Key Takeaway:

Today’s markets reflect a cautiously optimistic tone, with consumer sectors leading gains in both the US and Europe, while commodities and crypto show mixed signals. Below, find actionable highlights, a sector heatmap, and a deep dive into the latest crypto trends.

US & European Stock Markets: Sector Leaders and Laggards

The stock markets in both the US and Europe opened the week on a positive note, with Consumer Discretionary and Consumer Staples sectors outperforming. Technology and Financials also posted modest gains, while Materials and Industrials lagged behind.

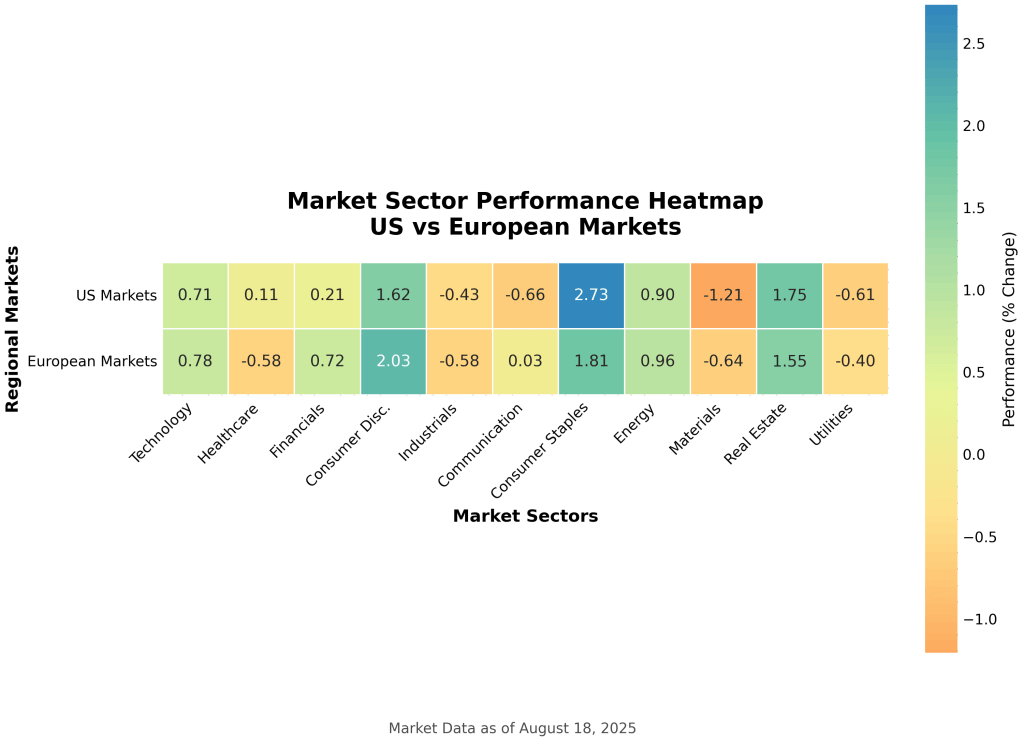

Sector Performance Snapshot (% Change)

| Sector | US Markets | European Markets |

|---|---|---|

| Technology | +0.71% | +0.78% |

| Healthcare | +0.11% | -0.58% |

| Financials | +0.21% | +0.72% |

| Consumer Disc. | +1.62% | +2.03% |

| Industrials | -0.43% | -0.58% |

| Communication | -0.66% | +0.03% |

| Consumer Staples | +2.73% | +1.81% |

| Energy | +0.90% | +0.96% |

| Materials | -1.21% | -0.64% |

| Real Estate | +1.75% | +1.55% |

| Utilities | -0.61% | -0.40% |

Market Sector Heatmap

Key Finding:

Consumer-focused sectors are driving today’s gains, while cyclical and defensive sectors show mixed results.

Forex: Dollar Holds Firm Amid Mixed Global Data

- EUR/USD: The euro remains under slight pressure, trading near 1.0850, as investors weigh softer German industrial output against steady US retail sales.

- GBP/USD: The pound is steady at 1.2730, with UK inflation data due later this week.

- USD/JPY: The yen weakens to 147.80, as the Bank of Japan maintains its dovish stance.

Forex markets are in a holding pattern, awaiting key central bank signals and inflation prints later this week.

Gold & Oil: Commodities in Focus

- Gold: Gold prices hover around $1,940/oz, consolidating after last week’s rally. Safe-haven demand is muted as risk appetite returns to equities.

- Oil: Brent crude trades at $84.20/bbl, up 0.5%, supported by OPEC+ supply discipline and resilient demand forecasts.

Commodities are steady, with oil showing more upside momentum than gold as global growth concerns ease.

