Key Takeaway:

U.S. stocks are rallying on Fed rate cut hopes and sector rotation, while the dollar softens, gold glitters, oil slips, and crypto markets remain volatile. Diversification is paying off as correlations shift across asset classes.

📰 Today’s Multi-Asset Market Dashboard

| Asset Class | 7-Day Best Performer | 7-Day Worst Performer | Notable Trend |

|---|---|---|---|

| Equities | S&P 500, Dow Jones | NASDAQ (lagging) | Value/cyclicals lead, tech cools |

| Forex | EUR/USD (+2.95%) | USD/JPY (–3.03%) | Dollar weakens vs. majors |

| Commodities | Gold (+2.61%) | Oil Brent (–1.63%) | Gold rallies, oil drifts lower |

| Crypto | Dogecoin (+7.57%) | XRP (–13.38%) | High volatility, mixed returns |

📈 Equities: Value & Cyclicals in the Spotlight

- S&P 500: 5,632.58 (+1.47%) — Bullish, overbought

- Dow Jones: 46,258.22 (+1.34%) — Bullish, overbought

- NASDAQ: 12,484.60 (–0.82%) — Bearish, under pressure

Rotation out of tech and defensives into health, minerals, and industrials. Overbought signals suggest a pause may be near.

💱 Forex: Dollar Softens as Rate Cut Bets Rise

| Pair | Latest Rate | 7D Change | 24H Change |

|---|---|---|---|

| EUR/USD | 1.1583 | +2.95% | +0.03% |

| GBP/USD | 1.3306 | –1.40% | +0.10% |

| USD/JPY | 147.50 | –3.03% | –0.03% |

The euro and yen are gaining ground as U.S. rate cut odds climb. The dollar index is under pressure, supporting gold and risk assets.

🪙 Crypto: Volatility Returns, Dogecoin Surges

| Coin | Price (USD) | 7D Return | 24H Change |

|---|---|---|---|

| Bitcoin | $114,206 | –11.81% | –0.03% |

| Ethereum | $3,637 | +0.49% | –0.33% |

| Dogecoin | $0.2011 | +7.57% | –1.87% |

| XRP | $2.95 | –13.38% | –2.42% |

Crypto markets are mixed: Dogecoin leads, Bitcoin and XRP lag. Volatility remains high, offering both risk and opportunity.

🏅 Commodities: Gold Shines, Oil Slips

| Commodity | Price | 7D Return | 24H Change |

|---|---|---|---|

| Gold (USD/oz) | $2,637 | +2.61% | +0.13% |

| Oil Brent (bbl) | $75.00 | –1.63% | –0.77% |

- Gold: Rallies on safe-haven demand, central bank buying, and a weaker dollar.

- Oil: Slips as supply growth outpaces demand, especially with China’s slowdown and robust U.S. output.

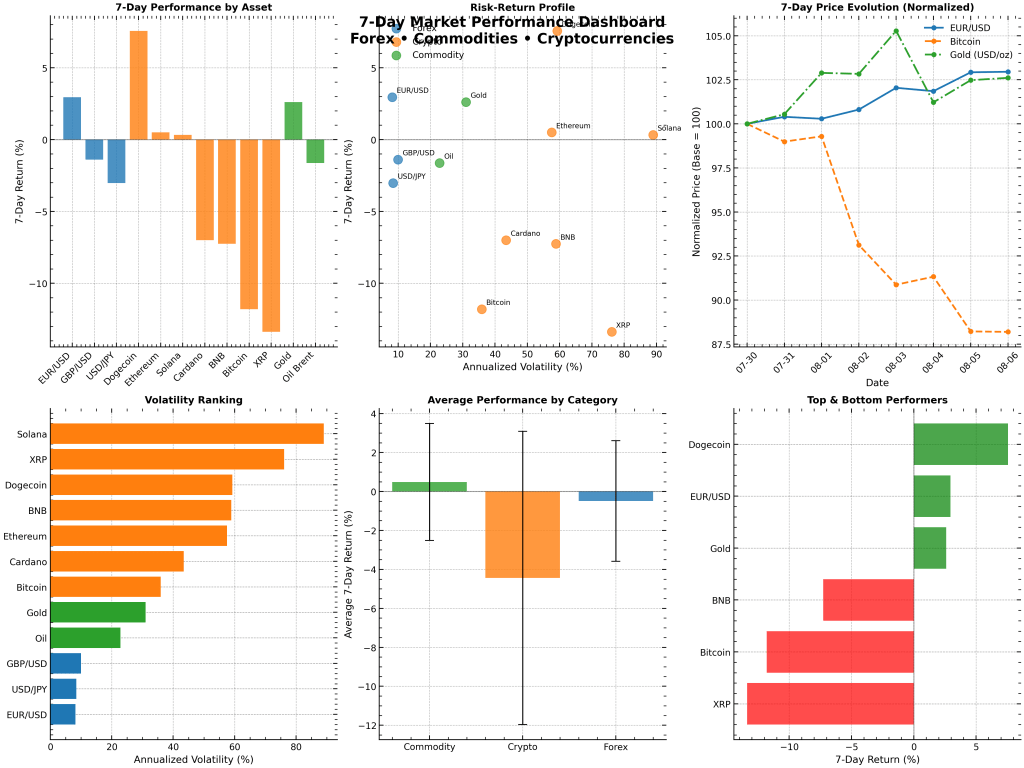

📊 7-Day Multi-Asset Performance Dashboard

🔗 Correlations & Cross-Asset Insights

- Gold & USD: Negative correlation—gold up as the dollar weakens.

- Oil & Equities: Correlation is context-dependent; currently, oil is lagging equities due to supply/demand imbalances.

- Crypto & Other Assets: Low or negative correlation, offering diversification but with high volatility.

- Forex & Commodities: Dollar weakness is supporting both gold and risk assets.

🧭 What’s Next? Strategy & Outlook

- Equities: Stay nimble—momentum is strong, but overbought signals suggest a possible pause.

- Forex: Watch for further dollar weakness if Fed cut expectations persist.

- Gold: Remains a favored hedge amid uncertainty and central bank demand.

- Oil: Cautious outlook as supply growth and energy transition weigh on prices.

- Crypto: High risk, high reward—focus on risk management and diversification.

Summary:

The global market rally is broadening beyond tech, with value, gold, and select cryptos outperforming. The dollar’s slide is fueling gains in commodities and risk assets. Stay diversified, monitor cross-asset signals, and be ready for volatility as macro data and Fed policy drive the next moves.