Key Takeaway:

U.S. inflation, as measured by the PCE index, remains stubbornly above the Federal Reserve’s 2% target. While the numbers aren’t running away, they’re not falling fast enough to give the Fed a clear green light for aggressive rate cuts. Investors and policymakers are now walking a tightrope—balancing persistent price pressures with signs of a cooling job market.

What’s Happening With Inflation?

The latest PCE inflation data shows prices rising at an annual rate of about 2.7% to 2.8%—a touch higher than the Fed would like, but a far cry from the runaway inflation of 2021 and 2022. Core PCE, which strips out food and energy, is even stickier at around 2.9%. This is the third month in a row that core inflation has ticked up, suggesting that while the worst is behind us, the “last mile” of getting inflation back to 2% is proving tough.

“There is nothing in today’s inflation report to stop the Fed from delivering a rate cut at the September meeting,” said Christopher Rupkey, chief economist at FWDBONDS, after the July numbers landed .

Why Is Inflation So Stubborn?

A big part of the story is services and shelter costs—think rent, insurance, and healthcare. These prices tend to move slowly and are less sensitive to interest rate hikes. On top of that, new tariffs introduced this year have nudged prices higher, with most economists estimating they’ve added about half a percentage point to inflation .

Fed Chair Jerome Powell recently acknowledged, “Near term risks to inflation are tilted to the upside,” but he also flagged that the job market is showing signs of strain. If unemployment starts to rise, the Fed may have to act quickly to support the economy—even if inflation is still above target .

How Are Markets Reacting?

Interestingly, Wall Street isn’t panicking. The S&P 500 and Dow Jones are at record highs, and the market is betting—by a wide margin—on a rate cut at the Fed’s September meeting. In fact, the odds of a cut have jumped to over 80% after the latest inflation and jobs data.

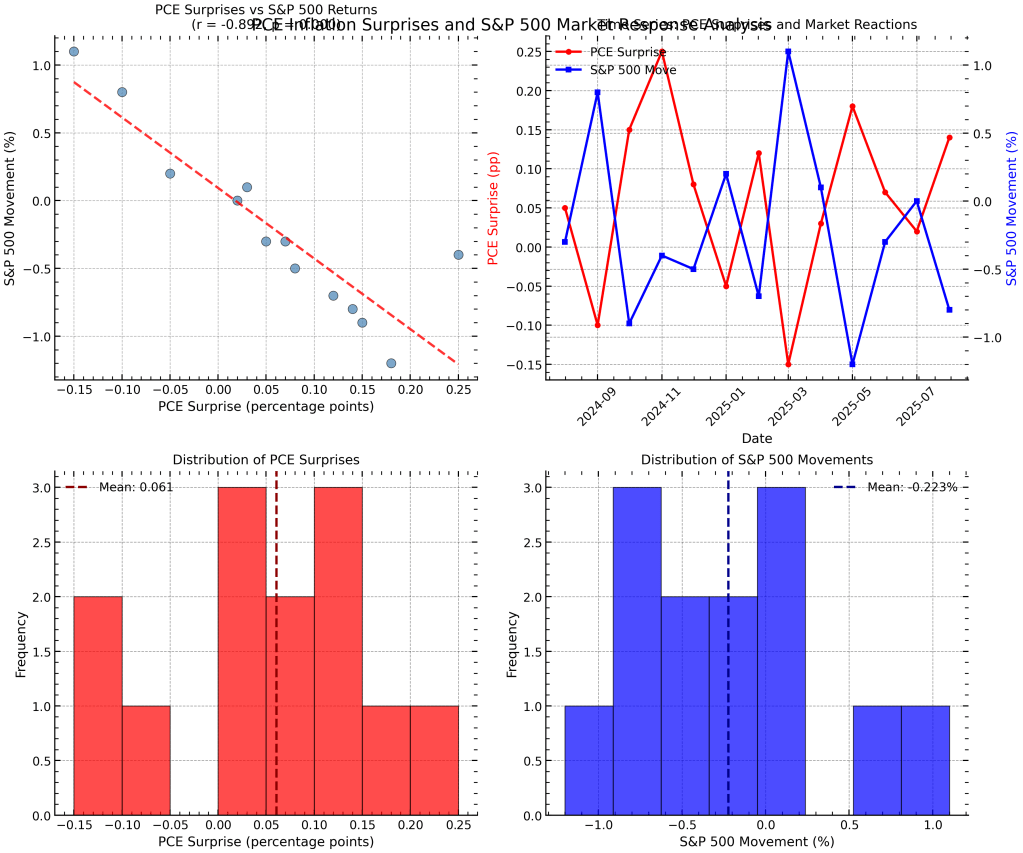

But there’s a twist: when inflation surprises to the upside, stocks tend to dip. Our analysis of the past year shows a strong negative correlation between unexpected inflation readings and S&P 500 performance. In other words, when inflation comes in hotter than expected, the market usually sells off—though the moves have become more muted as investors grow confident in the Fed’s playbook.

What’s the Fed Likely to Do Next?

Most economists agree: the Fed is stuck between a rock and a hard place. Inflation is still too high for comfort, but the job market is showing cracks. The consensus is that the Fed will cut rates soon—possibly as early as September—but will move cautiously. As Bret Kenwell at eToro US put it, “It may be hard for them to move as quickly or aggressively as they’d like with inflation moving higher” .

The Big Picture: Lessons From History

If this all feels familiar, it’s because we’ve seen similar transitions before. After World War II and the COVID-19 pandemic, inflation spiked as pent-up demand met supply shortages. In both cases, it took time—and sometimes a recession—for prices to settle down. The difference now is that the Fed is trying to thread the needle: cool inflation without derailing the recovery.

Bottom Line:

Inflation is cooling, but not fast enough for the Fed to relax. Markets are betting on a rate cut, but the path forward is anything but certain. For investors and households alike, the message is clear: stay nimble, watch the data, and expect a few more twists before the inflation story is over.

What’s your take? Are you seeing price pressures in your own life, or do you think the worst is behind us? Share your thoughts below or join the conversation on social media!