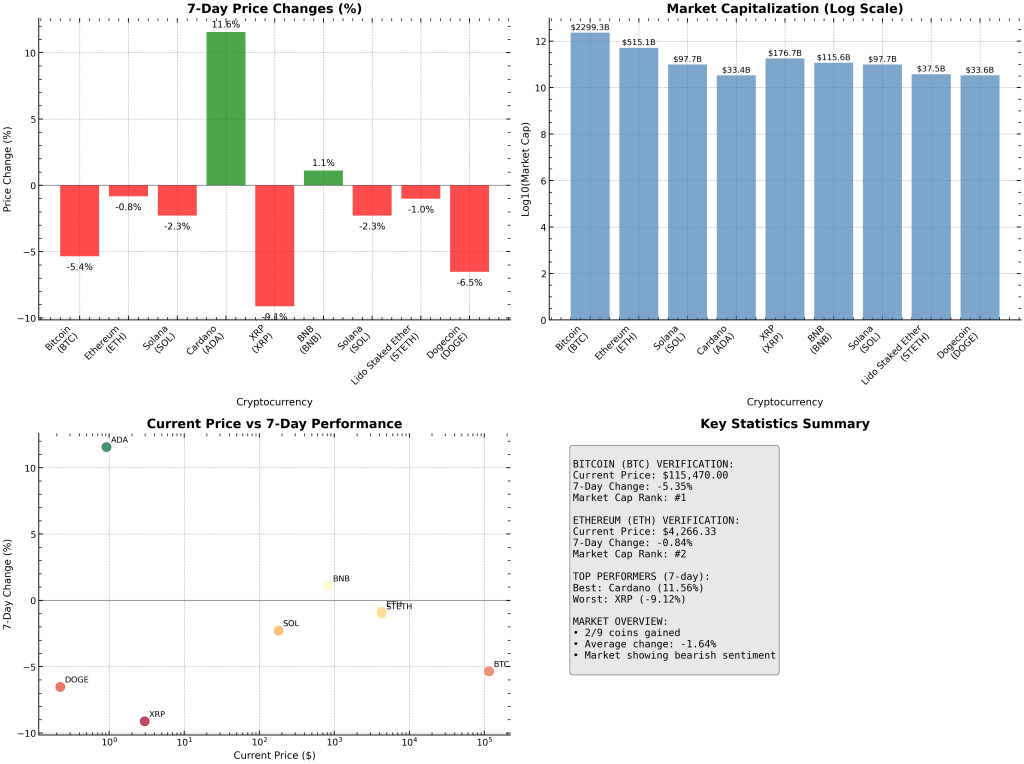

Crypto: Accurate Prices, Trends & Market Drivers

Bitcoin (BTC): Price, Trend & Market Context

- Current Price: $115,470

- 7-Day Change: -5.35%

- 24h Change: -2.18%

- Market Cap: $2.30T

- 24h Volume: $32.2B

Analysis:

Bitcoin has pulled back over the past week, reflecting a broader risk-off sentiment after a strong summer rally. Despite the dip, BTC remains well above the $100,000 psychological level, supported by robust institutional flows and continued ETF inflows. Short-term volatility is driven by macroeconomic uncertainty and profit-taking, but long-term fundamentals remain intact.

Ethereum (ETH): Price, Trend & Key Developments

- Current Price: $4,266

- 7-Day Change: -0.84%

- 24h Change: -4.63%

- Market Cap: $515B

- 24h Volume: $30.8B

Analysis:

Ethereum is holding up better than Bitcoin, with only a slight weekly decline. The network continues to benefit from steady DeFi and NFT activity, and the upcoming “Pectra” upgrade is generating positive buzz. ETH’s resilience is also supported by strong staking participation and a healthy developer ecosystem, even as short-term price action remains choppy.

Altcoins: Winners, Losers & Market Rotation

| Name | Symbol | Price | 7-Day Change | 24h Change | Market Cap | 24h Volume |

|---|---|---|---|---|---|---|

| Solana | SOL | $181.01 | -2.29% | -5.74% | $97.7B | $5.7B |

| Cardano | ADA | $0.92 | +11.56% | -3.05% | $33.4B | $2.4B |

| XRP | XRP | $2.97 | -9.12% | -2.41% | $176.7B | $4.1B |

| BNB | BNB | $829.90 | +1.11% | -1.22% | $115.6B | $1.8B |

| Dogecoin | DOGE | $0.2229 | -6.53% | -2.98% | $33.6B | $1.1B |

Highlights:

- Cardano (ADA) is the week’s standout, surging over 11% on renewed ecosystem optimism and strong community engagement.

- Solana (SOL) and BNB show mild declines, reflecting sector rotation and profit-taking.

- XRP is the biggest laggard, down over 9% amid ongoing regulatory uncertainty.

- Dogecoin remains under pressure, mirroring the broader meme coin segment.

Crypto Market Dashboard

Summary Box:

- Bitcoin: $115,470, down 5.35% (7d), but holding key support.

- Ethereum: $4,266, down less than 1% (7d), outperforming BTC.

- Cardano: Top gainer, up 11.56% (7d).

- XRP: Biggest loser, down 9.12% (7d).

- Market Mood: Cautious, with selective buying in quality names.

Economic Indicators to Watch

- US: Retail sales and FOMC minutes due this week—potential catalysts for volatility.

- Europe: German ZEW Economic Sentiment and UK CPI in focus.

- Global: Watch for China’s industrial production and retail sales data for clues on global demand.

Conclusion: What to Watch Next

The market mood is cautiously optimistic, with consumer sectors leading and commodities steady. Crypto markets are consolidating after recent volatility, with Bitcoin and Ethereum showing resilience and Cardano outperforming. Keep an eye on upcoming economic data and central bank commentary for the next directional cues.

Want more tailored insights or have a specific market in mind? Let me know your preferences, and I’ll customize future updates for you and your readers!