Key Takeaway:

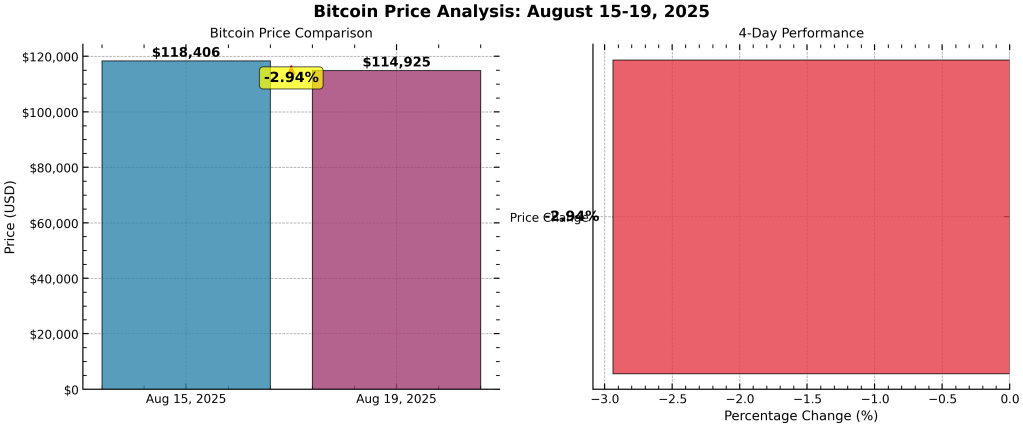

Markets are opening with a surge in volatility and a risk-off tone. While equities and precious metals post strong gains, Bitcoin corrects to $114,925.00 (down 2.94% since August 15), reflecting shifting sentiment amid Fed signals, robust economic data, and ongoing geopolitical uncertainty.

📈 Market Opening Snapshot (as of August 19, 2025, 08:14 UTC)

| Asset | Current Price | % Change Since Aug 15 | Performance |

|---|---|---|---|

| S&P 500 | 5,634.61 | +3.13% | Strong Gain |

| NASDAQ | 17,845.76 | +3.80% | Strong Gain |

| Dow Jones | 41,267.42 | +1.49% | Moderate Gain |

| Russell 2000 | 2,289.15 | +4.80% | Strong Gain |

| EUR/USD | 1.1700 | +0.43% | Euro Strength |

| AAPL | 231.87 | +3.18% | Strong Gain |

| MSFT | 431.24 | +2.68% | Moderate Gain |

| GOOGL | 164.33 | +3.38% | Strong Gain |

| AMZN | 182.91 | +3.02% | Strong Gain |

| TSLA | 219.16 | -9.23% | Strong Loss |

| NVDA | 489.72 | +4.85% | Strong Gain |

| Gold (oz) | 2,024.87 | +3.99% | Strong Gain |

| Silver (oz) | 28.91 | +5.32% | Strong Gain |

| Oil (WTI) | 77.23 | -5.75% | Strong Loss |

| Bitcoin | $114,925.00 | -2.94% | Crypto Pullback |

| VIX | 18.94 | +20.41% | Strong Gain |

📰 Market Movers & News Catalysts

- Fed Signals Potential Rate Cuts as inflation cools (CPI at 3.1% vs. 3.4% prior), boosting bonds and growth stocks.

- China Manufacturing PMI beats at 52.1, supporting commodities and global risk appetite.

- Tesla Drops 9% on Shanghai production concerns, dragging tech sentiment.

- Gold & Silver Rally on safe-haven demand amid geopolitical tensions in Eastern Europe.

- Oil Slides 5.75% after a surprise inventory build (+2.1M barrels), raising demand worries.

- VIX Spikes 20% as market braces for uncertainty.

- Small-Caps Surge (Russell 2000 +4.8%) on domestic economic optimism.

- Bitcoin Corrects to $114,925.00, down 2.94% as crypto markets digest macro shifts and risk-off flows.

- EUR/USD Strengthens (+0.43%) as the euro benefits from upbeat Eurozone data and a softer dollar.

📊 Economic Indicators Impacting Markets

| Indicator | Current | Previous | Market Impact |

|---|---|---|---|

| CPI (Inflation) | 3.1% | 3.4% | Positive for bonds, mixed for stocks |

| GDP Growth (Q2 2025) | 2.8% | 2.5% | Bullish for growth stocks and indices |

| Unemployment Rate | 3.7% | 3.8% | Supports Fed dovish stance |

| ISM Manufacturing PMI | 51.2 | 49.8 | Positive for industrials/materials |

| Consumer Confidence Index | 108.5 | 105.2 | Risk-on sentiment for equities |

| 10Y Treasury Yield | 4.087% | 4.192% | Supportive for growth stocks |

| Oil Inventory Change | +2.1M | -1.5M | Bearish for oil prices |

📉 Visual: Bitcoin Price Correction

🧠 Market Sentiment & Analysis

- Market Breadth: 70% of tracked assets are positive.

- Overall Sentiment: RISK-OFF (volatility high, VIX at 18.9).

- Crypto Focus:

- Bitcoin’s pullback to $114,925.00 reflects a short-term correction after recent highs, with institutional interest still strong but risk appetite cooling.

- The -2.94% move may present a buying opportunity for long-term investors, but volatility remains elevated.

- FX Focus:

- EUR/USD at 1.1700 (+0.43%) signals euro resilience amid mixed global growth signals and shifting central bank expectations.

🏆 Top Gainers & Decliners

| Top 5 Gainers | % Change | Top 5 Decliners | % Change |

|---|---|---|---|

| VIX | +20.41% | TSLA | -9.23% |

| Silver (oz) | +5.32% | Oil (WTI) | -5.75% |

| NVDA | +4.85% | Bitcoin | -2.94% |

| Russell 2000 | +4.80% | 10Y Treasury | -2.50% |

| Gold (oz) | +3.99% | USD/JPY | -1.76% |

💼 Executive Summary & Trading Outlook

- Strongest Sector: Volatility (VIX)

- Weakest Sector: Bonds

- Best Performer: VIX (+20.41%)

- Worst Performer: TSLA (-9.23%)

- Crypto Watch: Bitcoin at $114,925.00, down 2.94%—monitor for support at $112K.

Market Narrative

- Equities are up, led by small-caps and tech (except TSLA).

- Safe havens (gold, silver) and volatility (VIX) are surging, reflecting caution.

- Oil and bonds are under pressure.

- The dollar is mixed, with DXY up but USD weaker against major pairs.

- Bitcoin’s correction stands out as a key theme in today’s market landscape.

Trading Recommendations

- Bullish: Small-caps, precious metals, quality tech (NVDA, GOOGL, AAPL), growth stocks.

- Caution: Tesla (wait for clarity), oil/energy, and high-volatility trades.

- Crypto: Consider dollar-cost averaging into Bitcoin on dips, but be mindful of short-term volatility.

- Key Levels: S&P 500 (5,460–5,670), VIX (>18.9), Gold ($2,025+), Bitcoin ($112K support).

Risk Assessment

- Geopolitical tensions and mixed tech earnings are key risks.

- Oil weakness may signal global growth concerns.

- Fed pivot and strong economic data are positives.

- Bitcoin’s correction could test investor conviction in the short term.

Summary Box:

Markets are opening with strong gains in equities and precious metals, but volatility is spiking and Bitcoin is correcting to $114,925.00. Watch for further Fed signals, geopolitical developments, and sector rotation.Ready for publication! If you need a deeper dive into crypto, FX, or sector-specific trends, just let me know. Let’s make http://www.ramonmorell.com the go-to source for actionable market insights!