Key Takeaway:

U.S. markets closed mixed yesterday, with Financials under pressure and small caps showing resilience. This morning, pre-market action is muted, as investors brace for a wave of economic data—including inflation and retail sales—that could set the tone for the session.

Market Close: August 12, 2025

| Index / ETF | Close | % Change (Prev. Day) |

|---|---|---|

| S&P 500 (SPY) | 437.45 | -0.89% |

| NASDAQ 100 (QQQ) | 415.60 | +0.26% |

| Dow Jones (DIA) | 405.81 | +0.22% |

| Russell 2000 (IWM) | 208.32 | +0.81% |

| Total Market (VTI) | 402.06 | -0.46% |

- Sectors: Financials led the declines, dropping over 2%, while Healthcare and Materials posted the strongest gains.

- Breadth: 7 out of 16 tracked indices and sectors finished higher.

Pre-Market Snapshot: August 13, 2025

| Index / ETF | Pre-Market | Overnight Change (%) |

|---|---|---|

| S&P 500 (SPY) | 433.56 | -0.89% |

| NASDAQ 100 (QQQ) | 416.66 | +0.26% |

| Dow Jones (DIA) | 406.71 | +0.22% |

| Russell 2000 (IWM) | 210.01 | +0.81% |

| Financials (XLF) | 99.18 | -2.09% |

| Healthcare (XLV) | 101.15 | +0.76% |

| Materials (XLB) | 87.50 | +0.76% |

Notable Moves:

- Financials (XLF) is the clear outlier, down over 2% overnight.

- Small caps (IWM) and Healthcare (XLV) are showing early strength.

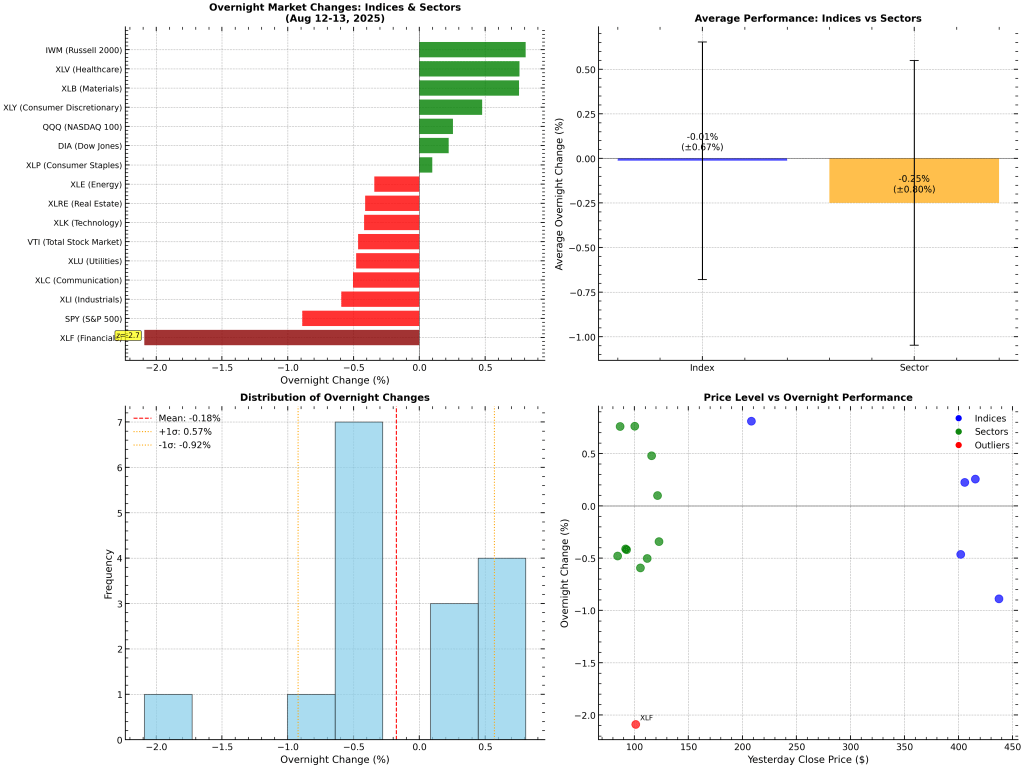

Visual: Overnight Market Moves

News Driving the Tape

- Bank Weakness: Financials are under pressure after several regional banks reported disappointing loan growth and rising delinquencies.

- Tech Steady: Big tech names are holding up, with the NASDAQ 100 slightly positive in pre-market trading.

- Small Cap Resilience: Russell 2000 is outperforming, suggesting some risk appetite remains.

Economic Indicators to Watch Today

| Time (EDT) | Indicator | Consensus | Market Impact | Sectors Most Affected |

|---|---|---|---|---|

| 8:30 AM | Consumer Price Index (CPI) July | +3.2% YoY | High | Consumer Staples, Utilities |

| 8:30 AM | Producer Price Index (PPI) July | +1.8% YoY | Medium | Materials, Energy |

| 8:30 AM | Retail Sales July | +0.4% MoM | High | Consumer Discretionary |

| 9:15 AM | Industrial Production July | +0.2% MoM | Medium | Industrials |

| 10:00 AM | Consumer Sentiment (Prelim) Aug | 71.2 | Medium | Financials |

Why it matters:

CPI and Retail Sales are the big ones—any surprise could move rates, the dollar, and stocks sharply at the open.

What to Watch as the Bell Rings

- Volatility Alert: With so many data points hitting before and just after the open, expect a choppy first hour.

- Sector Focus: Watch Financials for follow-through selling, and keep an eye on Consumer Discretionary and Staples as inflation and retail numbers hit.

- Breadth Check: If small caps keep leading, it could signal renewed risk appetite.

Quick Stats

- Average overnight change (all tracked): -0.18%

- Market volatility (std dev): 0.75%

- Outlier: Financials (XLF) -2.09% (statistically significant drop)

- Advancers vs. decliners (overnight): 7 up, 9 down

Final Take

Markets are opening on a cautious note, with Financials dragging and small caps showing some life. All eyes are on this morning’s inflation and retail sales data—expect swift reactions and sector rotation as the numbers hit. Stay nimble.

For more real-time updates and actionable insights, follow @ramonmorellcom and check www.ramonmorell.com throughout the day.