23 | USD/JPY (+0.26%) | GBP/USD (-0.15%) |

| Indices | 0.92 | 0.85 | 0.25 | Dow Jones (+1.36%) | Nasdaq (+0.72%) |

Figure: Real-time daily changes, outliers, and category performance across global markets.

📰 Overnight News & Market Drivers

- US Indices at Record Highs: Driven by Fed rate cut optimism and a tech rally, especially in AI/cloud stocks.

- Fed Rate Cut Hopes: Weak jobless claims and cooling labor market fuel expectations for monetary easing.

- AI/Tech Boom: Oracle, Nvidia, and other AI-exposed stocks lead gains.

- Commodities: Gold near all-time highs; oil up over the week but down today; wheat spikes on supply concerns.

- No Major Earnings: Today’s corporate calendar is quiet, with only small-cap reports.

🔮 Market Outlook & Strategy

- Sentiment: Bullish, but with moderate risk due to commodity volatility.

- Watchlist: Monitor wheat for further volatility, and oil for potential reversal.

- Key Levels:

- S&P 500: 6,600 resistance

- EUR/USD: 1.1700 support

- Gold: $3,700/oz resistance

Key Takeaway:

Markets are in a risk-on mode, but commodity volatility (especially wheat) warrants close attention. Stay alert for Fed commentary and global macro headlines.

Summary Box:

The global market opens strong, led by US and Asian equities at record highs, a slightly weaker dollar, and a standout surge in wheat prices. With moderate risk and bullish sentiment, today’s focus is on commodity volatility and central bank signals. Adjust portfolios accordingly and watch for breakout opportunities.