Key Takeaway:

Global markets ended the week on a defensive note: European indices closed lower amid economic and political headwinds, US stocks are trading in the red, and risk-off sentiment is visible across asset classes. Persistent inflation, central bank uncertainty, and geopolitical tensions are driving today’s moves.

🇪🇺 European Markets – Closing Prices

| Index | Closing Price | Daily Change (%) | Status |

|---|---|---|---|

| DAX | 23,919.73 | -0.85% | Closed |

| FTSE 100 | 9,187.34 | -1.20% | Closed |

| CAC 40 | 7,762.60 | -0.65% | Closed |

| STOXX 600 | 551.19 | -0.75% | Closed |

Summary: All major European indices closed lower, with the FTSE 100 underperforming due to UK bank tax rumors and the DAX pressured by weak German economic data.

🇺🇸 US Markets – Real-Time Quotes

| Index | Current Price | Daily Change (%) | Status |

|---|---|---|---|

| S&P 500 | 6,455.24 | -0.72% | Trading |

| Dow Jones | 45,451.41 | -0.41% | Trading |

| Nasdaq | 21,460.79 | -1.13% | Trading |

Summary: US indices are trading lower, with the tech-heavy Nasdaq leading declines as investors react to sticky inflation and shifting Fed expectations.

💱 Forex Market – Latest Rates

| Pair | Rate | Daily Change (%) |

|---|---|---|

| EUR/USD | 1.1698 | -0.20% |

| GBP/USD | 1.3504 | -0.35% |

| USD/JPY | 146.82 | +0.15% |

Summary: The US dollar is mixed; it’s weaker against the yen but firmer versus the euro and pound, reflecting global risk aversion and central bank policy divergence.

💰 Commodities – Gold & Oil

| Commodity | Price (USD) | Daily Change (%) |

|---|---|---|

| WTI Crude Oil | 64.14 | -0.30% |

| Brent Crude Oil | 68.12 | -0.25% |

| Gold (Spot, oz) | 3,447.70 | +0.15% |

Summary: Oil prices slipped on demand concerns and geopolitical risks, while gold edged higher as investors sought safe havens.

📰 News Impacting Market Behavior

- US Inflation & Fed Policy: The US PCE core inflation rate held at 2.9%, above the Fed’s 2% target. This has dampened hopes for aggressive rate cuts, weighing on equities and boosting gold.

- Europe’s Economic Woes: German unemployment topped 3 million and inflation rose to 2.2%, reducing the likelihood of further ECB easing. Political uncertainty in France and the UK (where rumors of a windfall tax hit bank stocks) added to the negative tone.

- Geopolitical Tensions: Ongoing conflicts in Ukraine and Gaza have increased risk aversion, leading to a flight from equities to safer assets like gold.

- Sector Moves: UK banks and European financials were hit hardest, while US tech stocks underperformed after recent rallies and profit-taking.

- Commodities & Currencies: Oil fell on demand worries, while the US dollar’s mixed performance reflected shifting rate expectations and global uncertainty.

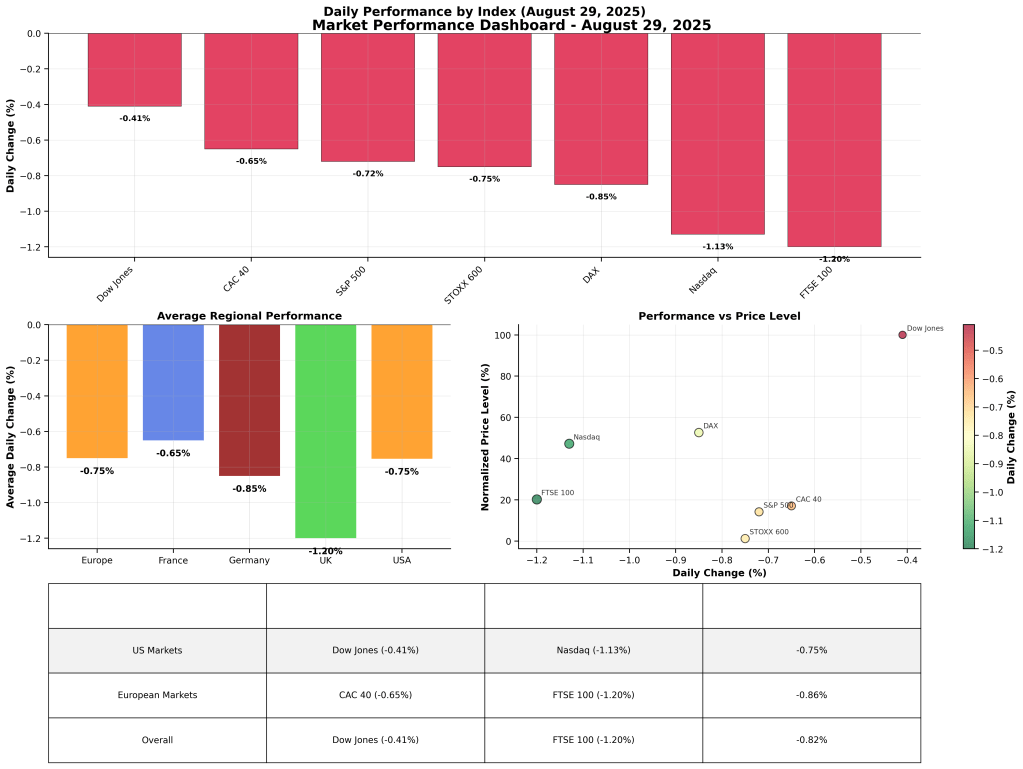

📊 Visual Dashboard

🏆 Performance Highlights

- Best Performer: Dow Jones (-0.41%) – least negative among major indices

- Worst Performer: FTSE 100 (-1.20%) – hit by UK bank tax rumors

- Commodities: Gold outperformed (+0.15%) as a safe haven; oil declined

- Market Breadth: 85% of tracked assets declined, reflecting broad risk-off sentiment

Summary:

Markets closed the week on a defensive footing, with European stocks under pressure from economic and political headwinds, US indices down on persistent inflation, and commodities reflecting global caution. The outlook remains clouded by central bank uncertainty and geopolitical risks—investors are advised to stay nimble and watch for further policy signals.