Key Takeaway:

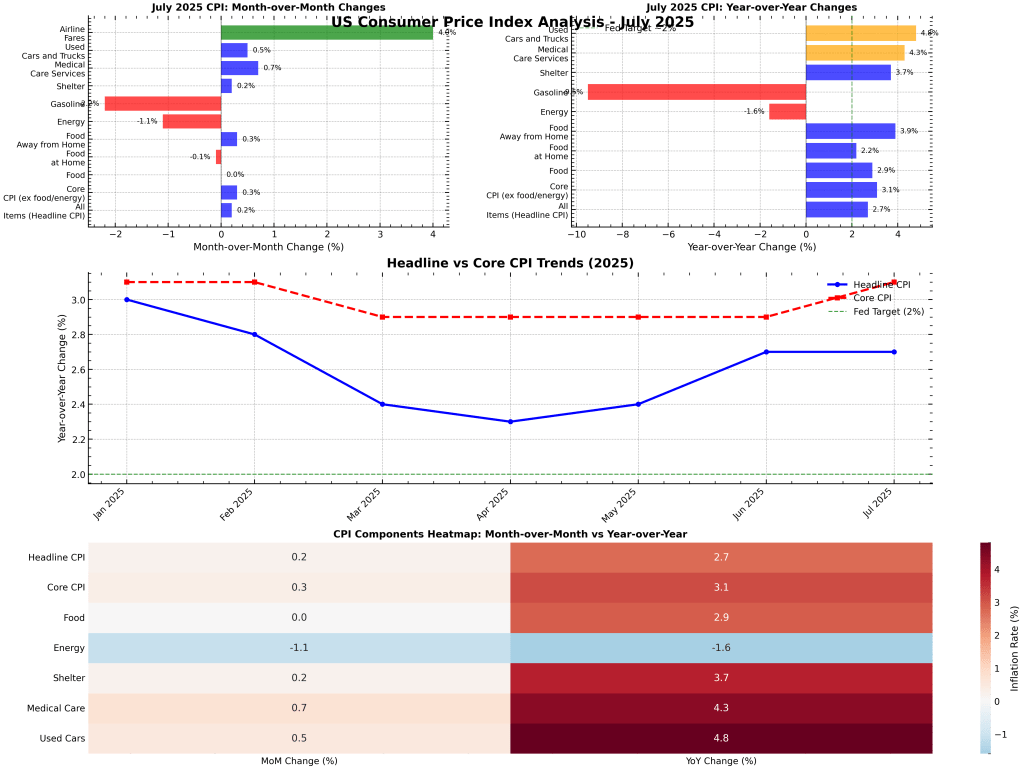

The latest US inflation data shows headline CPI holding at 2.7% year-over-year, with core inflation ticking up to 3.1%. While energy prices continue to drag overall inflation lower, sticky shelter and services costs keep the Fed on alert. Markets are digesting the numbers as slightly above expectations, but the overall trend remains one of gradual disinflation.

📰 Headline Numbers at a Glance

| Indicator | July 2025 (MoM) | July 2025 (YoY) | Consensus | Previous |

|---|---|---|---|---|

| Headline CPI | +0.2% | 2.7% | 2.6% | 2.7% |

| Core CPI | +0.3% | 3.1% | 3.0% | 2.9% |

| Food | 0.0% | 2.9% | ||

| Energy | -1.1% | -1.6% | ||

| Shelter | +0.2% | 3.7% |

- Energy: Gasoline prices fell sharply (-2.2% MoM, -9.5% YoY), continuing to offset other inflationary pressures.

- Shelter: Remains sticky at +3.7% YoY, a key driver of core inflation.

- Food: Flat for the month, with at-home prices down slightly and restaurant prices up.

🔍 What’s Driving the Numbers?

- Disinflationary Forces: Energy and gasoline prices are providing a significant drag on headline inflation.

- Persistent Pressures: Shelter, medical care services (+4.3% YoY), and used cars (+4.8% YoY) are keeping core inflation elevated.

- Volatility: Airline fares spiked 4.0% in July, highlighting ongoing volatility in services.

📈 Visual Insights

🗣️ What Are Experts Saying?

- Economists: The data is “slightly hotter than expected,” with core inflation’s uptick to 3.1% drawing attention. However, the overall trend remains consistent with a “soft landing” scenario, as energy deflation and moderating food prices help offset sticky services costs.

- Market Analysts: The CPI print keeps the door open for a Fed rate cut in September, but the uptick in core inflation means the Fed will remain cautious. Treasury yields are edging lower, the dollar is softening, and equities are mixed as investors weigh the implications.

- Consensus: Most see this as a “Goldilocks” report—neither too hot nor too cold. The Fed is likely to stay data-dependent, with the next move hinging on further progress in core and shelter inflation.

🏦 Policy & Market Implications

- Fed Outlook: The probability of a September rate cut remains high, but the slight upside surprise in core CPI may temper expectations for aggressive easing.

- Bond Market: Yields are drifting lower as investors bet on a dovish Fed, but the move is modest given the stickiness in core components.

- Equities: Defensive sectors (utilities, consumer staples) are outperforming, while tech and growth stocks are treading water.

- Currency: The US dollar is under mild pressure as rate cut bets persist.

- Commodities: Energy remains a drag, while gold is steady near recent highs.

🕰️ Historical Context

- Inflation has cooled dramatically from the 9.1% peak in June 2022 to the current 2.7%—now close to pre-pandemic norms.

- Core inflation remains above the Fed’s 2% target, but the gap is narrowing.

- Energy and food are no longer the main drivers; services and shelter are now the focus for policymakers.

📊 Key Insights & Risks

- Core inflation’s resilience means the Fed will want to see more progress before declaring victory.

- Shelter and services are the “last mile” for disinflation—watch these categories in coming months.

- Energy price volatility and global risks (geopolitics, supply chains) could still disrupt the trend.

- Market sentiment is cautiously optimistic, but sensitive to any surprises in future data.

Summary:

July’s CPI report confirms that US inflation is stabilizing near the Fed’s target, but core pressures—especially in shelter and services—persist. The data supports the case for a rate cut later this year, but the Fed will remain vigilant. For investors and policymakers alike, the focus now shifts to whether core inflation can continue to cool without a sharp economic slowdown.

For real-time analysis and actionable insights, follow www.ramonmorell.com and our social channels!