Key Takeaway:

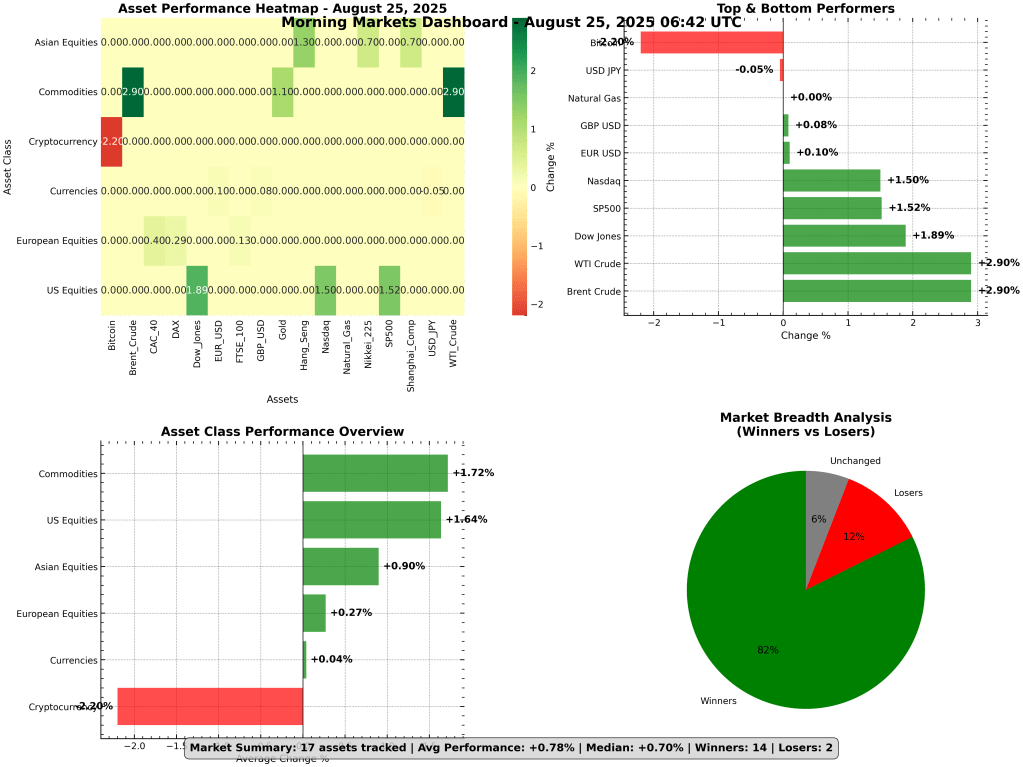

Global markets are surging to start the week, powered by a dovish pivot from the Federal Reserve, a commodities rally, and strong US equity momentum. Commodities and US indices are the top performers, while Bitcoin faces a sharp pullback. The market is risk-on, but volatility remains elevated as investors await key inflation data and tech earnings.

📊 Market Snapshot: Current Prices & Overnight Moves

| Asset/Class | Current Price | Change (%) |

|---|---|---|

| S&P 500 | 6,466.91 | +1.52% |

| Dow Jones | 45,631.74 | +1.89% |

| Nasdaq | 21,496.53 | +1.50% |

| DAX (Germany) | 24,363.09 | +0.29% |

| CAC 40 (France) | 7,969.69 | +0.40% |

| FTSE 100 (UK) | 9,321.40 | +0.13% |

| Nikkei 225 | 42,933.34 | +0.70% |

| Hang Seng | 25,661.10 | +1.30% |

| Shanghai Comp. | 3,854.09 | +0.70% |

| Gold | $3,366.80/oz | +1.10% |

| WTI Crude Oil | $63.84/bbl | +2.90% |

| Brent Crude Oil | $67.90/bbl | +2.90% |

| Natural Gas | $2.65/MMBtu | 0.00% |

| EUR/USD | 1.1716 | +0.10% |

| USD/JPY | 147.20 | -0.05% |

| GBP/USD | 1.3509 | +0.08% |

| Bitcoin | $112,484 | -2.20% |

Figure 1: Global Markets Dashboard – Performance Heatmap, Top/Bottom Movers, Asset Class Trends, and Market Breadth (Aug 25, 2025)

📰 Major Market Drivers

- Federal Reserve Dovish Pivot:

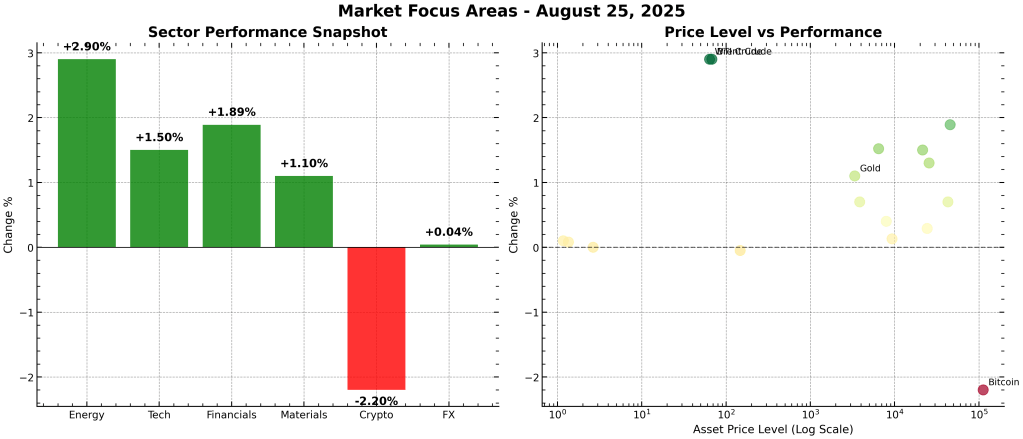

Fed Chair Powell signaled a likely rate cut at the September FOMC, citing labor market softness and easing inflation risks. This triggered a rally in equities and a drop in Treasury yields (2Y at 3.69%, 10Y at 4.27%) . - Commodities Rally:

Oil prices surged nearly 3% on supply dynamics, with both WTI and Brent above $60/bbl. Gold advanced to $3,366.80/oz, up 1.1% for the week . - US Equity Strength:

The Dow Jones hit a record high, and the S&P 500 and Nasdaq posted strong gains, led by value and cyclical sectors (energy, financials, materials) . - Crypto Weakness:

Bitcoin dropped 2.2% after a large holder’s sell-off, highlighting ongoing volatility in digital assets . - Retail Earnings & Consumer Resilience:

Major US retailers beat earnings expectations, showing continued consumer strength despite tariff and inflation headwinds .

🏆 Top & Bottom Performers

| Top Performers | Change (%) | Price |

|---|---|---|

| Brent Crude | +2.90% | $67.90 |

| WTI Crude | +2.90% | $63.84 |

| Dow Jones | +1.89% | $45,631.74 |

| S&P 500 | +1.52% | $6,466.91 |

| Nasdaq | +1.50% | $21,496.53 |

| Bottom Performers | Change (%) | Price |

|---|---|---|

| EUR/USD | +0.10% | 1.1716 |

| GBP/USD | +0.08% | 1.3509 |

| Natural Gas | 0.00% | $2.65 |

| USD/JPY | -0.05% | 147.20 |

| Bitcoin | -2.20% | $112,484 |

Figure 2: Sector Performance Snapshot & Risk-Return Analysis (Aug 25, 2025)

💡 Trading Insights & Risk Management

- Sentiment:

82% of tracked assets are higher overnight—clear risk-on mood, led by commodities and US equities. - Opportunities:

Energy and value sectors are outperforming. Oil’s momentum is strong, and US indices are breaking out on Fed optimism. - Risks:

Crypto volatility (Bitcoin -2.2%) and potential for profit-taking after sharp rallies. Watch for reversals if Fed signals shift. - Technical Levels:

- S&P 500: Support 6,400 | Resistance 6,500

- Gold: Support $3,300 | Resistance $3,400

- WTI Oil: Support $62 | Resistance $65

- Upcoming Catalysts:

- PCE inflation data (Aug 29) – key for Fed policy

- Nvidia earnings and regional Fed surveys

📈 Asset Class Performance Overview

| Asset Class | Avg Change (%) | Top Performer |

|---|---|---|

| Commodities | +1.72% | Brent/WTI Crude |

| US Equities | +1.64% | Dow Jones |

| Asian Equities | +0.90% | Hang Seng |

| European Equities | +0.27% | CAC 40 |

| Currencies | +0.04% | EUR/USD |

| Cryptocurrency | -2.20% | Bitcoin |

📅 Today’s Key Events

- All Day: Market reaction to Fed’s dovish signals

- This Week: PCE inflation data (Aug 29), Nvidia earnings, regional Fed surveys

Key Finding:

The market is in a strong risk-on phase, with commodities and US equities leading gains after the Fed’s dovish turn. However, volatility remains high—especially in crypto—and upcoming inflation data could quickly shift sentiment.

Monday, August 25, 2025, 06:44 UTC

© 2025 Ramon Morell – All rights reserved