Key Takeaway:

European markets are set for a mildly positive open, buoyed by Friday’s US tech rally and hopes for a Fed rate cut, but with caution as investors await key US inflation data and monitor ongoing geopolitical risks. Commodities are under pressure, the euro and pound are firming, and Asian markets delivered a mixed overnight lead.

🏦 European Market Futures Snapshot

| Index | Price | Change | % Change |

|---|---|---|---|

| FTSE 100 | 8,802.50 | +25.00 | +0.28% |

| DAX | 24,197.39 | +34.53 | +0.14% |

| CAC 40 | 7,755.06 | +12.06 | +0.16% |

| AEX | 894.89 | +3.53 | +0.40% |

| EuroStoxx 50 | 5,378.00 | +2.00 | +0.04% |

| IBEX 35 | 14,824.90 | +134.00 | +0.91% |

Market breadth: 9 out of 10 major European indices are trading higher pre-open, with the IBEX 35 leading gains.

🌏 Overnight: US & Asia Market Recap

| Region/Index | Change (%) | Highlights |

|---|---|---|

| S&P 500 | +0.2% | Tech rally, new record close |

| Nasdaq | +0.3% | AI/semis lead, Broadcom surges |

| Dow Jones | -0.2% | Small pullback, rotation into small caps |

| Nikkei 225 | -0.47% | Awaiting BoJ, cautious after Fed |

| Kospi (Korea) | +1.39% | Regional leader, 3rd day of gains |

| Hang Seng | +0.18% | EV stocks up, EU tariffs in focus |

| Shanghai Comp. | -0.43% | Weak demand, PPI deflation |

💱 Forex & Commodities – Early Moves

| Pair/Asset | Latest Rate/Price | % Change | Trend/Comment |

|---|---|---|---|

| EUR/USD | 1.1661 | +0.12% | Euro firmer, USD soft |

| GBP/USD | 1.3464 | +0.17% | Pound up, BoE in focus |

| USD/JPY | 147.55 | -0.09% | Yen steady after BoJ |

| Gold (fut.) | $3,365.40 | -0.98% | Pullback, still near highs |

| Brent Oil | $65.98 | -0.51% | Weak, supply concerns |

| WTI Oil | $63.29 | -0.09% | Flat, demand in focus |

₿ Crypto Market Update

| Coin | Price (USD) | Monthly Change (%) | Trend/Comment |

|---|---|---|---|

| Bitcoin | $62,678 | -8% | Rebounding after correction |

| Ethereum | $3,700 | -9% | ETF optimism, strong flows |

- Altcoins: Solana and Toncoin show resilience; meme coins remain weak.

- Sentiment: Cautious optimism, with focus on ETF approvals and regulatory news.

🗓️ Economic Calendar – Key Events Today

| Time (ET) | Event | Impact |

|---|---|---|

| 06:00 | NFIB Small Business Optimism Index | Moderate |

| 08:30 | US Consumer Price Index (CPI) | High |

| 10:00 | Fed Speaker: Thomas Barkin | Moderate |

| 10:30 | Fed Speaker: Jeffrey Schmid | Moderate |

| 11:30 | US Treasury Bill Auctions (3M, 6M) | Low |

Focus: US CPI is the main event—any surprise could shift Fed rate cut expectations and drive global volatility.

🔍 Key Market Drivers & Themes

- Tech Momentum: US tech outperformance and AI optimism are supporting risk appetite in Europe.

- Fed Watch: Softer US inflation and dovish rate expectations are buoying sentiment, but the Fed’s reduced rate cut projections temper enthusiasm.

- Commodities Weakness: Gold and oil are under pressure, reflecting risk-off in raw materials.

- Geopolitics: US-China trade tensions, Russia-Ukraine conflict, and Middle East instability remain key risks.

- Rotation: Investors are rotating into small caps and sectors expected to benefit from lower rates.

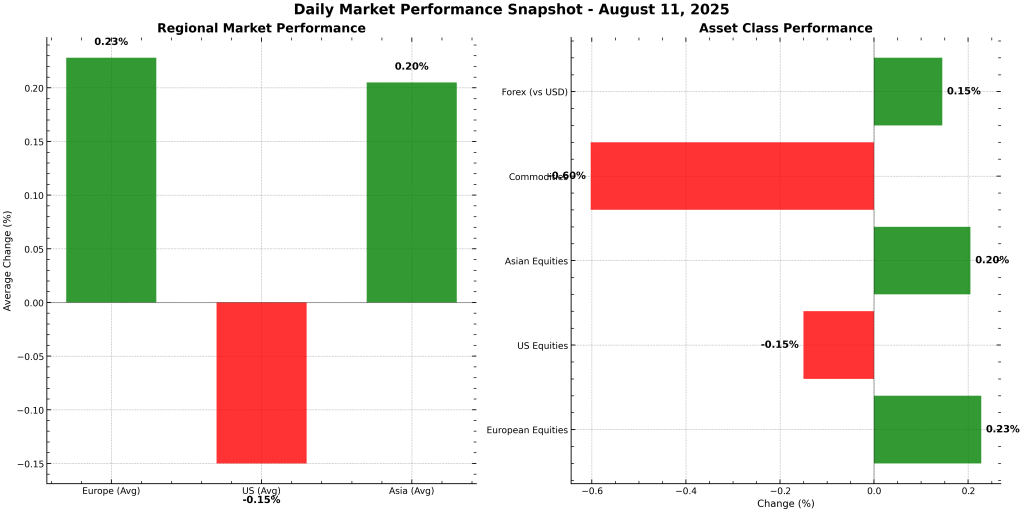

📊 Visual Market Dashboard

Summary:

European markets open with a positive bias, tracking US tech strength and a softer dollar, but with eyes on US inflation data and global geopolitical risks. Expect volatility around the CPI release and central bank commentary.

For real-time updates and actionable insights, follow www.ramonmorell.com and our social channels!