Key Takeaway:

The real-time EUR/USD rate is 1.1721, reflecting a bullish move after weak US jobs data. The US Dollar is broadly weaker across major pairs, with EUR/USD leading gains. Below is a full update of the latest FX rates, percentage changes, and market context.

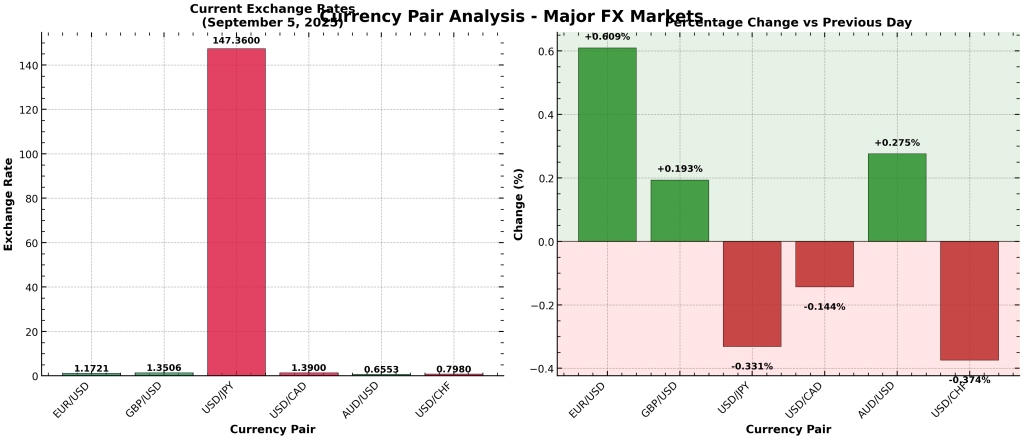

📊 Latest Major Currency Exchange Rates & Daily Changes

| Pair | Current Rate | Previous Rate | Change | % Change | Trend |

|---|---|---|---|---|---|

| EUR/USD | 1.1721 | 1.1650 | +0.0071 | +0.61% | ▲ Bullish |

| GBP/USD | 1.3506 | 1.3480 | +0.0026 | +0.19% | ▲ Bullish |

| USD/JPY | 147.36 | 147.85 | -0.49 | -0.33% | ▼ Bearish |

| USD/CAD | 1.3900 | 1.3920 | -0.0020 | -0.14% | ▼ Bearish |

| AUD/USD | 0.6553 | 0.6535 | +0.0018 | +0.28% | ▲ Bullish |

| USD/CHF | 0.7980 | 0.8010 | -0.0030 | -0.37% | ▼ Bearish |

EUR/USD is the biggest gainer today, up +0.61%—a clear sign of USD weakness following the disappointing US Nonfarm Payrolls report .

📈 Visual: FX Market Moves

📰 Market Context & Drivers

- EUR/USD Update:

- Real-time rate: 1.1721

- Daily change: +0.61% (from 1.1650)

- Status: Bullish, trading at a five-week high

- Key Drivers:

- US Dollar Weakness: The USD sold off sharply after US jobs data showed only 22,000 jobs added in August, well below expectations .

- Fed Rate Cut Bets: Markets are now nearly fully pricing in a 25bp Fed rate cut in September, with a 55% chance of another in October .

- Technical Momentum: EUR/USD is above all key moving averages, with short-term momentum favoring further gains .

- Other Majors:

- GBP/USD and AUD/USD also gained, reflecting broad-based USD weakness.

- USD/JPY and USD/CHF declined, as safe-haven flows and policy normalization in Japan support the yen and Swiss franc.

🔎 Summary Table: FX Market Highlights

| Biggest Gainer | % Change | Biggest Decliner | % Change |

|---|---|---|---|

| EUR/USD | +0.61% | USD/CHF | -0.37% |

Market Sentiment:

The US Dollar is under pressure across the board, with EUR/USD leading the advance. This aligns with the latest macro data and dovish Fed expectations.